Day Traders: Beware the Pattern Day Trader Rule

Day trading can be exciting, especially during times of stock market volatility. It can also be extremely risky—and you should be aware that if you execute too many day trades for the same security in your margin account across too many consecutive sessions, you could be branded a "pattern day trader" and have permanent limits placed on your brokerage account.

Let's explore how day trading works, what a pattern day trader is, the risks of day trading, and more.

What is day trading?

In most cases, day trading is the purchasing and selling (or short selling and purchasing) of the same security on a single day within a margin account.1 Day trading applies to virtually all securities—stocks, bonds, ETFs, and even options (calls and puts). Also, day trading can still apply to extended and overnight sessions, meaning trades placed or filled outside of the regular session may be considered day trades. A new trading day begins at 8 p.m. ET. For example, if an order to buy a security is executed in your account at 8:01 p.m. ET and your order to sell the same security is executed by 7:59 p.m. ET the next calendar day, it will most likely be considered a day trade. For more information, check out our 24/5 around-the-clock trading.

What is a pattern day trader?

If you make four or more day trades over the course of any five business days, and those trades account for more than 6% of your account activity over that time period, your margin account will be flagged as a pattern day trader account.

If this happens, even inadvertently, you'll be required to maintain a minimum equity of $25,000 in the flagged account—on a permanent basis. While flagged, if your account starts the day below this minimum equity (based on the prior day's close), and you then execute a day trade, you'll be limited to liquidating trades only until the situation is addressed.

The Financial Industry Regulatory Authority (FINRA) created the pattern day trader designation after the tech bubble popped back in the early 2000s, with the goal of holding active traders to higher standards than those who trade less frequently.

If you don't want to hold $25,000 equity in your account at all times, pay close attention to your trades to make sure you don't end up with a flagged account. That said, Schwab may allow a one-time exception to clients who may have been flagged as day traders, as long as they commit to not doing so again.

Day trading risks

Day trading involves significant risks and is not suitable for all investors. It's considered riskier than long-term investing due to several factors, including:

- Volatility: Day trading attempts to capitalize on short-term price movements, which are often unpredictable.

- Leverage: Day traders often use leverage in hopes of amplifying their gains to make quick profits, but this can also lead to amplified losses.

- Increased transaction costs: Trading stocks at a high frequency means you'll have more transaction costs, including commissions and fees.

Day trading at Schwab

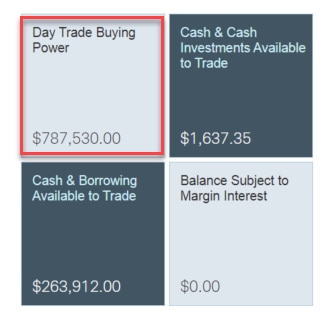

If you want to be a day trader, then the $25,000 minimum balance requirement will always apply to your account. To help with awareness of account activity and requirements, Schwab displays a feature called Day Trade Buying Power (DTBP), which represents the amount of marginable stock that you can day trade in a margin account without incurring a day trade margin call.

DTBP is displayed on both Schwab.com and thinkorswim®:

On schwab.com:

For illustrative purposes only.

On Schwab's thinkorswim® trading platform:

For illustrative purposes only.

Each day's maximum DTBP is determined by the prior night's market close. If you exceed your DTBP, a day trade margin call will be issued for the deficiency.

The trader will have, at most, five business days to make a deposit, journal or transfer of funds, journal or transfer of marginable stock, or sale of long options or non-margined securities in order to meet the call.

Funds deposited to meet a day trade margin or minimum equity call must remain in the account for a minimum of the deposit day plus two business days.

If you don't have an outstanding day trade margin call, your DTBP will update throughout the day as you execute trades—falling with opening trades and rising with closed day trades.

If you do have an outstanding day trade margin call, your DTBP will fall with each opening transaction during the day, but you won't be credited when transactions close.

Orders for leveraged exchange-traded funds (ETFs) reduce DTBP by an amount equal to the cost of the order multiplied by the leverage factor of that particular ETF. For example, if you place a $10,000 order for a 3x leveraged ETF, your DTBP will shrink by $30,000.

Trades with non-marginable securities are subject to cash account rules, not margin account rules, meaning you can day trade in your margin account without fear of being flagged as a pattern day trader.

I have a little over $25,000. Can I place occasional day trades?

Before you do that, be sure you really understand your account balance because there are many things that can affect your trade equity, such as:

- If you have no open positions, meaning no unrealized gains or losses, your start-of-day equity is likely to be the same as your previous day's end-of-day equity.

- If you have open positions, either unrealized gains or losses, your opening equity will depend on how your positions are "marked to market" at the beginning of the trading day. (Marked to market is the value of your positions if they were immediately sold or bought at current market prices.)

- If you hold positions with unrealized losses, your losses may reduce your trade equity (think of them as being marked to market at any given time).

- If you're holding stocks that were bought on margin, you may need to subtract the amount of maintenance margin from your trade equity, both cash and unrealized returns, to determine how much you actually have. If your account value falls below $25,000, then any pattern day trading activities may constitute a violation.

- If you trade futures in a linked futures account, keep in mind that futures cash or positions do not count toward the $25,000 minimum account value.

Bottom line on day trading

Having restrictions placed on your account because of pattern day trader rules isn't ideal. If you want to be a more active trader, or occasionally do a little day trading, be sure to keep tabs on all applicable limits. Otherwise, you should steer clear of violating the rules and keep your account value well over $25,000.

1Exceptions include a long security position (holder owns the security) held overnight and then sold the next day prior to any new purchase of the same security or a short security position (sale of security borrowed from Schwab) held overnight and then repurchased the next day prior to any new sale of the same security.