Looking to the Futures

Gold’s Shine Fades as Dollar Strength Builds

Gold prices continued to fall on Thursday, as a strengthening dollar maintained pressure on the precious metal. April expiration Comex Gold Futures (/GCJ26) settled lower at 5078.7, down -56.00 (-1.09%) from Wednesday's close. Prices are down roughly -6.5% for the week from the highs on Monday's session to Thursday's close. With Crude Oil prices and volume surging, the spotlight has been taken off Gold for now, which has been a market favorite over the past few months. April Crude (/CLJ26) flew another +8.5% on Thursday, settling at a year and a half high of 81.01.

With what has been a volatile week to say the least, the war in Iran entered its 6th day on Thursday with Iran doubling down on its retaliation efforts. The Strait of Hormuz has now been closed 5 straight days as supply chain constraints for oil continue to amplify. U.S. Secretary of Defense Pete Hegseth squashed ammunition shortage rumors on Thursday stating the U.S. can sustain its campaign against Iran indefinitely, raising concerns of a longer than anticipated conflict. The White House confirmed that the Trump administration intends to meet with U.S. defense executives on Friday to discuss accelerating weapons production.

On an economic front, U.S. weekly jobless claims supported a stronger labor market as claims were unchanged at 213,000, lower than the 215,000 expectations. Q4 nonfarm productivity also came in at a positive surprise with productivity rising +2.8%, better than the +1.9% expectations. Comments from Richmond Fed President Tom Barkin however added to inflation and rate cut fears as he stated that recent data showed "relatively high inflation" which "certainly puts pause to any conclusion that we're done fighting this." These economic numbers and hawkish commentary helped reinforce the dollar as the dollar index rose +0.43% for the day. With bond yields also trading higher this week, the notion that investors have taken a flight to liquidity and cash opposed to precious metals, appears to be reinforced.

Despite precious metals being a safe haven during other geopolitical risk events over the past months, fears of higher inflation due to soaring oil prices and hawkish economic data for Fed policy have kept prices subdued thus far this week. The U.S. Secretary of the Interior Doug Burgum reported on Thursday afternoon that the government is considering emergency measures to stabilize crude prices. The market will be intently watching what may come of this and if these measures will be able to alleviate prices, easing some inflation concerns. More job data will be released Friday morning with the February employment and unemployment rate coming in. February nonfarm payrolls are expected to increase by +60,000 and the unemployment rate is expected to remain unchanged at 4.3%. According to the CME FedWatch tool as of Thursday evening, the market is discounting a 4.7% chance of a -25-basis point rate cute at the next Fed meeting in 2 weeks.

Technicals

Looking at the daily chart for /GCJ26, prices continued lower on Thursday after starting the week session off at 4-week highs with the news on the attack on Iran breaking over the weekend. Prices have remained above the 20, 50, 100, & 200-day Simple Moving Averages, with the 20-day SMA appearing to act as a major support line over the past couple of weeks. The 14-day RSI closed at 51.9363, indicating slightly bullish but mainly neutral momentum, as buyers and sellers are rather balanced. Volume has fallen from Monday and Tuesday and remained below the 50-day average over the past 2 trading sessions. 145,784 contracts were traded on Thursday with the 50-day average sitting at 222,428. According to the Daily Hightower Report, /GCJ26 may experience some support at the 5014.8 and 4964.2 levels and resistance at the 5160.2 and 5254.9 levels.

20-Day SMA: 5089.3

50-Day SMA: 4846.7

100-Day SMA: 4503.5

200-Day SMA: 3995.3

14-Day RSI: 51.9363

50-Day Volume Average: 222,428

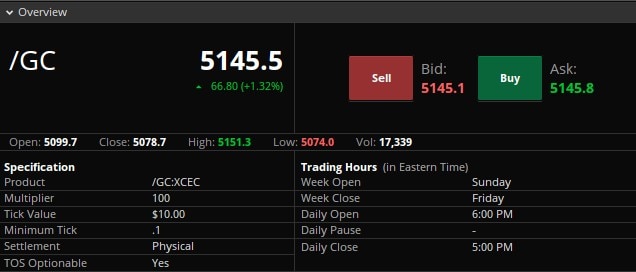

Contract Specifications

Economic Calendar

8:30 AM ET - U.S. Employment Report

8:30 AM ET - U.S. Unemployment Rate

8:30 AM ET - U.S. Hourly Wages

8:30 AM ET - Hourly Wages Year-Over-Year

8:30 AM ET - U.S. Retail Sales (Delayed Report)

8:30 AM ET - Retail Sales Minus Autos

10:00 AM ET - Business Inventories

10:15 AM ET - San Francisco Fed President Mary Daly Speaks

1:30 PM ET - Cleveland Fed President Beth Hammack Speaks

3:00 PM ET - Consumer Credit

New Products

New futures products are available to trade with a futures-approved account on all thinkorswim platforms:

- Ripple (/XRP)

- Micro Ripple (/MXP)

- 100 OZ Silver (/SIC)

- 1 OZ Gold (/1OZ)

- Solana (/SOL)

- Micro Solana (/MSL)

Visit the Schwab.com Futures Markets page to explore the wide variety of futures contracts available for trading through Charles Schwab Futures and Forex LLC.