Income-Generating ETFs: Covered-Call vs. Dividend?

From time to time, the market reminds investors that there's no such thing as a free lunch, and strategies that appear to serve up tasty returns turn out to be missing some key ingredients.

For example, exchange-traded funds (ETFs) that combine equity market exposure with a side of options may seem appetizing, but there are risks worth considering before adding a covered-call fund to your plate. For many investors, straightforward dividend ETFs may provide a better mix of income, price appreciation and after-tax returns than more complex options-based funds.

What are derivative income strategies and how do they work?

In the last few years, ETFs that sell call options to generate incremental income have become popular with investors. Call options give their buyers the right (but not the obligation) to buy a referenced security at a specified strike price on or before the option's expiration date. Conversely, the sellers of options are required to deliver the referenced security to the buyer if the option is exercised. The price of an option is called the "premium."

Many of these covered-call funds include terms such as "buy-write," "option income," "premium income" or "enhanced income" in their names. Like traditional ETFs, these funds provide exposure to equity markets via an index (such as the S&P 500®) or an actively managed portfolio of stocks. What makes them different is that they also write (or sell) call options on their underlying portfolios. Most write options that expire monthly, but some write options that expire daily or weekly.

How do derivative income funds generally perform?

Generally, covered-call funds have performed well in flat to modestly bullish markets. If the option expires without being exercised, the seller keeps the stock and the premium received. As a result, covered-call funds often report higher-than-average yields due to selling options and delivering the premiums along with dividends earned on stocks to investors. However, when an investment promises more income, it generally delivers lower capital appreciation.

When markets rise quickly, covered-call funds typically underperform traditional, long-only strategies that haven't sold options. That's because it's more likely that the call options they've sold will be exercised, and the referenced security will either be "called away" (delivered to the buyer of the call contract), or the fund will close its position by buying back the call option at a loss. In either case, the returns of covered-call funds are capped on the upside. This happened in 2024, for example, when the Dow Jones U.S. Dividend 100 index generated total returns of around 12% while the S&P 500 Dividend Aristocrats Enhanced Covered Call index produced total returns of just 5% (indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly).

On the other hand, when the market drops, covered-call funds may perform less poorly than long-only strategies since income from selling options may help cushion some of the blow, but they may still generate losses in tandem with the overall market. In 2022, the Dow Jones U.S. Dividend 100 index lost 3% while the S&P 500 Dividend Aristocrats Enhanced Covered Call index lost nearly 6%. In spite of what some issuers may claim, covered-call funds are typically not considered to be "hedged" against market risk.

How have derivative income funds performed longer term?

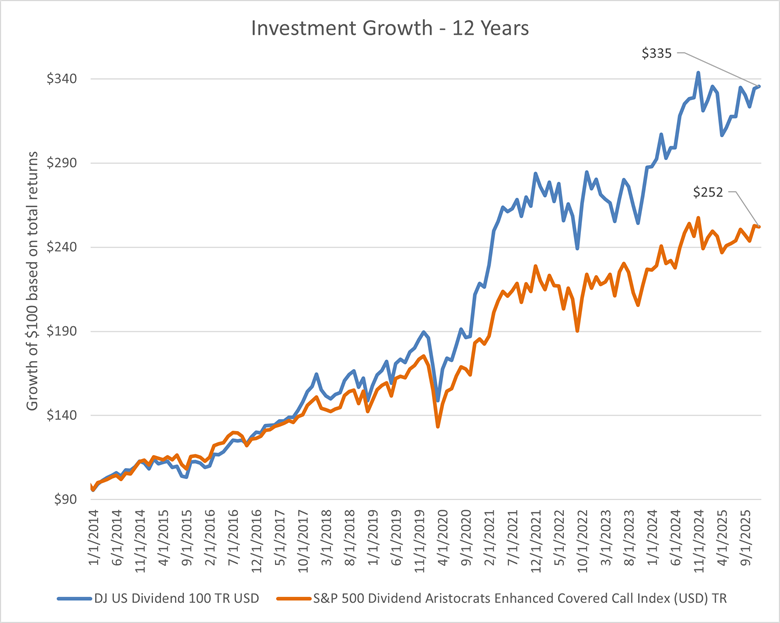

Over longer time periods, the impact of missing the upside can be seen clearly. From 2013 to 2025, the Dow Jones U.S. Dividend 100 index significantly outperformed the S&P 500 Dividend Aristocrats Enhanced Covered Call index.

Investment growth over 12 years

Source: Bloomberg, as of 2/15/2026.

The Dow Jones U.S. Dividend 100 TR Index is designed to measure the performance of high-dividend-yielding stocks in the U.S. with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios. The S&P 500 Dividend Aristocrats Enhanced Covered Call Index (USD) TR Index is designed to measure the performance of a long position in the S&P 500 Dividend Aristocrats NTR and a short position in a standard S&P 500 monthly call option. Performance is shown based on the total returns of each index, which include income and capital appreciation and assumes the reinvestment of distributions. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. The example does not reflect the effects of taxes or fees which would cause performance to be lower. Past performance is no guarantee of future results.

Even when markets move sideways and covered-call ETFs may perform best, higher expense ratios may still drag on performance. The average expense ratio (weighted by assets) of ETFs in Morningstar's Derivative Income Category is 0.52%, which is over three times higher than the 0.15% weighted average expense ratio of ETFs in the U.S. Large Value Category and about seven times higher than the 0.07% weighted average expense ratio of ETFs in the U.S. Large Blend Category. Morningstar primarily classifies covered-call ETFs into the Derivative Income Category, while U.S. focused dividend ETFs are often assigned to the Large Value Category.

What are potential tax implications for derivative income funds compared to traditional dividend income options?

The type of income a fund produces can make a big difference when it comes to the size of the bite taken by taxes. Generally, investment funds generate two main types of taxable income for investors: ordinary income (which is taxed at the same rate as wages, ranging from 10% to 37%) or tax-advantaged income (such as qualified dividends, which are taxed at the lower long-term capital gains rates of 0%, 15% or 20%). Taxpayers with higher incomes would also be subject to the 3.8% net investment income tax (NIIT).

Distributions from low-turnover funds that generate dividend income by holding U.S. and developed-market equities will be eligible to have dividend income taxed at the lower long-term capital gains tax rates (assuming the investor meets the holding period requirements). On the other hand, all or a portion of the income generated by selling options is typically taxed at the higher ordinary income tax rates. From a tax-efficiency standpoint, an ETF that generates significant income from covered calls will generally produce a larger tax drag on returns, especially for those in higher tax brackets.

However, it's important to keep in mind that these tax implications are only relevant for taxable accounts. Investors holding derivative income funds in tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k)s, are able to defer taxes until funds are withdrawn from the account (at that point, all distributions are taxed as ordinary income).

Bottom line

For investors who want the potential for higher income payouts from an equity fund, with additional income to cushion returns in down markets, but are willing to give up some potential upside in exchange for higher income, and who plan to hold the investment in tax-advantaged IRAs or other retirement accounts, a well-managed derivative income fund may be useful.

For investors who want to generate income without giving up the potential for growth and who invest in a taxable brokerage account, we think that dividend-focused ETFs may make more sense. These funds are generally less complex and lower-cost than covered-call ETFs, and distributions from these funds are more likely to be taxed as qualified dividend income rather than ordinary income. Investors should remember that companies may reduce or eliminate dividends in challenging market conditions. However, for investors focused on total return from a fund in addition to income, dividend-focused ETFs may benefit from upside performance if markets move sharply higher.