Screeners: Finding Potential Trade Ideas

New investors can sometimes be overwhelmed when searching for stocks or mutual funds because of the massive number of trades available. A screener tool can potentially help investors find stocks, mutual funds, or exchange-traded funds (ETFs) that fit their trading criteria. Here we'll discuss where to find screeners and how to add them to a trading toolbox.

How to find screeners

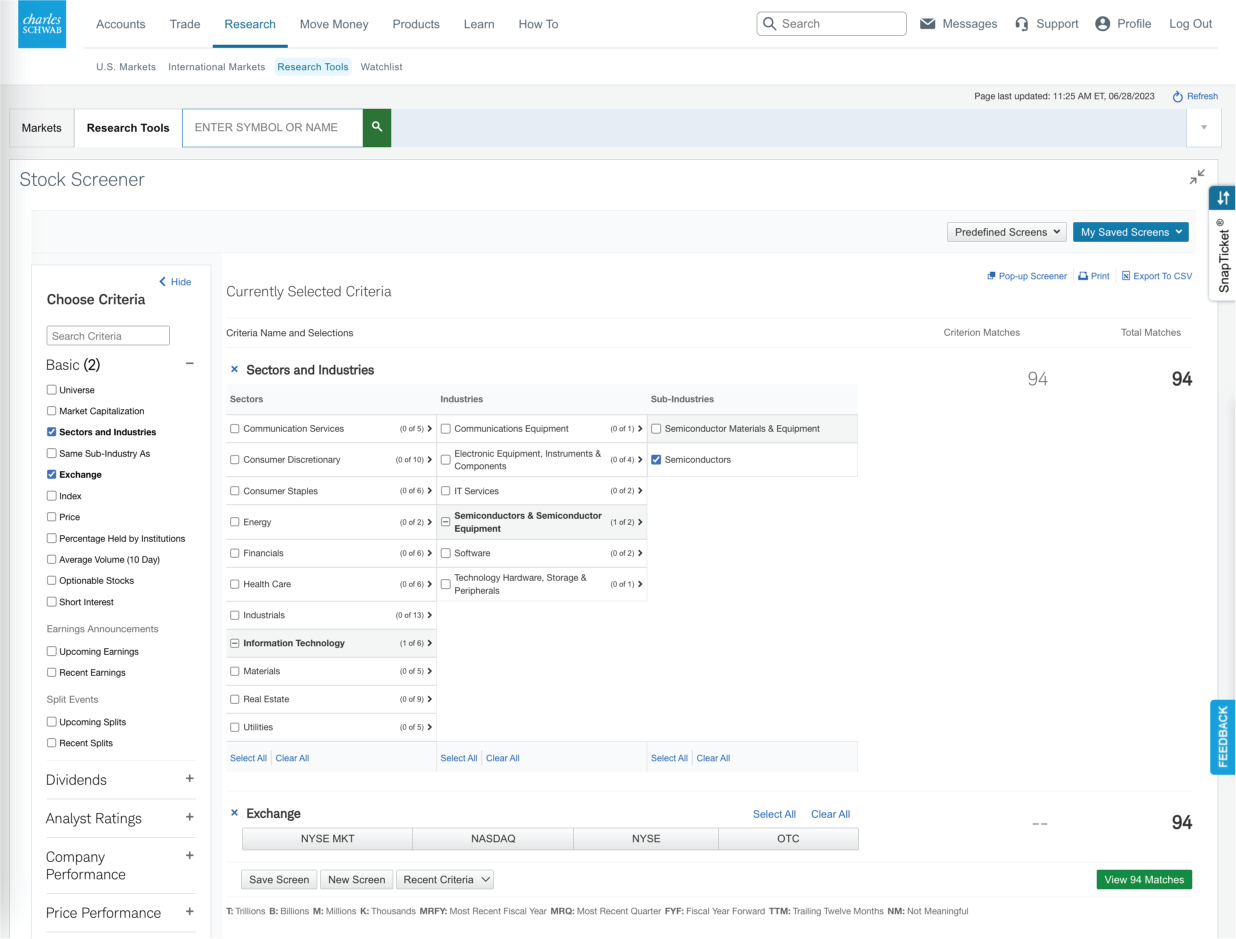

After logged in to Schwab.com, an investor can locate screeners by selecting Research > Research Tools in the upper navigation bar. Under Research Tools, there are various choices available to access screeners for different types of investments like stocks, mutual funds, and ETFs.

Using a screener

Schwab offers access to Predefined Screeners that can potentially provide investment ideas based on different traits, such as Dividend Growth and Top Analyst Ratings. However, investors can also create their own screen based on specific criteria. On the left navigation bar of the screener are criteria investors can add related to financial strength, dividends, technical indicators, and more. After creating a custom screen, it's possible to save it.

Source: Schwab.com

For illustrative purposes only.

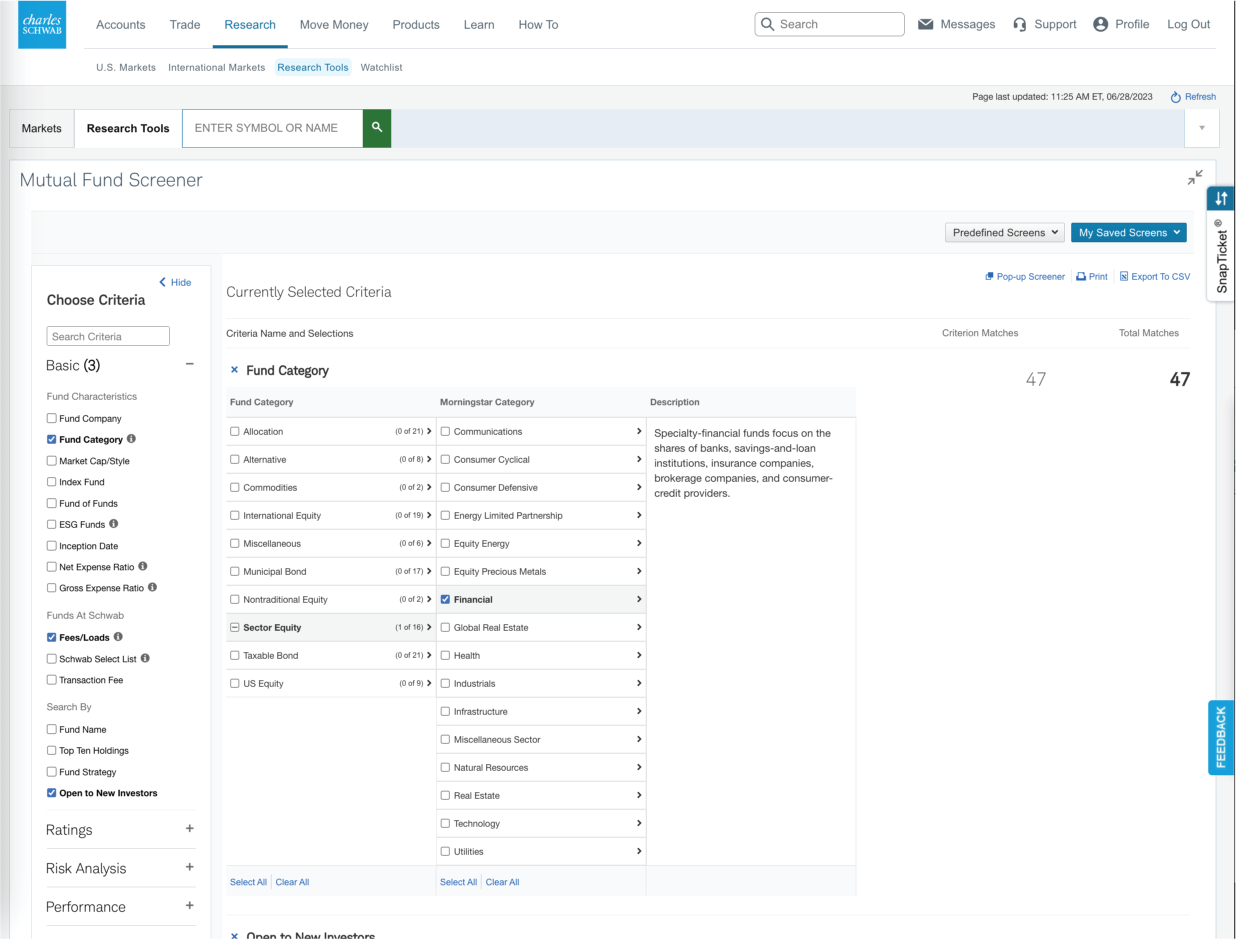

In addition to screening for individual stock, the Mutual Fund Screener can also be used to look for mutual funds to add to a portfolio. As with the Stock Screener, the Mutual Fund Screener allows investors to choose from predefined screens or create their own (see image below).

The criteria used for creating a mutual fund screen is a little different from a stock screen. Mutual fund criteria include items like bonds, distributions, and information about risk analysis and fees.

Source: Schwab.com

For illustrative purposes only.

Schwab also has an ETF Screener that can help investors identify ETFs that might fit their needs as well as a Fixed Income Screener. The Fixed Income Screener helps investors search for different types of bonds and CDs, allowing them to designate maturity preferences, ratings, sectors, and other criteria to find the fixed income securities they're most interested in.

Lastly, there's an Options Strategy Finder that can help traders identify potential strategies that might fit their trade objectives. However, an account must be approved for options before a trader can begin trading options.

Using screeners for investment ideas

Screeners can help investors build a portfolio based on their own goals and risk tolerance. Here are some ways screeners can potentially help investors find trades.

Research: Compare similar securities by selecting up to five tickers and see how they stack up against one another. It's also possible to create a relative performance chart based on the selected symbols.

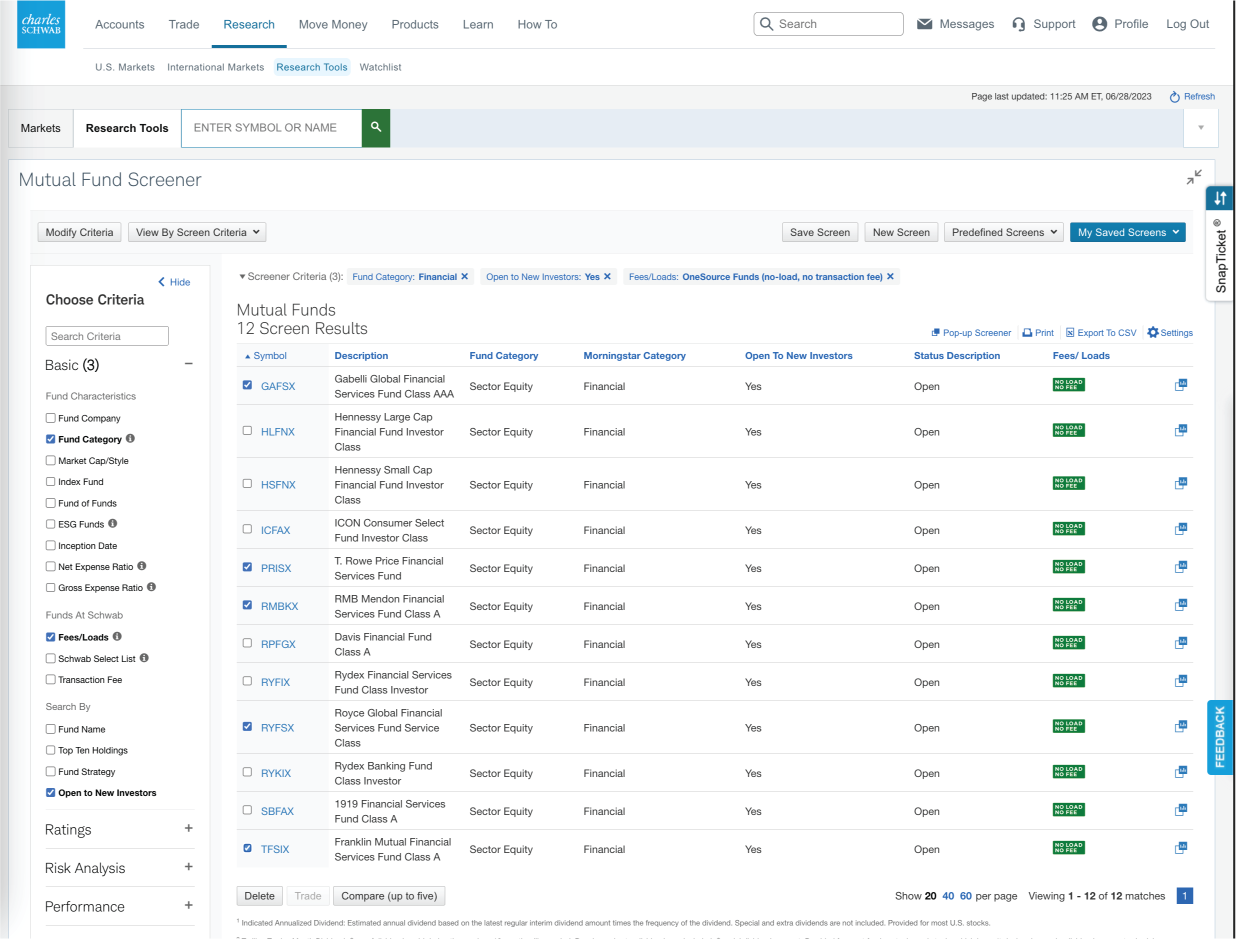

Save for later: Select Save Screen to save the filtered criteria list for future use (see image below).

Watchlist: The results from a screen appear in a list. Select a ticker symbol to be taken to the stock's page. Next, an investor can select Add to Watchlist to the right of the green Trade button. It's possible to add a symbol to an existing watchlist or create a new watchlist. It's also possible to set an alert related to price by selecting Set Alert.

Source: Schwab.com

For illustrative purposes only.

Do your homework

Screeners are a great tool for investors to begin their research on a particular equity, but remember, this is only the first step in the research process. Investors should take the time to fully research the equity they're investing in before making any decisions.

Investors should consider carefully information contained in the prospectus , of if available, the summary prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.