ITM vs. OTM Options for Spread Traders

Defining out of the money and in the money in options trading is relatively straightforward. Out-of-the-money (OTM) options have no intrinsic value—for example, a call with a strike price above the underlying stock price, or a put with a strike price below it. In-the-money (ITM) options, by contrast, have intrinsic value in addition to time value. An ITM call has a strike price below the underlying stock's price, while an ITM put is at a strike price above it.

While these definitions are simple, understanding how "moneyness" affects real-world trade outcomes can be more complex—especially when trading multi-leg strategies like vertical spreads.

For example, suppose a trader is considering a bullish spread trade. They could sell a vertical spread using OTM puts (short put spread) or buy a vertical spread using ITM calls (long call spread). Both express a bullish bias, but how should traders decide between the two strategies?

Key considerations for spread traders

Time decay

When a trader sells an OTM put vertical, it's synthetically the same as buying an ITM call vertical using the same strike prices A primary difference is that selling the OTM put vertical is theta positive, meaning time decay works in the trader's favor, while buying the ITM call vertical is theta negative, meaning time decay works against the trader.

Risk and reward

Consider stock ZYX, which is currently trading at $90. One bullish options strategy is selling the June 80/85 put vertical by selling the June 85 put and buying the June 80 put—both OTM—for a net credit of $1.50.

This position has the same risk and reward profile as the June 80/85 call vertical, which is traded by purchasing the June 80 call (ITM by $10) and selling the June 85 call for a $3.50 net debit.

For the call vertical, maximum profit (excluding transaction costs) is the $5 width of the spread minus the $3.50 debit for a net credit of $1.50. To achieve maximum profit, ZYX must be trading above $85 at expiration. The maximum loss for the call vertical is $3.50, which occurs if the stock is trading below $80 at expiration.

Maximum profit for the put vertical, minus transaction costs, is capped at the $1.50 net credit received. The maximum loss—identical to the call vertical—is the difference in strike prices minus the credit received.

In practical terms, the short put spread trader wants both puts to expire worthless, while the call vertical trader wants both calls to finish ITM. One additional consideration for the call spread trader is early assignment risk. Because the short 85 call is ITM, it carries a higher likelihood of being assigned early. If that occurs and the trader doesn't already own the underlying stock, they may need to exercise the long call to flatten the resulting short stock position. However, pay special attention to dividend-paying stocks. A trader holding a short stock position may be required to pay the dividend even if the long call is exercised after the ex-dividend date.

The break-even price for both strategies is the same, $83.50, which is why short put spreads and long call spreads with identical strikes are considered synthetically equivalent from a risk/reward perspective.

How these spreads differ in practice

The key differences between a long call spread and a short put spread are less about theory and more about real-world execution.

Liquidity. OTM vertical spreads tend to be more liquid in part because they're more commonly traded by retail participants and generally require less upfront capital. Higher trading volume often translates into tighter bid/ask spreads, which can potentially make OTM spreads more cost-efficient to trade.

Capital requirement. A bull call spread requires paying a net debit upfront because the trader is buying a lower-call strike. A bull put spread, on the other hand, requires margin or collateral equal to maximum possible loss—calculated as the difference between strike prices minus the credit received.

Total trade cost. If both options in a short OTM put spread expire worthless, the trade is complete, and the trader keeps the premium. With an ITM call spread, the long call will probably be automatically exercised at expiration, and the short call may be assigned. Depending on the broker, those actions can result in additional commissions or fees.

Time decay (in practice). Because the goal of a short put spread is for both options to expire worthless, time decay consistently works in the trader's favor. With a long call spread, the trader is more reliant on the underlying stock moving higher—or at least maintaining its value—before the long call decreases in value as expiration nears.

How to evaluate options

One way to explore these differences without risking capital is by testing scenarios on the thinkorswim® paperMoney® virtual trading platform.

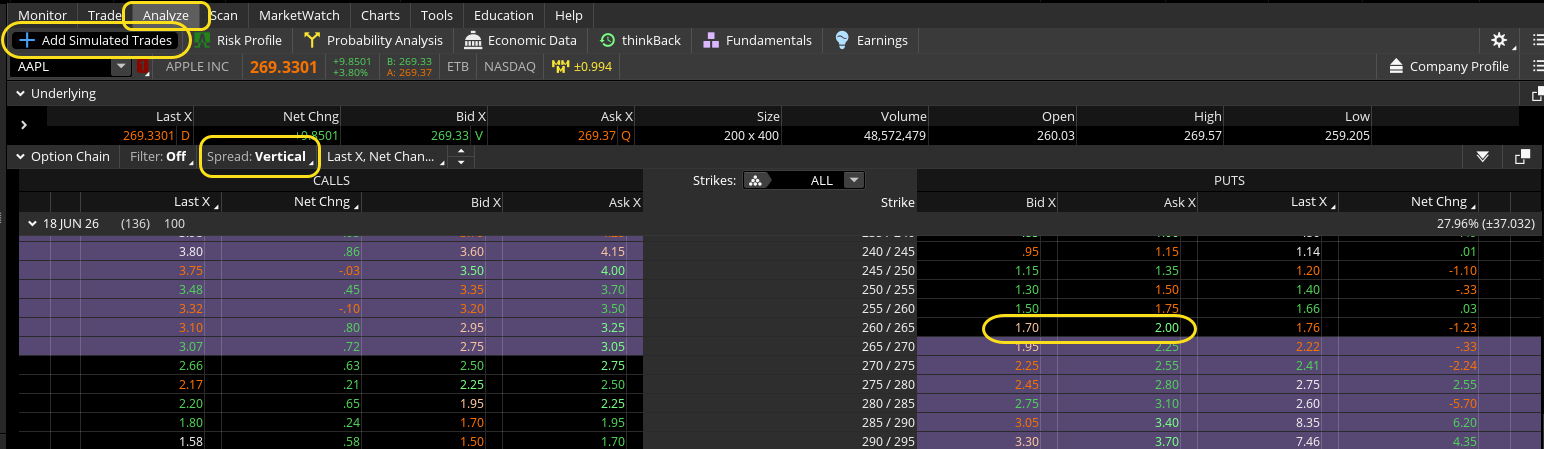

From the Analyze tab, enter a symbol and select Add Simulated Trades. Next, select the Spread menu and then Vertical. Expand the Option Chain and select a strike price on the Puts side of the chain.

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

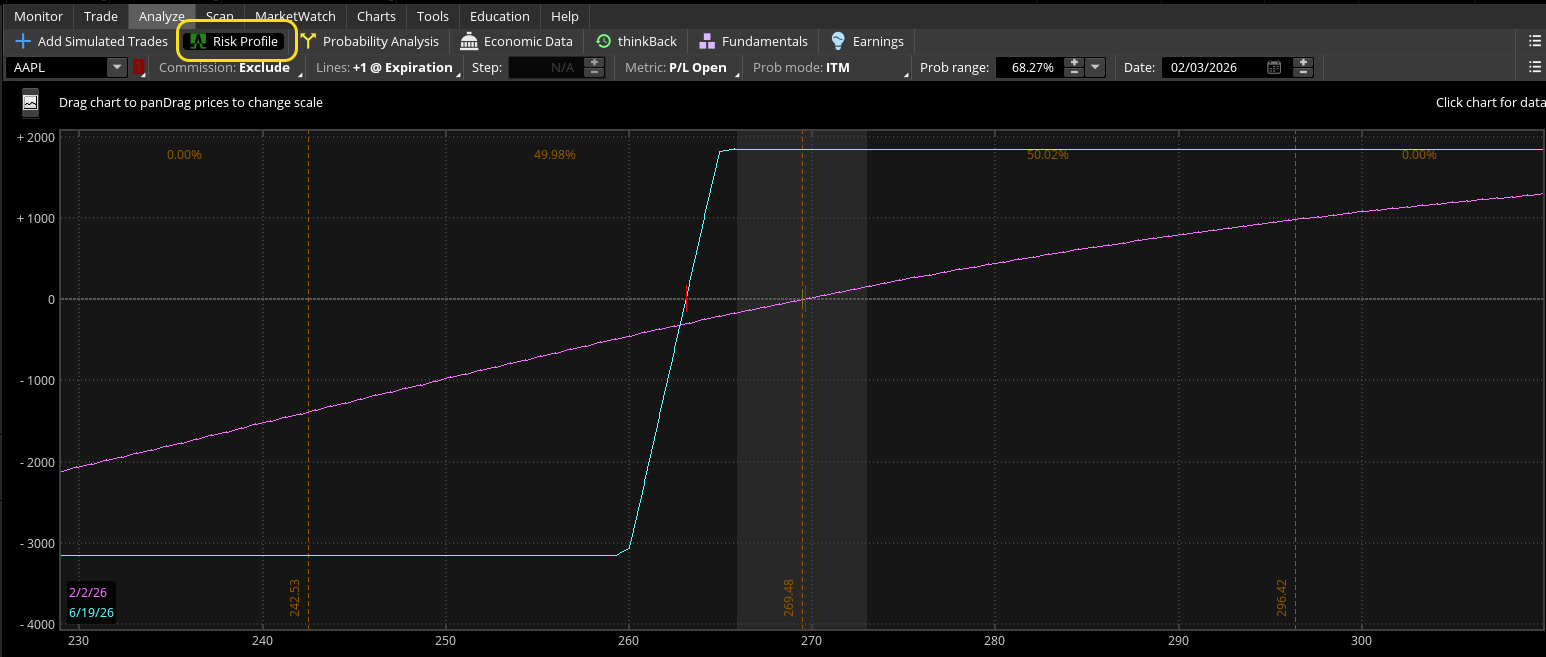

Right-click the chosen spread and select Analyze sell trade > Vertical. From there, review the Risk Profile tab—the teal line shows the profit/loss diagram of the spread at expiration, while the purple line shows it at any point during the life of the trade.

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

Then repeat the process using a call spread with the same strike prices and compare the two risk profiles side by side.

Bottom line

Bull call spreads using ITM calls and bull put spreads using OTM puts can produce identical profit/loss outcomes at expiration. The differences lie in liquidity, capital requirements, assignment risk, and how each strategy behaves in practice.

For traders focused on generating income and simplicity, bull put spreads may be appealing. For traders seeking a risk-defined way to express a bullish position (with less upfront capital than buying calls outright), bull call spreads may be an alternative to consider.