Lessons on Charitable Giving

In September of 2023, Valerie Adnams Smith traveled from her home near Twin Falls, Idaho, to the tiny Irish village of Courtmacsherry for an extraordinary event: the christening of a $3 million lifeboat bearing her maiden name, Val Adnams.

Dressed in a cowboy hat and boots, the then-88-year-old poured Champagne over the bow after giving a brief speech. "It is a great honor and privilege to have funded this Shannon-class lifeboat," Valerie told the crowd. "It warms my heart to know that this lifeboat will be helping the crew to keep the waters around Courtmacsherry lifeboat station safe."

As a donor to the Royal National Lifeboat Institution (RNLI), a U.K.-based nonprofit that uses these specially built boats to conduct maritime rescues around Ireland and the United Kingdom, Valerie provided the primary financial gift that made construction of the vessel possible. "This lifeboat is the best of its kind, and the crew who will use it deserve nothing less," she said.

While Valerie's charitable objective presented unique challenges, her journey offers plenty of guidance for those looking to establish or enhance their own approach to philanthropic giving.

Find your cause

Whether you have personal ties to a specific organization or choose to support numerous charities as needs arise, it's important to identify the reason you'd like to support a cause. One way to do that is to create a wealth mission statement that codifies your charitable values, which can help guide future gifts.

Incorporating your charitable aspirations into a family wealth mission statement can bring clarity to your intentions and help simplify the decision-making process for yourself and your heirs. In Valerie's case, her desire to help the RNLI was informed by a link dating back to her childhood.

Growing up in Weymouth, on the southern coast of England, Valerie started sailing at age 12. Right next to her sailing club were lifeboat crews tasked with rescuing boats reported to be foundering in the English Channel, the notoriously rough arm of the Atlantic that separates England from France. "The whole town would turn out to cheer them on," Valerie says.

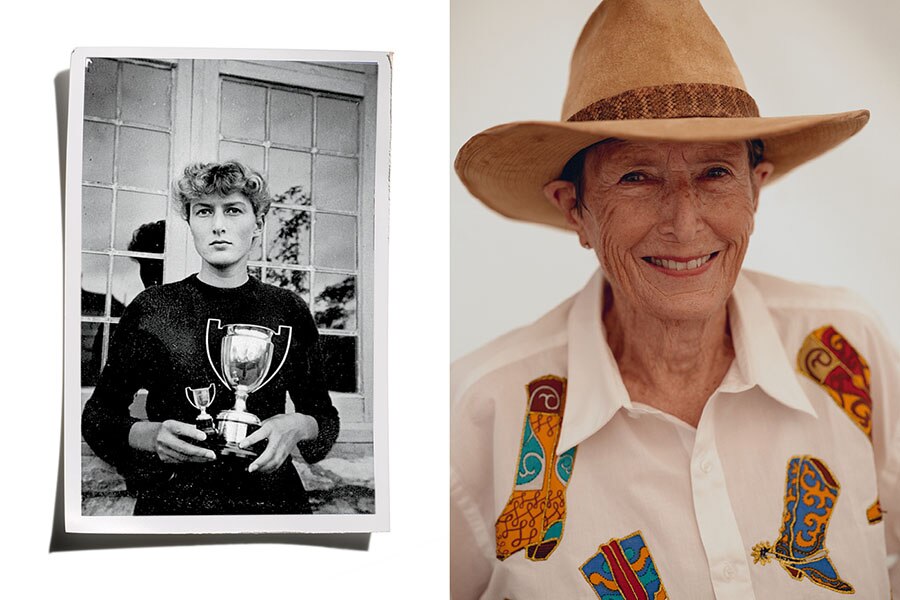

Valerie, who started sailing at age 12, garnered multiple awards by age 20 (left); Valerie at the christening of the lifeboat in Courtmacsherry, Ireland (right).

For those without such a meaningful connection, it can be helpful to reflect on your personal values and family history. If you believe strongly in education, for instance, you might gravitate toward a charity that builds schools in developing countries. If a family member battled a rare form of cancer, on the other hand, you might wish to sponsor research into that disease.

Once you've determined a cause or causes, you'll need to identify specific organizations that support such work—which isn't always as straightforward as you might think. In the U.S. alone, there are more than 1.8 million registered 501(c)(3) public charities, according to the National Center for Charitable Statistics.

The abundance of options can seem overwhelming, but fortunately organizations like Charity Navigator and Candid offer a wealth of information that can help guide your decision-making—including how much of your donation goes directly to the cause you're looking to support (as opposed to fundraising costs or overhead) and whether an organization has been flagged for misconduct or questionable practices.

The DAFgiving360™ Giving Guide (dafgiving360.org/giving-guide) offers a series of activities to help you identify your philanthropic focus.

Decide on your gifting method

Initially, Valerie and her late husband, Ed, included a bequest to the charity in their joint will. After Ed's death, however, Valerie realized they had substantially more assets than when she and Ed first created their estate plans, and she could make a more significant gift in her own name while she was still alive to see its impact.

It would have been simple enough for Valerie to liquidate securities, write a check directly to the RNLI, and call it a day—and that's initially what she wanted to do. However, Valerie's team of Schwab professionals helped develop a plan to maximize her gift.

"When we started talking about this gift, we saw an opportunity to not only do good for her chosen organization, but also do well by Valerie—the sweet spot of any charitable transaction," says Jan Schiedel, a Schwab senior financial consultant. "She was even able to participate in regular meetings with the RNLI to track the progress of the boat's construction, which brought her a lot of joy."

Directly donating appreciated securities held longer than a year, as opposed to selling them and donating the proceeds, can increase both your tax benefit and the amount a charity receives. "Selling those assets would have generated significant capital gains taxes," adds Tatiana Brownell, Valerie's wealth advisor at Schwab Wealth Advisory, Inc., who worked closely with Valerie to customize her giving plan. "Plus, because the RNLI isn't a U.S. 501(c)(3) public charity, the donation may not have been tax-deductible."

Do good and do well

Jan and Tatiana ultimately recommended that Valerie make her donation through a donor-advised fund (DAF) account with DAFgiving360—a tax-smart investment solution for charitable giving to which donors contribute cash or appreciated assets like securities.

"By donating appreciated long-term investments, you don't have to recognize the capital gains and you may be able to receive a tax deduction for the full fair-market value of the donation in the year it was made," Tatiana says. (The deduction can be up to 30% of your adjusted gross income—or your total income minus certain adjustments, such as alimony or contributions to a retirement plan.)

However, not all organizations are in the position to receive such a gift. Smaller charities, in particular, may not have the knowledge or resources to handle the receipt and sale of noncash gifts. Giving via a DAF shifts those responsibilities to the fund administrator, who can liquidate the securities and cut a check on your behalf.

Even better, the funds in a donor-advised fund can be invested for growth until you're ready to distribute all or part of them, potentially magnifying the amount you're able to give. Many donors looking to itemize their charitable deductions use DAFs to "bunch," or consolidate, what otherwise might have been multiyear contributions into a single year.

"The beauty of a donor-advised fund is that you can also capture the tax benefits of a sizable charitable contribution in a single year before making grants over a much longer time horizon as you see fit," Jan says.

Consider a client who sells a business and wishes to donate $100,000 per year from the proceeds over the next 20 years. They can offset all or part of the taxable proceeds from the sale by contributing $2 million to a donor-advised fund account, then recommending annual $100,000 grants from the account. Be aware, however, that donor-advised funds have administrative and investment fees that are deducted from your account balance.

Another tax-efficient option for giving is to make a charitable gift directly from your retirement account. If you have ample tax-deferred IRA savings and are at least age 70½, for example, you might consider a qualified charitable distribution (QCD) of up to $108,000 for the 2025 tax year ($111,000 for 2026) directly from your IRA. Although QCDs cannot be made to donor-advised funds, they can allow you to exclude the distribution from your taxable income and satisfy all or part of your annual required minimum distribution from your IRA—which kick in at age 73 (75 for those born in or after 1960)—thereby reducing your tax obligation in the year the QCD is made.

Expand your giving horizon

If, like Valerie, you are inclined to give internationally, it can present unique barriers that don't apply when donating to charities within the United States.

For those who want to support foreign organizations, typically the simplest approach is to donate to a U.S.-based charity that provides services overseas, like the American Red Cross International Services, which offer humanitarian aid.

Those with donor-advised fund accounts at DAFgiving360 can reach out to DAFgiving360's international granting specialists (dafgiving360.org/giving-internationally), who help ensure donations don't go to organizations that are subject to U.N. or U.S. sanctions, or that are included on fraud, terrorist, or trade-control lists.

Once Valerie and her team decided on using a donor-advised fund to facilitate her gift, they turned to DAFgiving360's Direct Global Giving Program to help channel support to the RNLI. Through this program, DAFgiving360 conducts due diligence and performs what's called an equivalency determination review in order to deem the foreign charity comparable to a domestic one. "When handled properly, these third-party certifications can be used to qualify your contribution for a U.S. tax deduction," Jan says.

It took about six months to perform the review and get the paperwork in order, and less than a week to transfer the securities to DAFgiving360 and then recommend a grant to the RNLI. Other than signing some documents and paying a nominal fee for the review, little was required of Valerie to get the RNLI certified. "Jan and I partnered with DAFgiving360 to handle all of the legwork," Tatiana says, "and Valerie received a deduction for her gift."

Learn more about DAFgiving360's Direct Global Giving Program at dafgiving360.org/giving-internationally.

Make it part of your plan

Valerie's charitable journey from an initial cash bequest in her will to a larger gift via a donor-advised fund shows the importance of revisiting your estate plan regularly—particularly when a major life event happens. Better yet, by having a knowledgeable team around her, Valerie realized methods of giving that not only maximized her gift but achieved a tax benefit that could help fund future philanthropy.

Christening the Val Adnams.