Required Minimum Distributions: What to Know

For many investors entering their 70s, diligently contributing to and saving in tax-deferred retirement accounts must soon turn to making mandatory annual withdrawals. That's because the government requires retirees to take required minimum distributions (RMDs) from such accounts after a certain age.

Retirees may find RMDs to be a bit daunting, in part because of the steep penalties for withdrawing too little. But RMDs really aren't so complicated once you understand a few basics.

With that in mind, let's take a look at how to calculate your RMDs, how to manage the distributions effectively, and how to potentially reduce the associated tax hit.

1. Do the math: Calculating RMDs

Typically, once you reach age 73 (or 75 if you were born in 1960 or later), you must begin taking annual RMDs from all tax-deferred retirement accounts, including:

- 401(k), 403(b), and similar workplace retirement plan accounts

- SEP IRAs

- SIMPLE IRAs

- Traditional IRAs

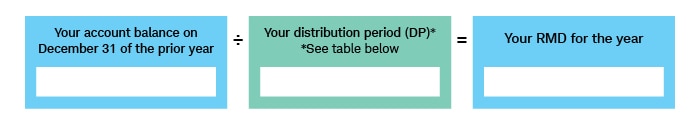

Generally speaking, you can calculate your RMDs for a given year by taking your account balance on December 31 of the previous year and dividing it by your "distribution period"—a number the IRS assigns to each age.

Running the numbers

A simple calculation can help you determine your RMDs for the calendar year.

| Age | Distribution period (DP) |

|---|---|

| 73 | 26.5 |

| 74 | 25.5 |

| 75 | 24.6 |

| 76 | 23.7 |

| 77 | 22.9 |

| 78 | 22.0 |

| 79 | 21.1 |

| 80 | 20.2 |

| 81 | 19.4 |

| 82 | 18.5 |

| 83 | 17.7 |

| 84 | 16.8 |

| 85 | 16.0 |

| 86 | 15.2 |

| 87 | 14.4 |

| 88 | 13.7 |

| 89 | 12.9 |

| 90 | 12.2 |

| 91 | 11.5 |

| 92 | 10.8 |

| 93 | 10.1 |

| 94 | 9.5 |

| 95 | 8.9 |

| 96 | 8.4 |

| 97 | 7.8 |

| 98 | 7.3 |

| 99 | 6.8 |

| 100 | 6.4 |

| 101 | 6.0 |

| 102 | 5.6 |

| 103 | 5.2 |

| 104 | 4.9 |

| 105 | 4.6 |

| 106 | 4.3 |

| 107 | 4.1 |

| 108 | 3.9 |

| 109 | 3.7 |

| 110 | 3.5 |

| 111 | 3.4 |

| 112 | 3.3 |

| 113 | 3.1 |

| 114 | 3.0 |

| 115 | 2.9 |

| 116 | 2.8 |

| 117 | 2.7 |

| 118 | 2.5 |

| 119 | 2.3 |

| 120 and over | 2.0 |

For example, let's say you're 75, single, and ended last year with $2 million in your IRA. According to the table, your distribution period is 24.6, which means your RMD for the year would be $81,301 ($2,000,000 ÷ 24.6). If you have multiple tax-deferred retirement accounts, you must calculate RMDs separately for each one.

Many financial institutions, including Schwab, will calculate your RMDs for you—and may even offer automated withdrawals—but typically only for the accounts held at their firms. If you have multiple retirement accounts, you might consider consolidating them with a single firm to streamline your RMDs and reduce the odds of withdrawing too much or too little.

2. Take the money—or else: Withdrawing RMDs

You must withdraw your entire RMD amount by December 31 of each year, with two possible exceptions:

- It's your first RMD. You may choose to delay your first RMD until April 1 of the year following your 73rd birthday (75th birthday for those born in 1960 or later). However, delaying your first distribution means taking your first and second RMDs in the same tax year, which could significantly increase your taxable income. This strategy may make sense if you're still bringing in steady income, but for most people, it's usually better to take the distribution by the end of the year rather than wait until April 1.

- You're still working. If you're enrolled in your current employer's qualified retirement plan and you don't own more than 5% of the business, you may be able to delay taking RMDs from that account until April 1 of the year after you retire—check with your plan administrator to confirm. However, you must continue taking RMDs from all other tax-deferred retirement accounts.

If you miss a deadline or don't withdraw your full RMD, you'll owe a penalty tax of up to 25% of the amount you failed to withdraw. For example, if your RMD was $100,000 but you withdrew only $50,000, you'd owe a quarter of the shortfall ($12,500) as a penalty.

As for when in the year to take your RMDs, it will ultimately depend on your income needs and personal preferences. For example, some may choose to take a lump-sum distribution at the beginning of the year so they don't have to think about it again until the following year. Others might find that taking regular withdrawals is the simplest way to meet their RMD requirements and manage their cash flow, especially if you need the funds to cover living expenses. However, be careful should you plan on waiting to take RMDs until the end of the year. You don't want to accidentally forget about them during the holidays.

Regardless of when and how you take your withdrawals, you should view it as an opportunity to revisit whether your asset allocation is still in line with your risk tolerance and rebalance as needed. That way, you're satisfying your RMDs for the year and ensuring your portfolio continues to be aligned with your goals.

3. Be tax smart: Minimizing RMD taxes

Retirees sometimes find that their RMDs provide more income than they need in a given year. What's more, when combined with other income sources, like dividends and interest payments, RMDs can push you into a higher income tax bracket and could affect the taxation of Social Security benefits and the premiums you pay for Medicare.

If you're worried about the effects of RMDs on your tax bill and health care costs, there are ways to help ease your RMD tax burden. Consider employing these three tax-saving strategies:

Making withdrawals prior to your RMD age

If you have significant savings in your tax-deferred retirement account, you should carefully consider whether it makes sense to start making withdrawals at your RMD age or begin drawing down your account as soon as possible without penalty. Waiting to take distributions allows your savings to potentially grow more during the intervening years, but a larger balance could result in a significant bump in the size of your RMDs, and thus your tax bill, once you retire.

But if you're concerned your RMD income may push you into a higher tax bracket, you can make penalty-free withdrawals from tax-deferred accounts once you reach age 59½. The distributions are still taxed as ordinary income, but over time they will reduce the size of your tax-deferred accounts—and hence your potential RMDs in future years.

When employing this strategy, it helps to think of it as tax-bracket optimization. For example, for tax year 2025 if you're a joint filer in the federal 24% tax bracket and you have $250,000 in taxable income after taking the standard deduction, you could withdraw another $144,600 from your tax-deferred accounts and stay in your current tax bracket.

The idea is to select a tax bracket that makes the most sense for your circumstances—and then fill up that bracket with distributions from your tax-deferred retirement accounts each year. Those funds can then be reinvested in a taxable brokerage account and, if invested tax efficiently, could produce very little additional taxable income each year.

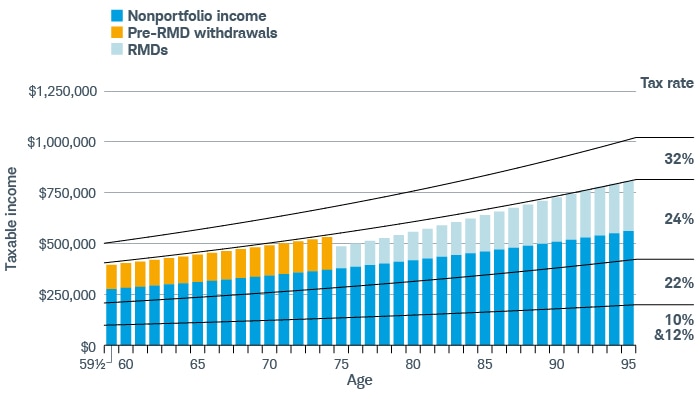

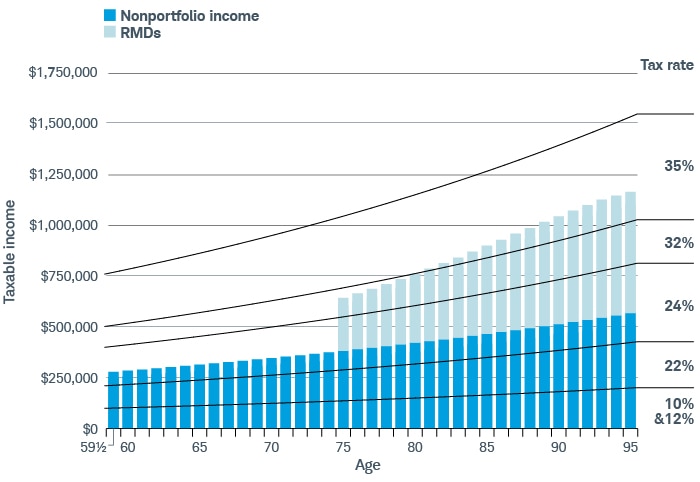

Now vs. later

Drawing down tax-deferred accounts without penalty starting at age 59½ can reduce RMDs—and help keep taxes in check.

Scenario 1: With pre-RMD withdrawals

Starting at age 59½, an investor begins making annual withdrawals up to the limit of the 24% federal tax bracket in 2025. Drawing down their account reduces their RMD income starting at age 75, keeping them out of the 32% federal tax bracket in retirement.

Scenario 2: Without pre-RMD withdrawals

Based on 2025 federal tax rates, without pre-RMD withdrawals, RMD income pushes the investor into the 32% tax bracket at age 75 and the 35% bracket at about age 81.

Source: Schwab Center for Financial Research.

Calculations are based on pre-RMD withdrawals starting in tax year 2025 and RMDs for tax years 2041 and beyond. Calculations assume a married couple with $275,000 in combined nonportfolio taxable income after taking the standard deduction and $2.5 million in combined tax-deferred accounts at age 59½. Annual growth of 6% is added to the account balance at the end of each year, and nonportfolio income and tax brackets increase by 2% annually to account for inflation (based on 2025 federal tax rates). Nonportfolio income may include business income, pension payments, rental income, Social Security benefits, etc. This hypothetical example is only for illustrative purposes. Tax changes and income fluctuations may negatively affect the outcome of this strategy.

A Roth IRA conversion

Another way to optimize your tax bracket and potentially reduce future RMDs is to convert some of your tax-deferred savings to a Roth IRA in the years leading up to your RMD age, since Roth accounts aren't subject to RMDs. Instead of taking the pre-RMD withdrawals and investing the funds into a taxable account, you could use those funds to do a Roth conversion each year until you reach your RMD age.

You'll have to pay tax on the converted amount in the year the conversion occurred, so this strategy is generally a good idea only if you think your tax bracket in the future will be equal to or higher than it is now. Taxes are historically low, and they could go up in the future. The decision ultimately comes down to whether you're comfortable locking in today's tax rates on the converted funds.

A qualified charitable distribution

A qualified charitable distribution (QCD) allows individuals age 70½ and older to donate up to $108,000 for tax year 2025 (indexed for inflation) from an IRA account directly to charity—and use some or all of those funds to satisfy RMDs for the year.

For example, if your RMD for the year is $100,000 but you only need $50,000 of that for living expenses, you could donate the remaining $50,000 via a QCD to satisfy the rest of your RMD.

For those that are charitability inclined, QCDs can be a great tool for managing taxable income in retirement while also helping a worthy cause. Just be aware that QCDs are not permitted from 401(k)s or other qualified plans.

Cash vs. QCD

If you're interested in making charitable donations, taking your full RMD and then donating cash could result in a higher tax bill than if you were to give through a QCD.

Scenario 1

Take RMD of $100,000 and donate $50,000 in cash

Other nonportfolio income: $50,000

Annual RMD: + $100,000

QCD: + $0

Pretax income: = $150,000

Itemized deduction: – $50,000

Taxable income: = $100,000

Estimated taxes due: $16,909

Scenario 2

Take RMD of $50,000 and donate $50,000 using a QCD

Other nonportfolio income: $50,000

Annual RMD: + $100,000

QCD: – $50,000

Pretax income: = $100,000

Standard deduction: – $17,000

Taxable income: = $83,000

Estimated taxes due: $13,180

This hypothetical example is only for illustrative purposes. Schwab does not provide tax advice. Clients should consult a professional tax advisor for their tax advice needs. Itemized deduction assumes the cash donation only. Tax calculations are estimated using 2025 federal tax brackets, do not reflect state taxes, and assume that 85% of Social Security benefits are taxable. In 2025, the standard deduction for a single filer age 65 and older is $17,000 ($15,000 standard deduction plus $2,000 additional standard deduction).

When implementing an RMD-reduction strategy, there's no substitute for personalized advice from a tax professional who knows the details of your individual situation. A tax advisor can help you anticipate potential challenges and consider how these strategies fit into your overall financial plan.