Using the Volume Profile Indicator

Are you tired of trying to guess where potential support and resistance levels are located on a chart? Wouldn't it be great if you could get a deeper view of the supply and demand dynamics at work beneath those price bars? At the most basic level, it has to do with volume and price.

A different perspective on support and resistance levels

Let's start with volume, which may provide valuable trading information. For example, increasing volume on a breakout above resistance or below support may indicate a trend continuation or reversal. It may also indicate institutional buying.

On a specific day, a stock might experience high volume, which may imply there's interest in that stock. But volume alone doesn't indicate the specific price or prices at which traders are most interested.

So, if you're interested in volume amplification, consider using the Volume Profile indicator, one of many studies on the thinkorswim® platform. It's based on price and is designed to help traders see price levels where demand was highest and lowest.

The Volume Profile doesn't show when volume occurred. Instead, it shows the price at which volume occurred. Unlike a typical volume study that aggregates volume for a specified time period and displays a vertical column of the total volume for that period, the Volume Profile indicator plots a horizontal histogram of volume traded at specific prices.

Depending on the settings, you can see volume at each price level traded throughout a day, month, year, or longer. The price level with the the highest volume (widest horizontal row) is referred to as the point of control (POC), which identifies the price level where most trades took place (see chart below). The range of prices around the POC that contain 70% of total volume for the period is called the value area.

The Volume Profile indicator can be plotted on most price charts.

Let's look at an example. In the chart below, the shaded area around the POC is called the value area, which encompasses one standard deviation of all the volume traded for the time frame. The area above and below the value area shows the remaining range for the time period. Generally, the levels outside the value area don't experience much volume.

Volume profile

Chart source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

Practical application of volume profile

When price trades in a symmetrical fashion around a center point, it's considered standard distribution and shows a bell curve. The high volume price, or POC, is generally near the midpoint, and there's light volume near the day's high and low range. This would indicate a balanced market.

Some traders interpret this scenario as having an established "fair price" with activity that may fluctuate around that level. In this scenario, one strategy traders could employ is to attempt to sell the top 15% of the range or buy the bottom 15%, with the expectation of price returning to the POC.

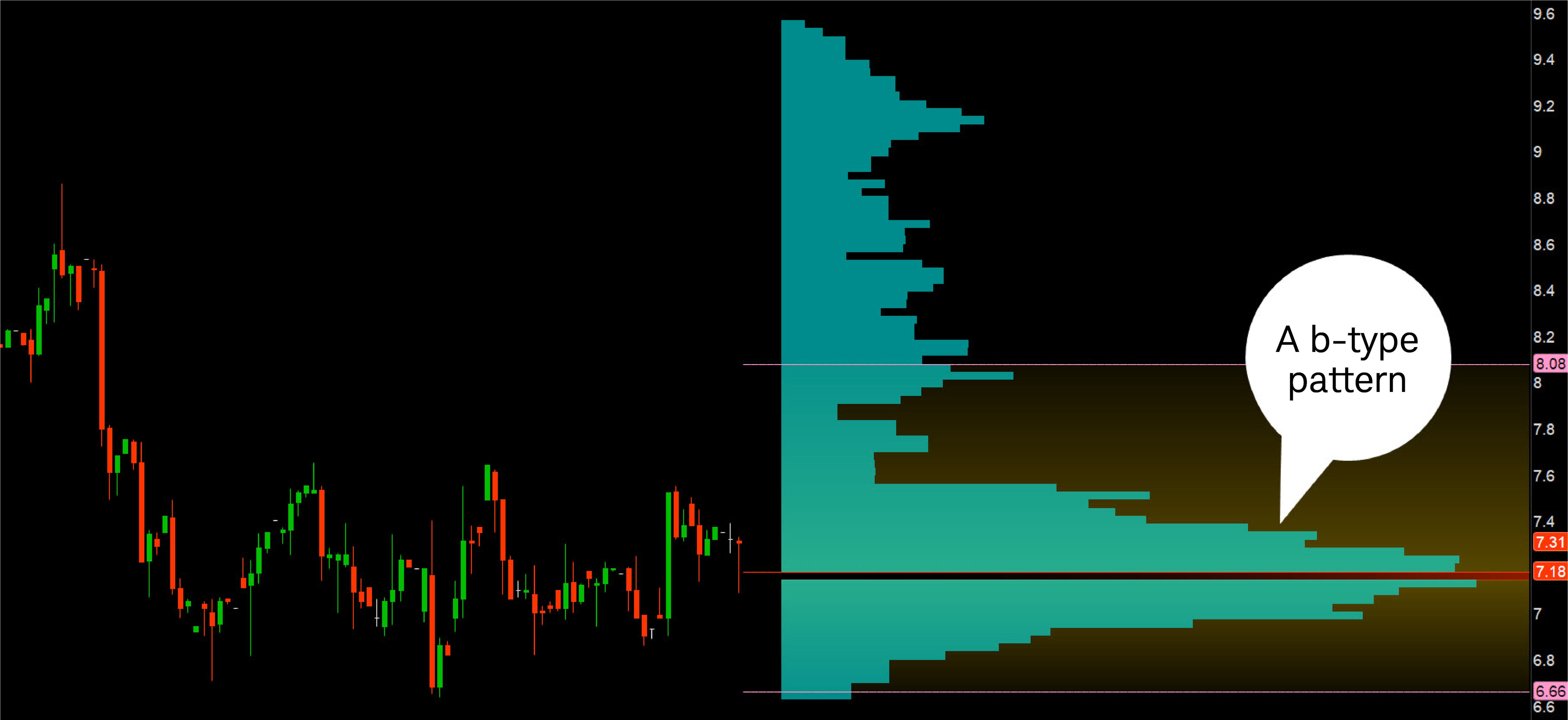

When prices trade in a skewed or asymmetrical pattern, the POC will be either high or low in the range, creating an imbalanced market. When the market becomes imbalanced, it often indicates a trending market. If the POC and value area are at the top of the range and create a p-type pattern (see chart above), this can potentially indicate a bullish trend. If the POC and value area are toward the bottom and create a b-type pattern (see chart below), this can potentially indicate a bearish trend.

When a p-type pattern appears, some traders might look for an opportunity to buy near the bottom of the value area if they think there's a potential emerging trend. Each day after the p-pattern was formed, traders might consider the value area low as a price level to buy on the dip for the next day's trading, or they might look for a break above the value area high as the trend continues.

B-type patterns

Chart source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

The b-type pattern in the chart above is similar to the p-type pattern, only bearish. The skewed and asymmetrical pattern near the lower end of the trading range can potentially establish a bearish trend. Some traders may look to sell near the value area high.

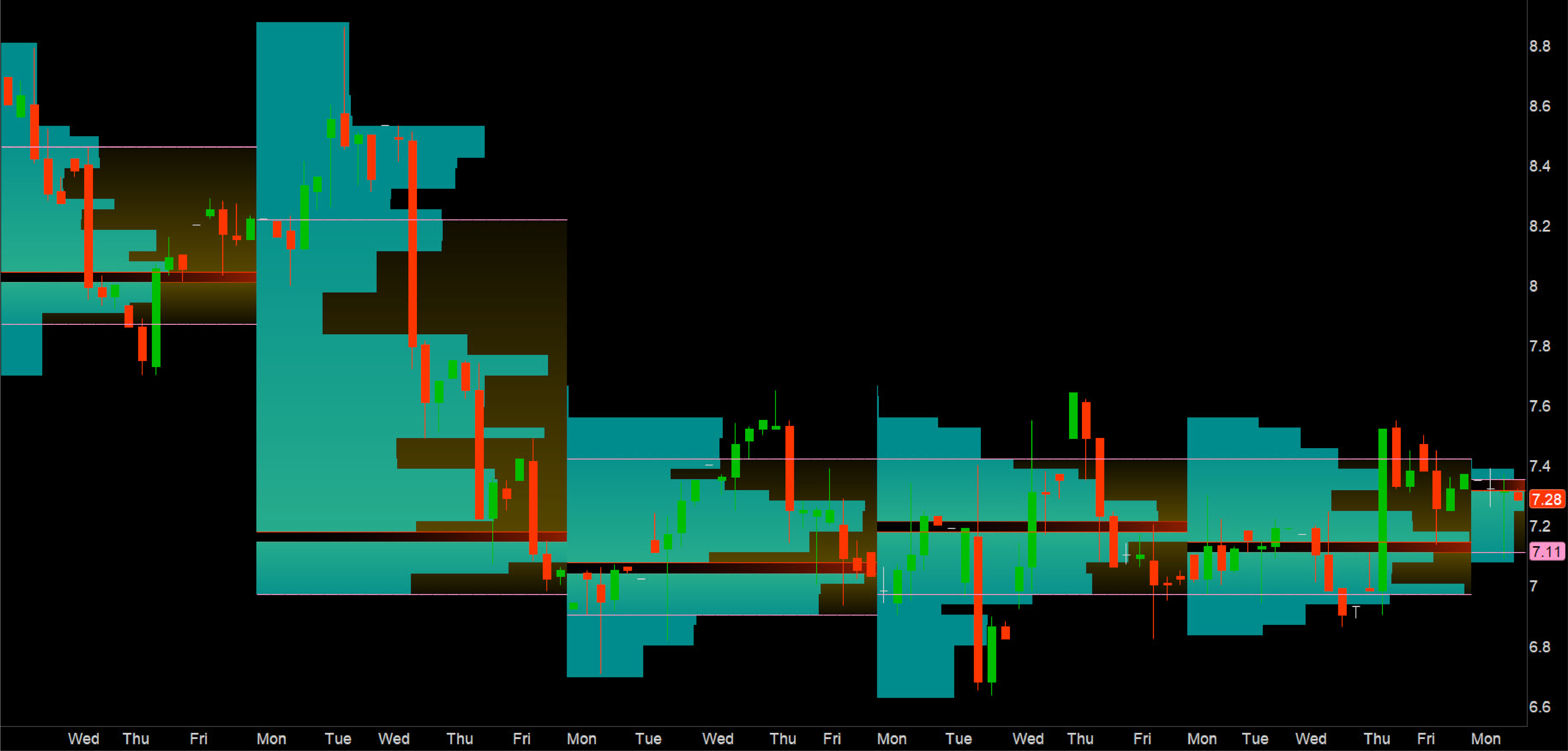

By default, Volume Profile displays in the expansion area to the right of a price chart. But the settings can be changed to have it displayed over the price chart (see chart below). By overlaying the Volume Profile on the price bars, you can view the profile of each time period to get an idea of potential price movement. The advantage of this view is that you get more of a "big picture" perspective. You can apply the data in different time frames, such as intraday, daily, weekly, monthly, and so on.

Big picture view of price action

Chart source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

How to add volume profile to a chart

1. From the Charts tab, bring up a chart

2. Select Studies > Add study > All Studies > U–W > Volume Profile

3. To change the display of Volume Profile, select Studies > Edit studies...

4. Select the settings icon for Volume Profile

5. For on expansion, select No to overlay the Volume Profile on the price chart

High and low volume

Prices at which the highest and lowest volume occurs are worth noting. Volume indicates levels of acceptance (high volume) and rejection (low volume). Intuitively, when volume is high, the price could be equally attractive to buyers and sellers.

At a price where fewer participants are willing to transact, volume may adjust—sometimes quickly—to find equilibrium. In other words, low volume could occur at extreme highs or lows. That's because prices may be too high for buyers or too low for sellers. Higher trading volume usually occurs between extreme highs and lows at an equilibrium price.

Hypothetically, you could think of the high and low value areas as potential support and resistance levels. Some traders use the low volume areas as support and resistance levels based on the thought that prices are likely to revert to the value area.

The premise of Volume Profile is based on the idea that markets tend to have memory. Because the POC is where the most volume traded, this level could sometimes act like a magnet. It may take a little getting used to watching the Volume Profile, but it can give you a different perspective of price action. As you watch the Volume Profile develop during the trading day, you may get a sense of which prices traders gravitate toward and which ones they consider outliers.

While this article discusses principles of technical analysis, other approaches, including fundamental analysis, may assert very different views.