Investing in Artificial Intelligence (AI)

Artificial intelligence (AI) is still developing—along with related regulations and business uses—but it is likely to become ubiquitous. It won't be feasible to avoid exposure. Much like it's not practical to avoid being invested in "the internet" these days with companies across the spectrum of industries embracing online products and services.

AI holds the potential to transform employment, drive faster productivity growth, and drive gains for investors. We'll also discuss the risks prospective investors should consider.

Transforming employment

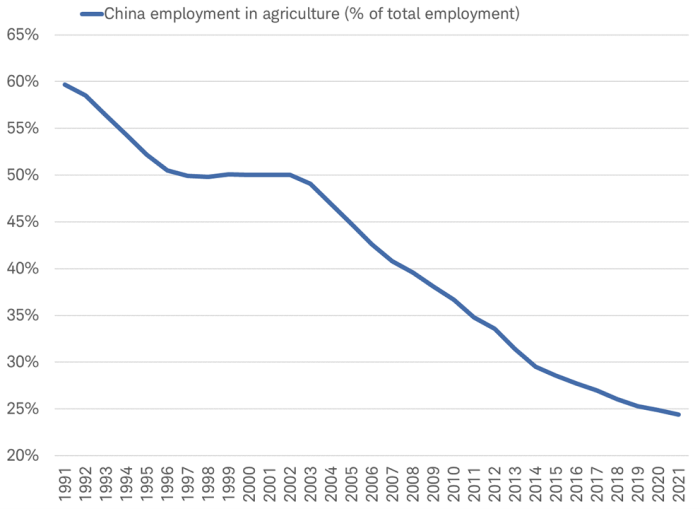

AI has the potential for disruption, displacing some jobs and creating new ones as it transforms the global labor force. New technology transforming the labor market is characteristic of our modern economy, and a great example can be seen in China over the past 30 years. In China, agriculture workers made up 60% of the workforce in 1991, but just 24% in 2021, having been replaced by technology (e.g., tractors, harvesters, processing equipment, irrigation, and seed innovations) and people moved to cities to work in factories as manufacturing increased as a portion of the economy. These advances helped improve incomes for workers in new industries in China and even for those workers that remained in agriculture, according to data from China's National Development and Reform Commission.

Tech-driven transformational change in China's labor market

Source: Charles Schwab, World Bank data as of 8/6/2023.

The economic impact of AI could be even more rapid and transformative. As humans and machines combine intelligence, there are potential benefits for both workers and businesses in old and new industries. Productivity gains from AI could boost wages and corporate profits. It might even improve government budgets through taxes on higher incomes of both workers and firms.

It could even spur another type of globalization. Traditionally, globalization focused on the manufacture and movement of goods. But the next facet of globalization could be in services. For example, the shortage of workers in healthcare and education industries in local communities around the world could be addressed by AI bots developed by competing multinational providers.

Faster productivity

The tightest labor market in generations—with unemployment rates in the U.S., Canada, Germany, and the United Kingdom recently falling to lows not seen in 50 years—threatens to raise labor costs and slow growth. It's been a key focus of central bankers this year. AI could help manage wage costs by filling the gaps and boosting output per worker. How significant might this be and how long could it take?

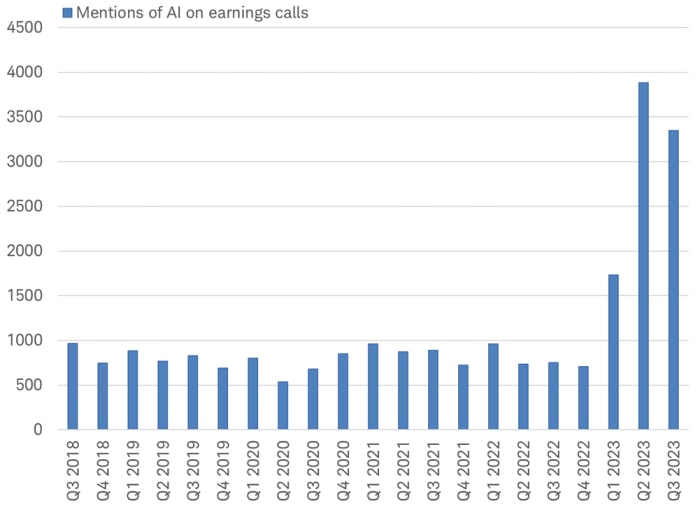

History suggests it takes a while for new technologies to coalesce and businesses to adopt and effectively implement them. Recent examples of this include the internet and the Global Positioning System (GPS). It begins with business capital investments in AI. Reviewing quarterly earnings calls, we observe that business leaders are increasingly discussing AI with shareholders, signaling the potential for investment. Our tracking has revealed that mentions of AI on earnings calls that have occurred during the second and third quarters of this year have soared to over 3,000. Of course, the third quarter is far from over yet, which suggests further upside momentum to the discussion of AI by businesses.

Business leaders increasingly talk to shareholders about AI

Source: Charles Schwab, Bloomberg data as of 8/6/2023.

Search of reports from companies in MSCI World Index Including terms: artificial intelligence, AI, machine learning, chatGPT, neural networks, deep learning.

At this time, few firms have currently incorporated AI into their operations. The latest survey by the U.S. Census Bureau of 300,000 businesses, published in November 2022 (just ahead of the ChatGPT excitement), revealed that only 4% used AI in their business. Surveys conducted by Gartner, McKinsey, Accenture and others have found higher adoption rates in specific industries, such as the retail industry adopting AI-suggested product recommendations for shoppers. Still, integration seems to be in its infancy across wide swaths of industry, with a long way to go for AI adoption in manufacturing, product design, drug development, transportation, construction, customer service, heath care, agriculture, and mining.

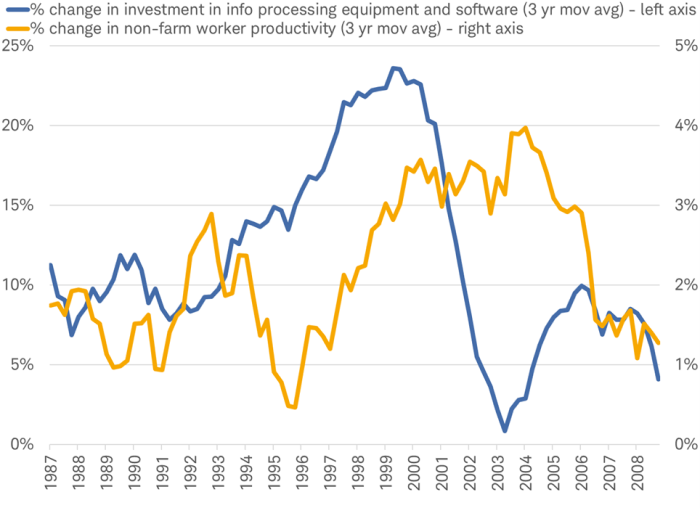

In general, history shows that the greater and more rapid the investment in new technologies by businesses, the greater the potential impact on productivity. We can gauge the potential impact of AI by monitoring the scale of investment into AI-related capital focused on information processing equipment and software. We would expect a similar pattern as observed during the most recent, tech-driven boost to productivity in the 1990s internet boom. An upturn in technology investment by businesses took place around 1993, preceding the start of a rise in productivity just a few years later in 1996. A deceleration in investment growth began in 1998, reaching a peak level in 2000. Productivity growth stabilized in 2000, and then declined until 2004. Both changes in productivity were signaled a few years in advance by the change in investment. Why the lag of a few years? Economy-wide productivity wasn't enhanced until enough businesses had integrated the new technology into their operations and were able to capitalize on new capabilities. AI could be adopted more quickly or slowly, watching the pace of investment may be the key.

Investment growth precedes productivity by a few years

Source: Charles Schwab, Bureau of Economic Analysis, Bloomberg data as of 8/6/2023.

Business investment is likely to climb as the benefits of AI to their businesses becomes more evident, offering the potential for a productivity payoff in the second half of this decade. However, it is difficult to estimate the impact until the data reveals the extent of businesses' capital expenditures. While AI is promising, there are plenty of challenges to implementation. Not only has the cost of capital gone up with the climb in interest rates, but there are also plenty of costs tied to the regulatory uncertainty and data privacy issues that may temper the rising enthusiasm for AI investment.

Investing in AI

It's likely we will all be AI investors eventually, given what may become widespread adoption by businesses around the world. But what about right now? For those considering investing in AI stocks, consider Schwab.com's AI theme that features 25 AI-related stocks from around the world. Besides individual stocks, there are also several ETFs and mutual funds focused on AI-related investments to consider.

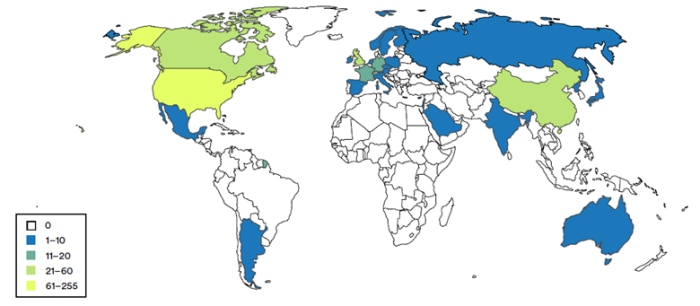

We often think of U.S.-based manufacturing companies when it comes to new technologies like AI, but exposure to AI spans borders and industries. Arguably the most well-known AI-related stock, the U.S.'s Nvidia, does not manufacture its own graphic processing chips (GPUs) that are all the rage for AI applications. Instead, it relies on Taiwan Semiconductor Manufacturing Company (TSMC), the most advanced chipmaker in the world, to manufacture its GPUs. TSMC relies on machines from Netherland's ASML, the biggest semiconductor equipment maker in the world, to manufacture the world's most advanced semiconductors. Machine learning models have moved from academia to industry according to the Artificial Intelligence Index Report for 2023, offering the potential for global firms with massive amounts of data related to finance, health care and consumer products to advance AI technology. As you can see in the chart below featuring the distribution of machine-learning models, AI is not just a U.S.-focused theme.

The global distribution of machine-learning models

Source: 2023 AI Index Report, retrieved 7/31/2023.

It's hard to pick winners or get the timing right for any new technology, so diversification may offer broad exposure to AI as a theme with less individual company risk. In general, look for AI stocks that provide critical components (hardware and software) and those that use AI to improve products or gain a strategic edge.

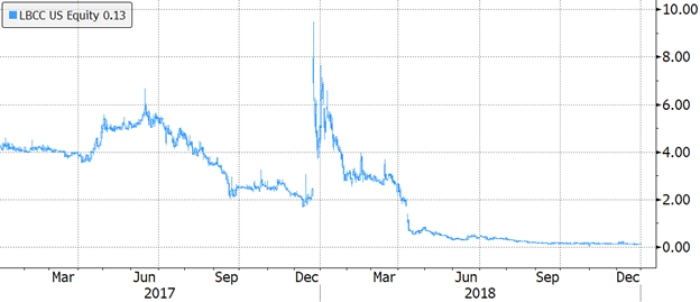

Meanwhile, be on guard against poorly performing companies that suddenly trumpet AI product plans. For example, during the blockchain boom of 2017, a $24 million microcap iced tea company sent its share price spiking as much as 380% merely by announcing a "pivot" to blockchain technology. Long Island Iced Tea Corporation even changed its name to Long Blockchain Corporation. Even though the company had no actual business tied to blockchain at the time and no experience in the cryptocurrency space, its Nasdaq-listed share price sky-rocketed and trading volume spiked. The stock hit an intraday high of $9.49 in December 2017 only to fall below $0.09 a share within a year. Long Blockchain was delisted by the Nasdaq in February of 2021 for allegedly making a "series of public statements designed to mislead investors and to take advantage of the general investor interest in bitcoin and blockchain technology," according to the Securities and Exchange Commission.

"Blockchain" boom and bust

Source: Charles Schwab, Bloomberg data as of 8/6/2023.

In addition to the specific risks related to individual stocks, AI stocks broadly face tougher regulation and legislation as agencies and lawmakers work on putting safety boundaries on the development and uses of AI. The Federal Trade Commission is investigating whether AI models violate consumer protection laws. The use of intellectual property for generative AI companies is also an issue.

AI bubble?

Is the surge in AI-related stocks another classic investing bubble? Hundreds of years of history shows us that investment bubbles have been a regularly occurring feature of the financial markets. For as long as humans have been trading investments, whether in commodities, real estate, or stocks, there have been periods of time when the prices of assets have become disconnected from their underlying value. Although bubbles typically are identified after they have popped, there is a repeating pathway characterized by a specific set of conditions that helps to predict them. Investment bubbles often begin as a natural byproduct of extremely stimulative polices enacted in the wake of global recessions. They are born of easy money, grow on speculation fueled by a strong fundamental theme and high investor confidence, and collapse as money tightens, usually well after disconnecting from intrinsic value.

The specific set of conditions that characterize the start of a classic investment bubble appear to no longer be present. Perhaps the meme investing craze of 2021 was the classic bubble of the 2020s; easy money cycle when rates were zero and quantitative easing (QE) was in full swing along with abundant government aid to consumers and businesses. But now central banks have been hiking rates aggressively for over a year. The money supply in most major economies is contracting. It doesn't appear that easy money is giving rise to the surge in AI stocks. That doesn't mean AI stocks can't retreat or disconnect from their fundamentals, but it suggests the rise in AI stocks may not be just another one of the classic bubbles that have almost always ended in disappointment for investors.

Transformational tech

Technological innovation has been a key driver of global economic growth, improving worker output and productivity since before the printing press replaced hand-copying manuscripts in the 15th century. Business investment is likely to climb as the benefits of AI to their businesses becomes more evident, offering the potential for a productivity payoff in the second half of this decade. AI-related stocks may benefit from increasing capital investment and provide an opportunity for investors as firms look to improve their business processes. But portfolio diversification remains important given the heightened volatility that often accompanies new technologies and likely shifts in leadership as the technology and adoption evolves.

Michelle Gibley, CFA®, Director of International Research, and Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.