The 4% Rule: How Much Can You Spend in Retirement?

You've worked hard to save for retirement, and now you're ready to turn your savings into a paycheck. But how much can you afford to withdraw from savings and spend? If you spend too much, you risk being left with a shortfall later in retirement. But if you spend too little, you may not enjoy the retirement you envisioned.

How the 4% retirement rule works

One frequently used rule of thumb for retirement spending is known as the 4% rule. It's relatively simple: You add up all of your investments and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation. By following this formula, you should have a very high probability of not outliving your money during a 30-year retirement, according to the rule.

For example, let's say your investment portfolio at retirement totals $1 million. You would withdraw $40,000 in your first year of retirement. If the cost of living rises 2% that year, you would give yourself a 2% raise the following year, withdrawing $40,800, and so on for the next 30 years.

The 4% rule assumes you withdraw the same amount from your portfolio every year, adjusted for inflation

Source: Schwab Center for Financial Research.

Assumes an initial portfolio value of $1 million. Withdrawals increase annually by 2%. The example is hypothetical and provided for illustrative purposes only.

While the 4% rule is a reasonable place to start, it doesn't fit every investor's situation. A few caveats:

- It's a rigid rule. The 4% rule assumes you increase your spending every year by the rate of inflation—not on how your portfolio performed—which can be a challenge for some investors. It also assumes you never have years where you spend more, or less, than the inflation increase. This isn't how most people spend in retirement. Expenses may change from one year to the next, and the amount you spend may change throughout retirement.

- It applies to a specific portfolio composition. The rule applies to a hypothetical portfolio invested 50% in stocks and 50% in bonds. Your actual portfolio composition may differ, and you may change your investments over time during your retirement. We generally suggest that you diversify your portfolio across a wide range of asset classes and types of stocks and bonds, and that you reduce your exposure to stocks as you transition through retirement.

- It uses historical market returns. Analysis by Charles Schwab Investment Management (CSIM) projects that market returns for stocks and bonds over the next decade are likely to be below long-term historical averages. Using historical market returns to calculate a sustainable withdrawal rate could result in a withdrawal rate that is too high.

- It assumes a 30-year time horizon. Depending on your age, 30 years may not be needed or likely. According to Social Security Administration (SSA) estimates, the average remaining life expectancy of people turning 65 today is less than 30 years. We believe that retirees should plan for a long retirement. The risk of running out of money is an important risk to manage. But, if you're already retired or older than 65, your planning time horizon may be different. The 4% rule, in other words, may not suit your situation.

- It includes a very high level of confidence that your portfolio will last for a 30-year period. The rule uses a very high likelihood (close to 100%, in historical scenarios) that the portfolio would have lasted for a 30-year time period. In other words, it assumes that in nearly every scenario the hypothetical portfolio would not have ended with a negative balance. This may sound great in theory, but it means that you have to spend less in retirement to achieve that level of safety. By staying flexible and revisiting your spending rate annually, you may not need to target such a high confidence level.

- It doesn't include taxes or investment fees. The rule guides how much to withdraw from your portfolio each year and assumes that taxes or fees, if any, are an expense that you pay out of the money withdrawn. If you withdraw $40,000, and have $5,000 in taxes and fees at year-end, that's paid from the $40,000 withdrawn.

Beyond the 4% rule

However you slice it, the biggest mistake you can make with the 4% rule is thinking you have to follow it to the letter. It can be used as a starting point—and a basic guideline to help you save for retirement. If you want $40,000 from your portfolio in the first year of a 30-year retirement, increasing annually with inflation, with high confidence your savings will last, using the 4% rule would require you to have $1 million dollars in retirement. But after that, we suggest adopting a personalized spending rate, based on your situation, investments, and risk tolerance, and then regularly updating it. Further, our research suggests that, on average, spending decreases in retirement. It doesn't stay constant (adjusted for inflation) as suggested by the 4% rule.

How do you determine your personalized spending rate? Start by asking yourself these questions:

1. How long do you want to plan for?

Obviously you don't know exactly how long you'll live, and it's not a question that many people want to ponder too deeply. But to get a general idea, you should carefully consider your health and life expectancy, using data from the Social Security Administration and your family history. Also consider your tolerance for managing the risk of outliving your assets, access to other resources if you draw down your portfolio (for example, Social Security, a pension, or annuities), and other factors. This online calculator can help you determine your planning horizon.

2. How will you invest your portfolio?

Stocks in retirement portfolios provide potential for future growth, to help support spending needs later in retirement. Cash and bonds, on the other hand, can add stability and can be used to fund spending needs early in retirement. Each investment serves its own role, so a good mix of all three—stocks, bonds and cash—is important.

We find that asset allocation has a relatively small impact on your first-year sustainable withdrawal amount, unless you have a very conservative allocation and a long retirement period. However, asset allocation can have a significant impact on the portfolio’s ending asset balance. In other words, a more aggressive asset allocation may have the potential to grow more over time. The downside is that the "bad" years can be relatively worse than with a more conservative allocation.

Asset allocation can have a big impact on a portfolio's ending balance

Source: Schwab Center for Financial Research.

Assumes a constant asset allocation, a 75% confidence level, and withdrawals growing by a constant 2.27% over 30 years. Assumes a starting balance of $1 million. Confidence level is defined as the number of times the portfolio ended with a balance greater than zero. See the disclosures below for a summary of the Conservative, Moderately Conservative, Moderate, and Moderately Aggressive asset allocations and return assumptions. The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product, and the example does not reflect the effects of taxes or fees.

Remember, choosing an appropriate mix of investments may not be just a mathematical decision. Research shows that the pain of losses exceeds the pleasure from gains, and this feeling can be amplified in retirement. Picking an allocation you're comfortable with, especially in the event of a bear market, not just the one with the greatest possibility to increase the potential ending asset balance, is important.

Overall, we find that the relative downside risk is small across different asset allocations, further illustrating the conservativeness of the rule.

3. How confident do you want to be that your money will last?

Think of a confidence level as the percentage of times in which the hypothetical portfolio did not run out of money, based on a variety of assumptions and projections regarding potential future market performance. For example, a 90% confidence level means that after projecting 1,000 scenarios using varying returns for stocks and bonds, 900 of the hypothetical portfolios were left with money at the end of the designated time period—anywhere from one cent to an amount more than the portfolio started with.

We think aiming for a 75% to 90% confidence level is appropriate for most people, and sets a more comfortable spending limit, if you're able to remain flexible and adjust if needed. Targeting a 90% confidence level means you will be spending less in retirement, with the trade-off that you are less likely to run out of money. If you regularly revisit your plan and are flexible if conditions change, 75% provides a reasonable confidence level between overspending and underspending.

4. Will you make changes if conditions change?

This is the most important issue, and one that trumps all of the issues above. The 4% rule, as we mentioned, is a rigid guideline, which assumes you won't make adjustments to spending or your investments as conditions change. You aren't a math formula, and neither is your retirement spending. If you make simple changes during market downturns, like lowering your spending on a vacation or reducing or cutting expenses you don't need, you can increase the likelihood that your money will last.

Putting it all together

After you've answered the above questions, you have a few options.

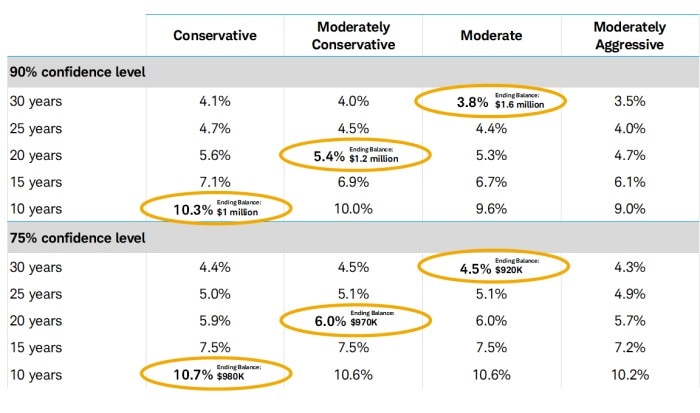

The table below shows our calculations, to give you an estimate of a sustainable initial withdrawal rate. Note that the table shows what you'd withdraw from your portfolio this year only. You would increase the amount by inflation each year thereafter—or ideally, re-review your spending plan based on the performance of your portfolio. (We suggest discussing a comprehensive retirement plan with a financial advisor who can help you tailor your personalized withdrawal strategy. Then update that plan regularly.)

We assume that investors want the highest reasonable withdrawal rate, but not so high that your retirement funds will run short. In the table, we've highlighted the maximum and minimum suggested first-year sustainable withdrawal rates based on different time horizons. Then, we matched those time horizons with a general suggested asset allocation mix for that time period.

For example, if you are planning on needing retirement withdrawals for 20 years, we suggest a moderately conservative asset allocation and an initial withdrawal rate between 5.4% and 6.0%.

The table is based on projections using future 10-year projected portfolio returns and volatility, updated annually by Charles Schwab Investment Management (CSIM). The same annually updated projected returns are used in retirement saving and spending planning tools and calculators at Schwab.

Choose a withdrawal rate based on your time horizon, allocation, and confidence level

Source: Schwab Center for Financial Research.

This table uses Charles Schwab Investment Management’s (CSIM) 2025 10-year long-term return estimates and volatility for large-cap stocks, mid/small-cap stocks, international stocks, bonds and cash investments. CSIM updates its return estimates annually, and withdrawal rates are updated accordingly. See the disclosures below for a summary of the Conservative, Moderately Conservative, Moderate, and Moderately Aggressive asset allocations. The Moderately Aggressive allocation is not our suggested asset allocation for any of the time horizons we use in the example. The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product and the example does not reflect the effects of taxes or fees. Past performance is no guarantee of future results.

Again, these spending rates assume that you will follow that spending rule throughout the rest of your retirement and not make future changes in your spending plan. In reality, we suggest you review your spending rate at least annually.

Schwab's suggested allocations and withdrawal rate

- Planning time horizon

- Asset allocation

-

Initial withdrawal rate (for a 75% to 90% confidence level)

-

Planning time horizon30-yearsAsset allocationModerateInitial withdrawal rate(for a 75% to 90% confidence level)4.2% to 4.8%

-

Planning time horizon20-yearsAsset allocationModerately ConservativeInitial withdrawal rate(for a 75% to 90% confidence level)5.8% to 6.3%

-

Planning time horizon10-yearsAsset allocationConservativeInitial withdrawal rate(for a 75% to 90% confidence level)10.6% to 10.9%

Here are some additional items to keep in mind:

- If you are regularly spending above the rate indicated by the 75% confidence level (as shown in the first table), we suggest spending less.

- If you're subject to required minimum distributions, consider those as part of your withdrawal amount.

- Be sure to factor in Social Security benefits, a pension, annuity income, or other non-portfolio income streams when determining your annual spending. This analysis estimates the amount you can withdraw from your investable portfolio based on your time horizon and desired confidence, not total spending using all sources of income. For example, if you need $50,000 annually but receive $10,000 from Social Security, you don't need to withdraw the whole $50,000 from your portfolio—just the $40,000 difference.

- Rather than just interest and dividends, a balanced portfolio should also generate capital gains. We suggest using all sources of portfolio income to support spending. Investing primarily for interest and dividends may inadvertently skew your portfolio away from your desired asset allocation and may not deliver the combination of stability and growth required to help your portfolio last.

- The projections above and spending rates are before asset management fees, if any, or taxes. Pay those from the gross amount after taking withdrawals.

Stay flexible—nothing ever goes exactly as planned

Our analysis—as well as the original 4% rule—assumes that you increase your spending amount by the rate of inflation each year regardless of market conditions. However, life isn't so predictable. Remember, stay flexible, and evaluate your plan annually or when significant life events occur. If the stock market performs poorly, you may not be comfortable increasing your spending at all. If the market does well, you may be more inclined to spend more on some "nice to haves," medical expenses, or on leaving a legacy.

Bottom line

The transition from saving to spending from your portfolio can be difficult. There will never be a single "right" answer to how much you can withdraw from your portfolio in retirement. What's important is to have a plan and a general guideline for spending—and then monitor and adjust, based on your circumstances, as necessary. The goal, after all, isn't to worry about complicated calculations about spending. It's to enjoy your retirement.

1 The tables show sustainable initial withdrawal rates calculated by simulating 1,000 random scenarios using different confidence levels (i.e., probability of success), time horizons and asset allocation. "Confidence" is calculated as the percentage of times where the portfolio's ending balance was greater than $0. The initial withdrawal amount, in dollars, is then increased by a 2.27% rate of inflation annually. Returns and withdrawals are calculated before taxes and fees. The moderately aggressive allocation is left out of the summary table, because it is not our suggested asset allocation for any of the time horizons we use as an example. For illustrative purposes only.