Is the Next Temperamental Era Upon Us?

Excluding the 2007–2009 global financial crisis, the roughly 30-year period that preceded the 2020 pandemic was about as good as it gets for U.S. investors. During that time, which is called the Great Moderation Era, we enjoyed a decrease in the rate of inflation, fewer recessions, and lower economic volatility relative to the prior three decades. At the same time, globalization provided companies with cheap and abundant labor, elevating corporate profits as a percentage of gross domestic product (GDP).

Since the pandemic, however, we've seen an uptick in volatility across many economic and inflation readings, as well as more uncertainty and trade risk on the geopolitical front. We've also seen an increase in labor's power, with wages accounting for a rising share of GDP.

All told, the current environment bears a striking resemblance to the period from the mid-1960s through the early 1990s, which I've dubbed the Temperamental Era. If the comparison holds and we are indeed in a prolonged cycle of macroeconomic choppiness, it could have significant implications for investors.

Here we go . . . again?

If we're to understand the possible sequel, it's important to scrutinize two key characteristics that defined the Temperamental Era:

GDP volatility

The Temperamental Era exhibited more robust growth during periods of economic expansion, but with higher highs and lower lows in GDP growth—and more frequent recessions. Since the pandemic erupted, we've seen similar economic behavior, with the year-over-year change in real GDP swinging from –7.5% in mid-2020 to nearly 12% in mid-2021 to around 5% in 2022.

Big swings

Compared with the subsequent 30 years, the Temperamental Era experienced larger and more frequent swings in real GDP.

Source: Charles Schwab and Bloomberg.

Data from Q1 1965 through Q2 2024.

Inflation volatility

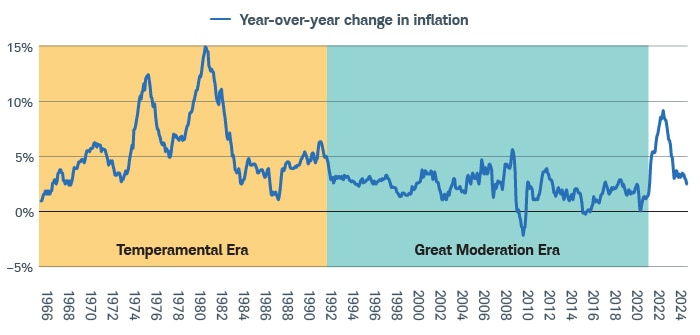

Another defining characteristic of the Temperamental Era was heightened inflation volatility. The period was punctuated by two extreme peaks during the mid- to late-1970s, exacerbated by the Federal Reserve declaring victory on inflation too early. In both cases, the Fed eased policy only to see inflation creep up again. The aggressive rate hikes that followed hit the economy hard, generating back-to-back recessions in the early 1980s.

Today, the Fed is easing its interest rate policy as inflation pressures recede and the labor market weakens. We continue to believe that the latest trend of disinflation will hold, but there could be more inflation volatility going forward—for two principal reasons:

- The supply shocks caused by the pandemic prompted companies to shift their inventory management from a global to a more diversified or regional approach. Although this can improve delivery timelines, regional supply chains may have limited capacity, which can drive up prices due to scarcity or higher production costs.

- The reemergence of big rivalries between the United States and China, and NATO and Russia, is raising the odds of more trade restrictions (like tariffs) and other supply risks.

Twin peaks

Inflation spikes were a hallmark of the Temperamental Era—and have recently recurred.

Source: Charles Schwab, Bloomberg, and the Bureau of Labor Statistics.

Data from 01/31/1965 through 08/31/2024. Inflation is represented by the Consumer Price Index.

How to respond

The epic decline in interest rates that followed the global financial crisis created a tailwind that benefited both strong and weak companies. With borrowing rates near record lows for much of that period, "zombie companies" with no profits and insufficient cash flows to pay interest on their debt were able to skate by. However, if higher economic and inflation volatility is upon us, investors will likely need to be more selective, opting for stocks with strong fundamentals over those subsisting on hype alone.

- For fund investors, that might mean favoring actively managed funds—particularly those with a strong focus on fundamentals.

- For single-stock investors, focusing on fundamental factors like earnings per share, free cash flow, and return on equity can help identify strong balance sheets and a propensity for growth (for more, see "X factors").

- For all investors, regularly rebalancing may become increasingly important as economic volatility disproportionately affects various corners of the market.

X factors

Focusing on fundamentals can help identify healthier companies.

By Steven Greiner

Factor-based investing involves screening for fundamentals that can help identify healthy companies with positive growth prospects. That's why we incorporate more than 200 fundamental factors into Schwab Equity Ratings®, our proprietary stock-rating system. We look at factors related to growth, momentum, quality, stability, and value to determine which stocks might be well positioned to outperform over the long run.

If you want to incorporate factor-based investing into your strategy, you can consider stocks that have Schwab Equity Ratings of A or B. Since 2002, A-rated stocks have tended to consistently outperform B-rated stocks, and B-rated stocks have tended to beat those rated C, D, or F.

To incorporate fundamental factors into your own research, consider the following three:

- Price-to-cash flow: A lower reading relative to the stock's peer group may indicate the company is in a good position to sustain its operations and meet its financial obligations.

- Price momentum: Trends are powerful: Stocks that go up tend to keep going up, and vice versa. I like to look at how a stock has performed relative to its industry over the past year.

- Return volatility: Nobody wants to buy a stock that can go from $100 one day to $50 the next and back again; slow and steady often wins the race. Look for stocks with a beta reading of less than 1.0, which indicates lower price volatility than the overall market.

Given some similarities between today's economic environment and the Temperamental Era, I want to underscore the importance of due diligence. Although there may be more frequent contractions, it may also mean the return of more robust expansions. In other words, there tend to be opportunities to further your financial goals—for those willing to put in the work.

- To research actively managed funds for your portfolio, log in to Schwab's Fund Screener or ETF Screener.

- You can use the Stock Screener to research stocks by:

- Schwab Equity Rating: Under Analyst Ratings, select Schwab Equity Rating, then select the relevant letter grades.

- Price-to-cash flow: Under Valuation, select Price/Cash Flow. To compare stocks on a relative basis, select all available options.

- Price momentum: Under Price Performance, scroll to Performance vs. Industry, then select Year to Date.

- Return volatility: Under Price Performance, scroll to Total return, select Beta, and then select the relevant ranges.

Discover more from Onward

Keep reading the latest issue online or view the print edition.