Optimism Versus Reality

Findings from Schwab's 2024 Modern Wealth Survey

Americans today say they're in better shape to reach their financial goals than the generations that came before them. That’s because they have more ways to build wealth, better access to investing, and more investment options, according to the 2024 Schwab Modern Wealth Survey, an annual survey of 1,000 Americans ages 21 to 75.

However, there's a disconnect between optimism and reality. While survey respondents are optimistic about achieving their goals and highly confident in their investing strategies, fewer say that they feel in control of their finances.

How can this be? In this column I'll highlight key points from the survey, with insights.

Americans are feeling more optimistic about reaching their financial goals

Across all generations surveyed, 64% feel they are better positioned to achieve their financial goals than generations that came before them, with boomers the most optimistic in this way. Survey respondents also say that they are very confident in their investing strategies. For example, 71 percent of Gen Z investors say they are confident in their investing strategies, followed by boomers (70%), millennials (68%) and Gen X (64%).

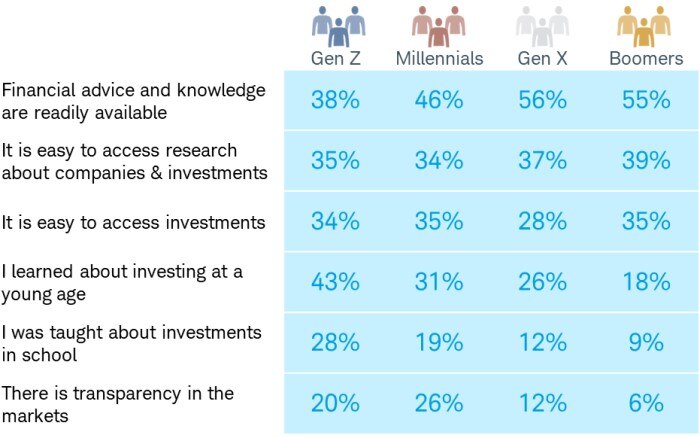

What's driving this optimism? Greater access to a deeper bench of investment strategies that can help build wealth is one part of the good news. In addition, for most investors surveyed across all generations (51%), there's more readily available financial advice and knowledge, followed by easy access to research on companies and investments (37%). For Gen Z, though, optimism and investing confidence are also increasingly driven, for those who are interested in investing, by having more opportunities to learn about and be exposed to investing at a younger age.

No doubt, and it's good news: More access to investments, knowledge, and advice increases optimism in most activities, including investing. But, as we'll see in other findings in the survey, that optimism doesn't necessarily translate to the reality of having finances in order and the feeling of being in control.

Why are you confident in your investment management?

Source: 2024 Schwab Modern Wealth Survey

Americans are starting to save and invest at younger ages

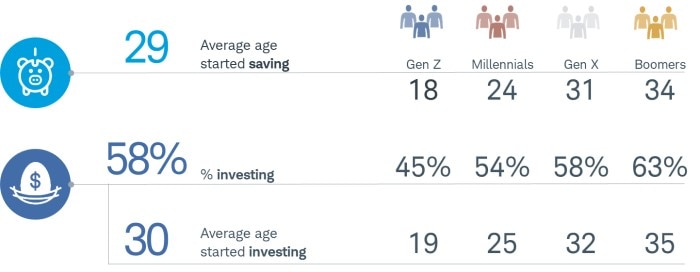

Nearly three in five Americans surveyed (58%) say they are investing today—a record number when we look at similar findings from the Federal Reserve on the number of American households that now own stock. Survey results suggest that, with increasing ways to build wealth, Americans are tapping into those opportunities, and they're starting to save and invest at younger ages.

On average across all generations, survey respondents started saving at age 29 and investing at age 30. But those numbers change across generations, suggesting that each generation is saving and investing earlier than the ones before them.

Gen Z started saving at age 18, and investing at age 19, while boomers surveyed didn't start saving until age 34, and investing at 35, on average This makes sense, and is part of a multi-decade long growth and democratization of investing. Other factors likely play a role as well, such as the decline of the company-provided pension, increasing life expectancy, and as noted, access to markets, information, and knowledge. The trend overall is encouraging.

As investors, we can't control markets, but we can control the amount we save and spend. Saving is the No. 1 factor and foundational habit, we believe, in the path to achieving investment goals. The sooner each of us start, the better, even if it's just small amounts. Not only does that start the imprinting of moneywise habits, but it also enables the "magical" power of compounding. Starting to save and invest earlier starts the compounding engine much sooner, and it adds up. This, more than trading or picking a hot stock, is a foundational principle for any disciplined investor.

At what age did you start saving and investing?

Source: 2024 Schwab Modern Wealth Survey

There's a disconnect between optimism and reality

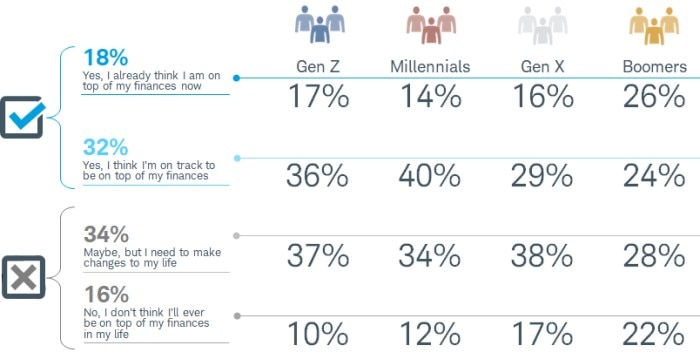

Despite the optimism, the survey results reveal a disconnect. Only 18% of those surveyed say they feel they're already on top of their finances, and another 32% feel they're "on track" to being on top of them. The remaining half of respondents either say they need to make changes in their lives to stay on top of their finances, or they believe they'll never be on top of them.

Do you think that you will be on top of your finances in your lifetime?

Source: 2024 Schwab Modern Wealth Survey

These are the same individuals surveyed who also express all that optimism in achieving their financial goals.

I believe this may illustrate a disconnect between opportunity and reality. Opportunity in that we have more opportunities to pursue wealth, versus reality, as in, how on top of my finances do I personally feel now or feel I'm on track to be, taking advantage of all the options and opportunities?

This disconnect is natural, and likely normal. As Americans, and investors, we have a growing number of choices, real or perceived opportunities, and expectations on how to take ownership of our finances and our lives. But access to investments, information, education, or knowledge doesn't mean that access and life fall in line. It's a complex world, with more information now than is possible to digest. Translating access to actions in which we can feel confident and in control can be difficult, because they are different tasks.

A financial plan is often the connection. Only one-third of survey respondents told us that they have a written financial plan. And nearly all (96%) survey respondents with a plan say they feel confident they will reach their financial goals. Having a plan—and working with an advisor—can help connect the dots between optimism, access, and outcomes.

The idea of a "plan" can be fluid. It can be as simple as writing down a few guardrails to keep your saving and investing on track, or something much more complex. Whatever it means to you—and whatever form it takes—be dynamic. Update it regularly so you know where you are on your path to achieving your goals, and so you can make any changes to stay balanced with your lifestyle.

Bottom line

Engaged American investors have enjoyed a multi-decade expansion of both the ways to invest and information guiding them how to do so. But optimism, and success, go beyond a single decision or investment. With a wealth of information, education, and insights available, putting the pieces together and cutting through noise becomes critical. Planning, as always, and as our survey tells us, helps connect optimism and access with action. Access alone is a huge step forward, but it's not on its own a solution. And a goal without a plan, after all, is just a goal.