Set Trading Alerts to Help Monitor Your Portfolio

With an avalanche of real-time news pouring in on the global economy, markets, and company events, it can be a time-consuming task for investors to stay up to date on information that can affect their investment strategy.

Alerts can help investors cut through the daunting clutter by notifying them of information and news that may affect their holdings, portfolio performance, and investment decisions. These automatic notifications can keep investors informed about poorly performing assets they may want to shed or better-performing securities they may consider buying.

Alerts save time and help investors stay informed.

Alerts for managing a portfolio

Investors can choose from many types of alerts on Schwab.com. Some alerts are designed to track a specific security; they can also signal a potential buying or selling opportunity. Other alert types can help investors monitor their portfolio's performance by notifying them when there are significant changes in their portfolio.

Investors can customize alerts to suit their needs, like setting a specific target price or other criteria that will signal a potentially opportune time to buy or sell a security or exit a trade.

Setting up alerts

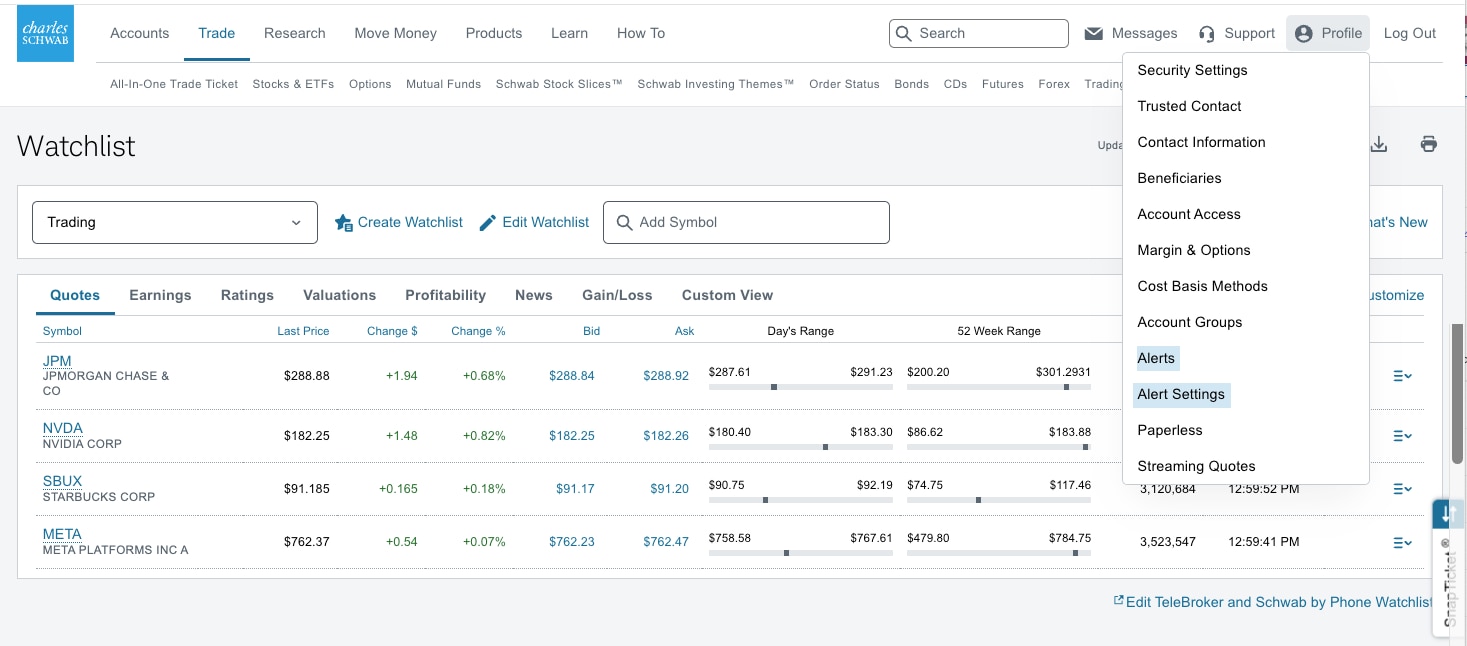

To set an alert, Schwab clients can log in to their account and create an Alert on an existing Watchlist. Clients can access watchlists from either the Research or Trade tab> Watchlist. Clients can also create alerts directly from their existing Positions under the Accounts tab > Positions.

Source: Schwab.com

Clients can update their preferred Alert delivery methods under Profile > Alert Settings.

Note: Alerts may be sent via email or wireless device.

Source: Schwab.com

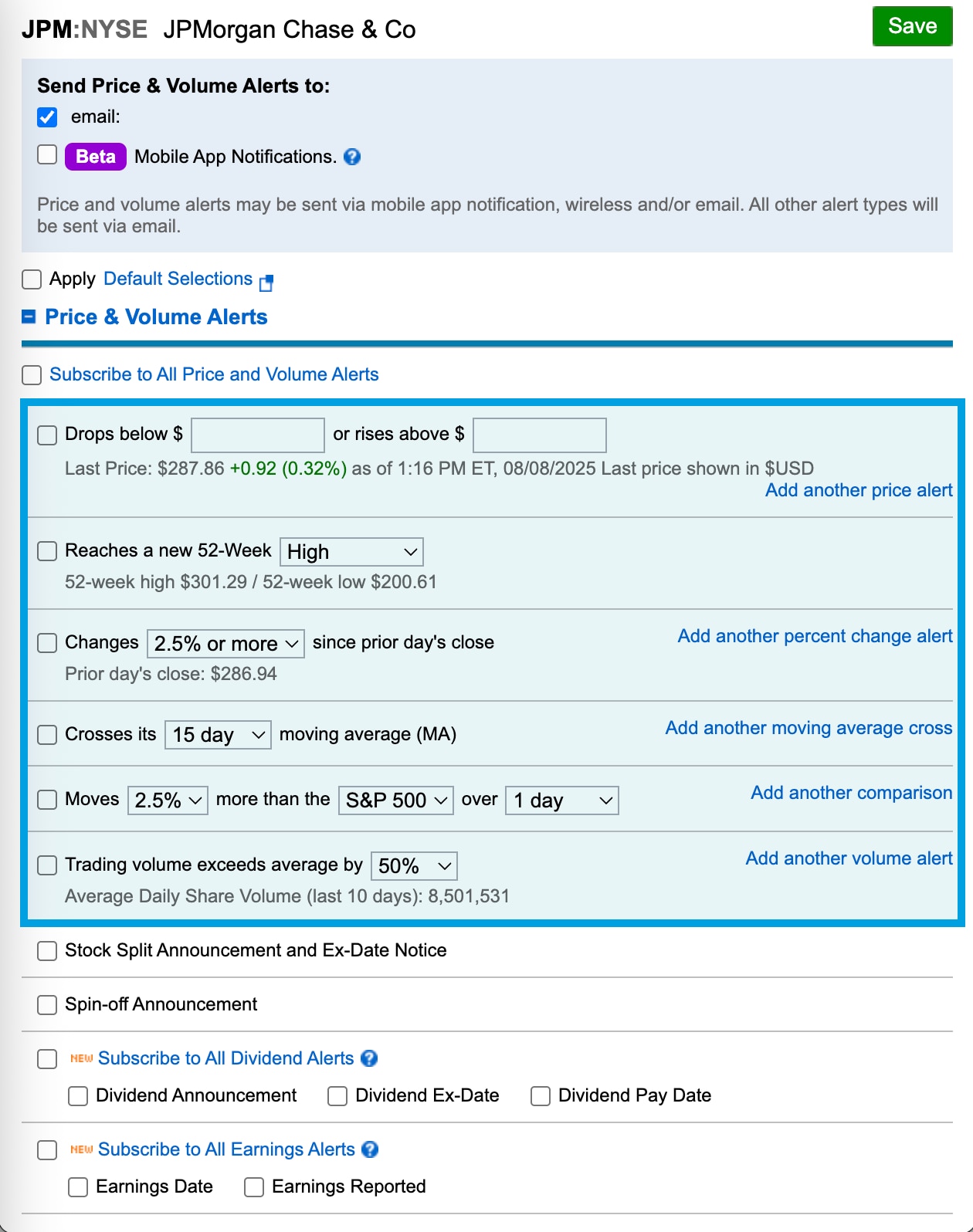

Price & volume alerts for individual securities

Under Profile > Alerts> Securities Alerts, investors can track the performance of individual securities, including changes in price or volume. For example, investors can set alerts for when a security has moved by a certain percentage above or below a specific price target, or when there's a meaningful percentage change in the volume of shares being traded.

Source: Schwab.com

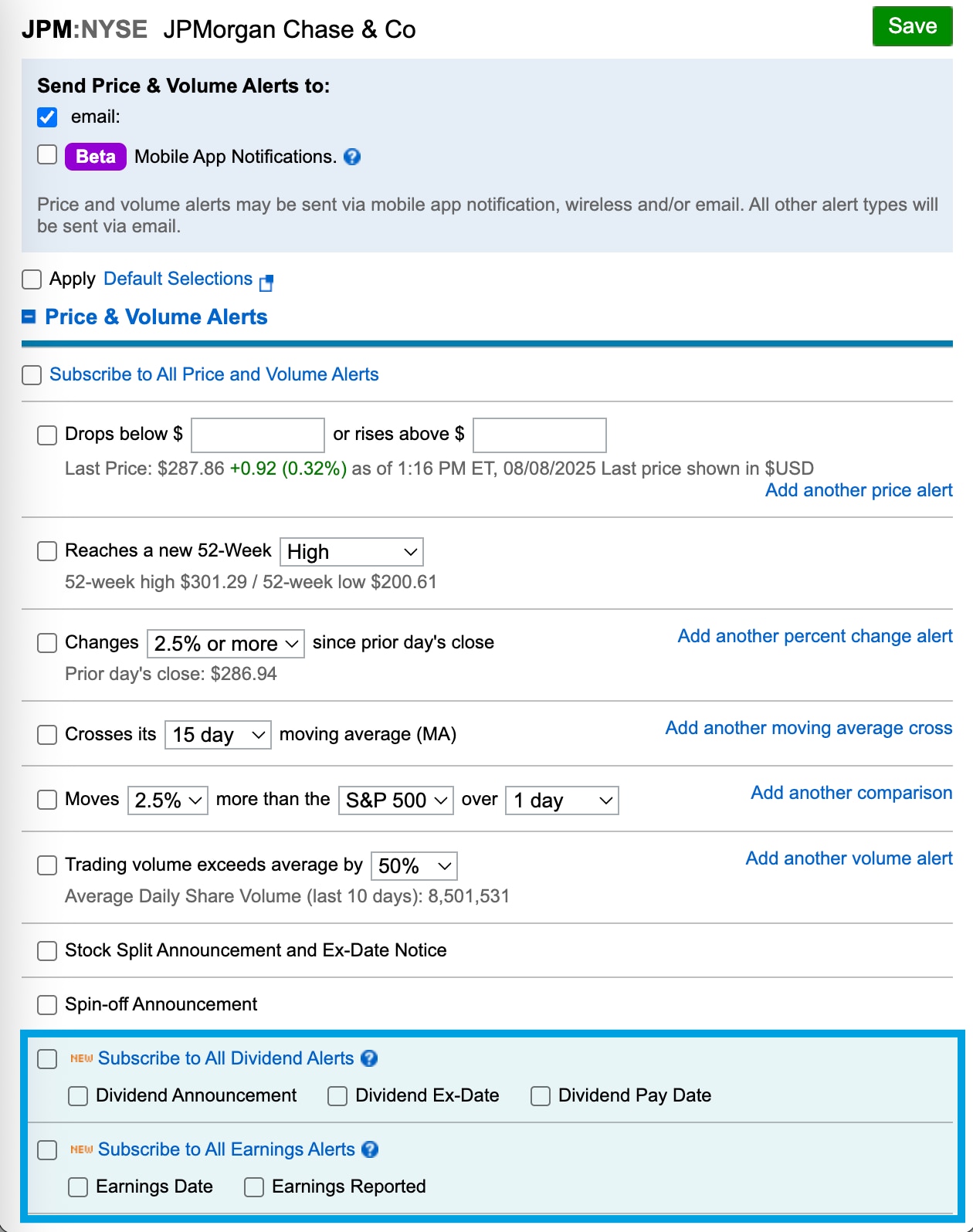

There's also selections under Price & Volume Alerts where investors can subscribe to dividend and earnings alerts.

Source: Schwab.com

Dividend alerts

A Dividend Announcement alert is sent when the selected company announces details for an upcoming dividend. Alert details include the expected dividend amount, ex-dividend date, and payable date. The Dividend Ex-Date alert is sent on the ex-dividend date, which is the first day following a dividend declaration when a stock buyer is not entitled to the next dividend payment. The Dividend Pay Date alert is sent on the dividend pay date for the selected company.

Other alerts

- Investors can select alerts based on the Earnings Date (sent when the selected company publishes the date for its next earnings announcement) and Earnings (sent when the selected company's earnings are released).

- Receive News Alerts based on news stories or press releases for securities on a watchlist or in a portfolio.

- Use Research & Reports for updates on the latest research reports from third-party resources.