Stocks Swoon, Crude and VIX Spike as War Erupts

Published as of: March 2, 2026, 9:22 a.m. ET

Listen to this update

Listen here or subscribe to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® Index | 6,878.88 | -29.98 | -0.43% |

| Dow Jones Industrial Average® | 48,977.92 | -521.28 | -1.05% |

| Nasdaq Composite® | 22,668.21 | -210.17 | -0.92% |

| 10-year Treasury yield | 4.01% | +0.05 | -- |

| U.S. Dollar Index | 98.49 | +0.89 | +0.92% |

| Cboe Volatility Index® | 23.23 | +3.37 | +16.9% |

| WTI Crude Oil | $72.20 | +$5.17 | +7.71% |

| Bitcoin | $66,175 | +$295 | +0.45% |

(Monday market open) Crude oil and volatility surged this morning and major indexes fell about 1% after war erupted in the Middle East. In cooperation with Israeli forces, the U.S. began an attack on Iran Saturday that resulted in the death of Supreme Leader Ayatollah Khamenei and other casualties. The violence has investors scurrying for perceived "safety," though no investment is truly safe. This shift could lead to near-term strength in "defensive" sectors like staples, small caps, and utilities with less exposure to geopolitical currents. The benchmark U.S. 10-year Treasury note yield briefly fell below 3.94% over the weekend for the first time since October 2024 as investors flocked to where they saw lower risk.

The war could hurt airline, shipping, and delivery firms that might face disruptions and higher costs, and give defense contractors and energy companies a lift. Risk-sensitive assets like cryptocurrencies could also see pressure. Though turbulence could continue depending on how long the conflict lasts and its effect on oil shipping, investors should keep in mind that geopolitical conflict often has a short-lived impact on markets, which, so far, are holding together relatively well, without signs of panic. While the initial move is relatively contained overall, "second order" effects on the economy will matter, too. Higher energy prices can tighten financial conditions, which could pressure consumer spending, not to mention margin issues in energy-intensive sectors. There could also be a quick upward adjustment in inflation expectations and a resulting adjustment to expectations around the Federal Reserve's rate path.

On Friday, before violence flared, major indexes wrapped up a tough February that featured slight descents for both the S&P 500 Index and the Nasdaq-100® (NDX). Defensive areas including health care, staples, and utilities rose, with eight of 11 sectors ending the day higher. Financials and tech were well in the red, keeping the S&P 500 down but above technical support near the 100-day moving average of 6,830. South of that is the 6,750-6,775 area, which was tested several times in recent months. A break below this level could trigger short selling activity.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Four things to watch

Assessing bullish, neutral, and bearish market cases for Iran conflict: At this point, considering the various scenarios about how the current situation could evolve is the best approach, said Chris Ferrarone, head of equity research and strategy at the Schwab Center for Financial Research (SCFR).

- Under the neutral case of de-escalation and a stable Strait of Hormuz, oil prices are expected to trade in a range around pre-crisis prices, providing a neutral backdrop for global equities and credit markets in this scenario, episodes of volatility are likely to persist as deescalation plays out, Ferrarone said.

- In adverse scenarios involving supply outages or an extended closure of the strait, oil prices could spike well above $100, leading to stagflation risks and heightened financial volatility, Ferrarone said. However, high spare capacity and diversified global supply could reduce the likelihood of catastrophic outcomes, he said.

- A rapid resolution accompanied by a regime collapse in Iran could be a bullish surprise for risk assets—though regime change at this point seems a complicated and uncertain process, he said. In that optimistic scenario, the removal of the geopolitical risk premium could push oil prices lower than their pre-attack price below the prior baseline—and spur rallies in equities, particularly in Asia Pacific and Europe. Safe haven assets would likely decline, and central banks could accelerate rate cuts as energy prices fall, Ferrarone said.

- In the short term, uncertainty is likely to prevail, and investors are likely to react by preparing for an adverse scenario. "Don’t overreact to the news," said Kathy Jones, chief fixed income strategist at SCFR. "A diversified portfolio should be able to withstand volatility in the short term. If investors are not well diversified, it might be time to look at portfolio allocations. But it probably isn't a good time to swing for the fences, given the wide range of potential outcomes. The past isn't necessarily a perfect guide to the future, but previous experience tells us that staying the course during times of heightened global risks, generally, is the right strategy."

On the move

- Crude oil (/CL) skyrocketed more than 8% early Monday to nearly $73 per barrel for U.S. futures as Middle East violence flared, raising concerns about the impact on the Strait of Hormuz, a passage that carries 20% of global supplies. In an extreme scenario of the Strait of Hormuz being blocked, Bloomberg economists estimate that crude oil could spike to $108 per barrel. Crude is now at its highest price since late last June, the last time Iran came under attack. Iran produces about 4% of the world's oil.

- Energy stocks led gains in pre-opening bell trading. Exxon Mobil (XOM) and ConocoPhillips (COP) rose more than 4% and Chevron (CVX) climbed 3%, boosted by the oil rally.

- Airlines were hard hit by the Middle East war, which could raise input costs and interrupt travel flow in the region. United Airlines (UAL) plunged more than 6% this morning ahead of the open, and Delta Air Lines (DAL) and Southwest (LUV) fell nearly that much.

- Defense industry firms including Lockheed Martin (LMT) and Northrop Grumman (NOC) were among the few solidly green stocks this morning as war led to ideas these companies could see increased demand for their weapons. Both climbed 5%.

- Berkshire Hathaway (BRK.B) edged up 0.4% early today after reporting earnings over the weekend. Earnings from operations fell almost 30% from a year earlier last quarter, and insurance underwriting profits fell 54% year-over-year.

- Credit card issuers fell Friday on concerns that employment would fall if AI replaces workers.

- Nvidia (NVDA) continued its descent Friday from mid-week earnings-related peaks, dropping 4%. The company announced a $30 billion investment in OpenAI, which triggered investor anxiety. Shares fell another 1.7% this morning as chip stocks got caught up in the general maelstrom. Broadcom dropped 3% and Advanced Micro Devices (AMD) lost 2%.

- Chip stocks in general played defense amid competition and hyperscaler spending concerns, and the PHLX Semiconductor Index (SOX) slid close to 1.5% for the week. Software stocks managed around a 1% weekly gain, helped by strong earnings from Salesforce (CRM) and Snowflake (SNOW).

- Netflix (NFLX) fell 2% after Friday's surge following its losing battle to buy Warner Bros. Discovery (WBD). JPMorgan Chase upgraded Netflix to Overweight from Neutral, saying Netflix is a "healthy organic growth story," driven by strong content, global subscriber growth, continued pricing power, and an "under-monetized" advertising tier.

- Norwegian Cruise Line (NCLH) dropped more than 7% after quarterly results came in short of consensus on revenue.

- Bitcoin (/BTC) inched up 0.6% this morning despite risk-off sentiment. It had slipped nearly 3% Friday and ended the week slightly lower.

- The Cboe Volatility Index (VIX) surged 18% to above 23.5 early Monday, the highest since late November.

- Treasury yields edged up early today but remained below 4% for the 10-year note. Friday's trading activity in the 10-year might have been a clue that bond markets were anticipating elevated conflict in the Middle East. Yields fell after January's Producer Price Index (PPI) was reported way above expectations. That was an interesting development, to say the least.

- The S&P 500 Equal Weight Index (SPXEW), which weighs all components the same, not by market capitalization, managed a light gain Friday and was up slightly for the week. Friday marked its second consecutive all-time high close, suggesting that under the surface, the market remains in decent shape.

- Natural gas futures (/NG) surged more than 5% early Monday. Qatar accounts for around 20% of global liquid natural gas (LNG) exports, and its infrastructure sits on the vulnerable side of the Strait of Hormuz—a global chokepoint for the oil trade. Any serious disruption could reverberate across Europe and Asia. European stocks fell 1% to 2% in midday trading on Monday. Qatar stopped LNG production at the world's top plant after an attack, CNBC reported this morning.

- Silver and gold rose around 2% this morning as risk-off trading sent some investors toward metals. Both rebounded last week amid private credit concerns and shaky stock market trading. A 6.3% gain on Friday took silver back up to $93.12, its highest mark in nearly a month. Copper remains above $6, historically pricy, while gold stayed above $5,200.

- The Nasdaq Bank Index (BANK) fell 4.5% Friday. Asset management firms exposed to software were among the hardest hit. "Private credit concerns continued to weigh on investor sentiment last week, and the concerns broadened beyond exposure to software," said Nathan Peterson, director of derivatives research and strategy at SCFR. He noted a UK media report that Barclays may have exposure to potential losses following the collapse of Market Financial Solutions. Financials fell again early Monday amid Middle East tremors that generally weighed on risk appetite.

- There's still less than a 3% chance of a Fed rate cut at this month's meeting, according to the CME FedWatch Tool. Looking ahead, futures trading soon after the war began showed odds increasing of more pauses ahead. The chance of at least one rate cut by mid-year is around 45%, down from 55% a week ago, possibly driven by inflation concerns as crude oil rallies. The market still works in 70% chances of at least two cuts this year.

- The U.S. dollar index ($DXY) rose nearly 1% this morning on what appeared to be "flight to safety" trading.

- For market bulls, February was a month to forget. The S&P 500 Index fell almost 1% for the month and the Nasdaq-100® (NDX) dropped 2.3%. The SPX is up a trace for the year while the Nasdaq-100 is down 1.1% so far in 2026. The Dow Jones Industrial Average managed slight February gains to bring its monthly win streak to 10.

- Beyond the geopolitical turmoil, coming days are packed with jobs data, building up to this Friday's February nonfarm payrolls report. That data is under intense scrutiny after the economy added less than 200,000 jobs all last year before a revival to January's 130,000 growth. A repeat looks unlikely, with consensus for February around 60,000. Even that kind of outcome might be welcome after Block's (XYZ) layoff announcement sent shivers through the market on Friday as investors faced renewed concern about AI replacing workers.

More insights from Schwab

Emerging markets in the AI era: Investing in emerging markets used to be associated with commodities. It's now more of a play on chips and software as these sectors increasingly dominate the scene, and Schwab's latest look at international investing examines the implications.

Resources for volatile markets: Turbulent market conditions can make anyone worried about their portfolio, and Schwab offers several perspectives that provide ideas to keep in mind at such times:

Market Volatility: What to Do During Turbulence

Bear Market: Now What?

Market Volatility in Retirement: Are You Prepared?

Navigating the Markets: Tariffs and Trade

Chart of the day

Data source: S&P Dow Jones Indices, ICE. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Quietly amid all the anxiety over AI, inflation, the Middle East build-up to war, and private credit, the Dow Jones Transportation Average ($DJT—candlesticks) has staged an impressive rally over the last six months. The $DJT, which includes delivery firms, railroads, and airlines, among other companies, is often seen as a barometer of U.S. economic activity. So is the U.S. Dollar Index ($DXY—purple line), which has held its own over this period despite lots of pressure from tariffs to rising rates in Japan to falling U.S. yields. All this suggests investors at least for now continue to bet on the U.S. economy.

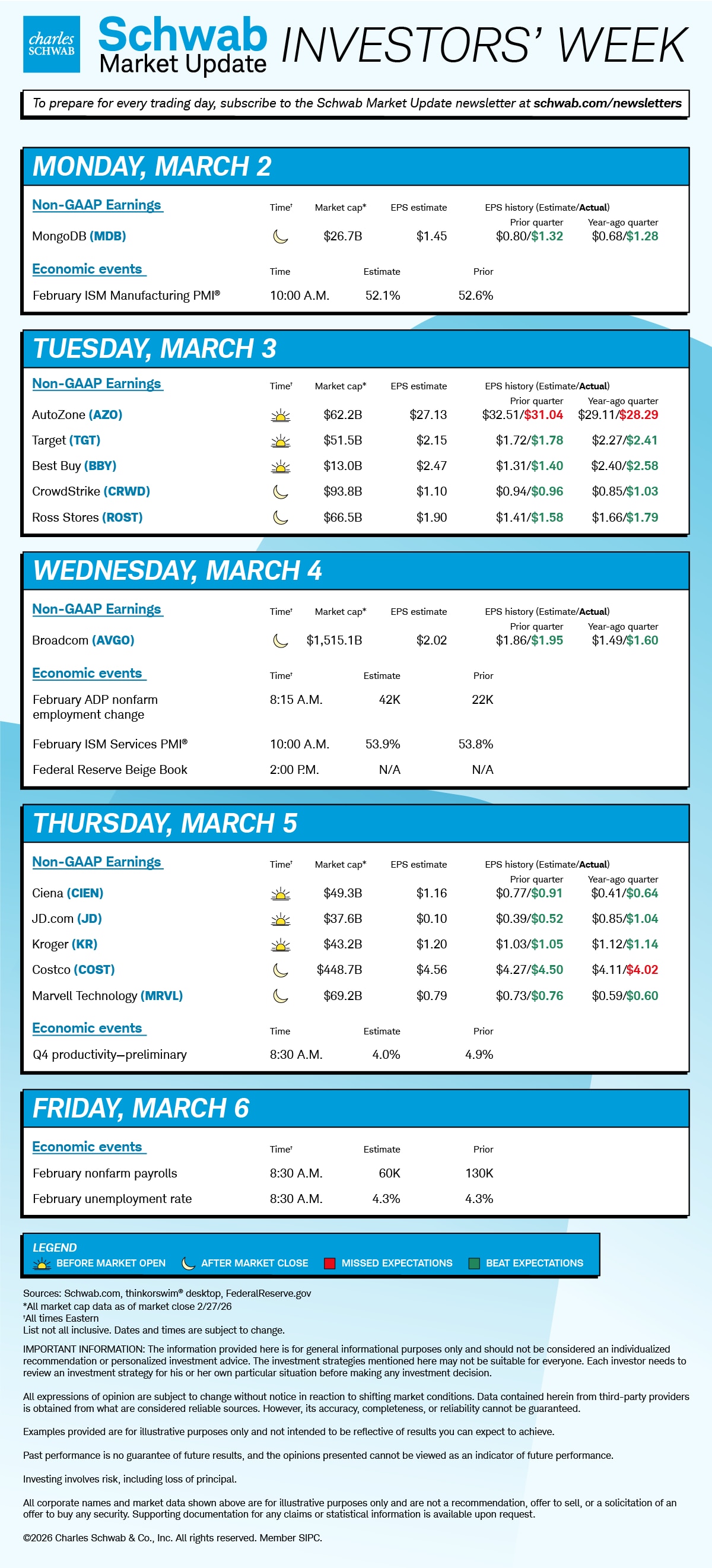

The week ahead