Retiring Single: 5 Questions to Help You Plan

While many Americans imagine entering retirement hand in hand with a partner or spouse, that isn't always the case. Nearly a third of men and more than half of women over age 65 are widowed, divorced, or have never been married, according to a 2024 report from the U.S. Administration on Aging.

Retirement advice for singles can resemble that of couples, there are some important differences to consider. While all retirees will need to replace a paycheck to meet ongoing expenses, plan for unexpected expenditures, and address health care and other needs, some of these goals can be uniquely challenging to singles.

Here are five questions every single should ask themselves as they plan for this new phase of life.

1. What do I want my retirement to look like?

If you've been on your own for a while, your plan may already account for a solo retirement. But those who are newly single will need to revisit what you want in the next stage of life and adjust your income and savings targets accordingly.

While finances are a core part of any retirement plan, single retirees need to consider other aspects of life in retirement—including health care needs, living arrangements, and a community that can help counter the social isolation common among elderly singles.

As you build and stress-test your retirement plan, factor in your potential longevity. At some point, the risk of outliving your investments may become greater than the risk of suffering short-term losses in a down market. So, if you're in excellent health and likely to live for several decades, you might consider a larger allocation to stocks than to fixed income.

2. Are my savings on track?

According to research by the Employee Benefit Research Institute, unmarried workers tend to be less confident about a comfortable retirement than married workers. Living expenses like heat and housing aren't necessarily less just because there's only one of you, which makes a robust savings plan all the more important. However, a plan can show you a projection of how likely your retirement assets will last throughout life expectancy.

If a plan shows that you're on track, great: Keep going, continue to monitor, and adjust your plan as things change. If not, you may need to rethink your transition to retirement, your spending in retirement, or your savings toward retirement. For example, you could potentially save more by contributing the maximum to your 401(k) or other workplace plan each year, plus you can make catch-up contributions once you reach age 50. If you have a health savings account (HSA), consider maxing it out, since health care costs can be a significant portion of your ongoing expenses in retirement (see No. 4).

Retirees should also expect the unexpected. An emergency fund is critical—especially for single retirees since they'll be footing any unexpected bills themselves. If that's you, consider having enough cash on hand to cover a year of spending—minus any guaranteed retirement income like a pension, annuity, or Social Security. Also, consider maintaining two to four years' worth of anticipated portfolio withdrawals in relatively stable investments such as cash, short-term or investment grade bonds, or bond funds to avoid having to sell during a down market.

3. When should I collect Social Security?

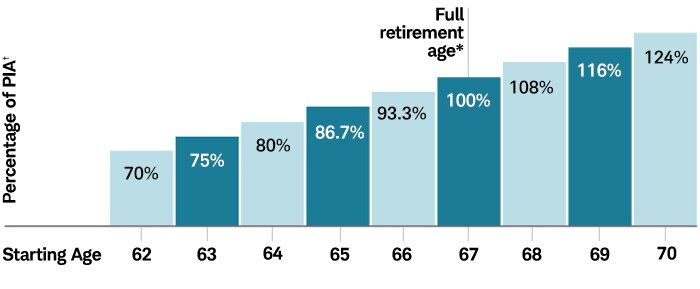

You can start collecting Social Security benefits as early as age 62, but doing so will permanently reduce your benefits. Conversely, for every year you delay collecting past your full retirement age (between 66 and 67, depending on your birth year), you'll receive roughly an 8% boost to your payouts. And if you can wait to collect until age 70—after which there is no incremental benefit for delaying—you'll collect roughly 77% more than if you had begun collecting at 62.

Time = money

The longer you wait to collect Social Security, the bigger your permanent monthly payout will be.

Source: Social Security Administration.

*Represents full retirement age (FRA) based on birth date of 01/02/1960. FRA as of 08/05/2025.

†Primary insurance amount (PIA) is the basis for benefits paid.

Single retirees in good health and solid financial capacity may want to consider waiting as long as possible to claim their benefit, even if that means using savings or securing part-time income as a bridge to fund retirement spending. Social Security is a guaranteed income source that increases with inflation and will last as long as you do. In that sense, it's a form of insurance in case you live longer than average. Not even the best investments can offer that.

If you're divorced or widowed, there are additional considerations:

Divorced retirees who were married 10 years or more may be eligible for a Social Security benefit of up to 50% of their ex-spouse's full retirement-age benefit. If your ex-spouse passes away, you may remarry and still be entitled to part of her or his benefits if your remarriage occurs after age 60 (50 if you're disabled).

While your marital status doesn't affect your eligibility for Medicare, you may need to pay Part A (hospital insurance) premiums if you or your spouse didn't work and pay Medicare taxes for at least 10 years. In that case, divorced retirees who were married for 10 years or more may be able to use their former spouse's earning record to avoid such premiums.

Starting at age 60 (50 for those who are disabled), surviving spouses can collect a reduced amount of their late spouse's Social Security benefit or wait until full retirement age (between ages 66 and 67) to collect 100% of survivor benefits. (You'll lose these benefits if you remarry before the age of 60.) If surviving spouses also qualify for their own retirement benefits, they could potentially switch to their own (if higher) up to age 70.

Surviving spouses, too, can rely on their late spouse's work history to avoid Medicare premiums, provided they were married at least nine months before their spouse's death.

By law, private defined-benefit pension plans must provide a pension to the spouse of a deceased employee, though the payouts may be less than the employee's full benefit. Many federal, state, and local government plans offer similar protections.

4. Have I planned enough for health care?

A recent analysis concludes the average 65-year-old woman will need to have saved $226,000 ($191,000 for men) to have a 90% chance of meeting her health care expenses.

What's more, roughly 70% of people turning age 65 can expect to require some form of long-term care during their lifetimes. While unpaid caregivers—typically loved ones—provide the majority of such help, paid care is likeliest among singles. A good retirement plan will consider these risks and prepare for them, whether that involves family and friends for care support, using personal savings for paid care, long-term care insurance, or some combination of these.

Although long-term care insurance premiums can be expensive, extended long-term care without insurance can quickly deplete your savings or result in less-than-ideal care. For example, the average cost of care in an assisted living community exceeds $70,000 a year. The most cost-effective time to buy long-term care insurance is generally between ages 50 and 65.

5. What are my emergency and estate plans?

In the absence of a spouse, singles of all ages should take special care in articulating and documenting their wishes in the event of incapacitation or death, unless you want the courts to decide for you. That includes:

- Establishing powers of attorney who can act on your behalf if you become unable to make financial or medical decisions yourself.

- Designating beneficiaries on all retirement accounts and establishing transfer-on-death provisions for all other financial accounts.

- Drafting a will with clear instructions for who should inherit your nonfinancial assets and other property.

Singles who don't have immediate family members who can act as trustees and executors for trusts and wills may wish to consider a close friend or even a professional to serve in those roles.

In addition, single retirees should work with an estate attorney who can help them think through the various considerations. Otherwise, you risk overlooking important details that can make settling your estate much more challenging.

Schwab Personal Trust Services

Professional trust management can help give you options for the future.

A corporate trustee provides financial expertise, unbiased decision-making, and fiduciary responsibility for the duration of a trust. For example, Schwab Personal Trust Services, administered by Charles Schwab Trust Company, will:

- Administer your trust according to your wishes as set forth in the trust agreement.

- Invest your trust's assets to benefit future generations.

- Handle the preparation and filing of trust income tax returns.

- Put the interests of the trust and your beneficiaries first.

- Allow you to originate your trust in Nevada, which may offer greater creditor and divorce protection.

Of course, there's no one-size-fits-all solution for every trust creator. The consulting team at Schwab Personal Trust Services can help you think through the options and capabilities that work best for your needs.

Learn more about Schwab Personal Trust Services.

Getting help

Retiring single doesn't have to mean going it alone. A trusted financial planner can help navigate the challenges unique to a solo retirement.

A good retirement plan will be interactive, engaging, and ongoing—not a simple one-time calculation. The key is to find an advisor who you can trust to stay engaged with your plan.