Swing Trading Strategies

Many long-term investors tend to focus on the bigger market picture, brushing off day-to-day fluctuations to focus on larger market trends and cycles. But within these larger currents are a multitude of minor price fluctuations: "swings" in the form of smaller rallies and declines. Some traders actually attempt to capture returns on these short-term price swings.

The term "swing trading" denotes this style of market speculation which, like any other trading strategy, offers both opportunity and risk. Past performance is no guarantee of future outcomes, as is with all market speculation.

What is swing trading?

Swing trading simply seeks to capture short-term gains over a short period (days or weeks) by attempting to capitalize on dramatic price movements in the underlying security. Swing traders might choose to go long or short the market to potentially capture price swings toward the upside or downside, or between technical levels of support and resistance.

These four components are widely considered critical to a swing trade setup:

- Which direction to trade—long or short

- Where to enter the market

- What price to take profits

- What price to cut losses

In addition, traders must ask themselves why they're buying or selling at a specific price and why the trade's target levels make sense. Because the time constraints of these trades are tight, technical analysis is critical in swing trading. For example, if the underlying asset doesn't reach a specific price within a relatively specific window of time, a trader may want to close the trade.

Although swing traders may use fundamental analysis—like economic cycles, earnings, and other longer-term trends—to provide perspective for their trade opportunities, most will use technical analysis tactics.

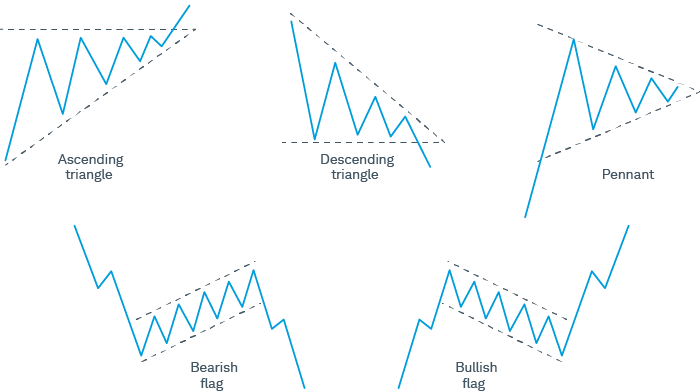

Chart patterns that focus on a narrower time frame and price context might help traders identify specific entry points, exit points, profit targets, and stop order target levels.

Given its focus on timing, swing trading as a strategy resides somewhere between so-called day trading and traditional long-term position trading or investing. But there are some key differences.

Swing trading vs. day trading

Although swing trading and day trading both target short-term profits, they can differ significantly when it comes to duration, frequency, size of returns, and even analysis style.

Day traders generally seek to get in and out of a trade within hours, minutes, and sometimes seconds, often making multiple trades within a single day. Because of the ultra-narrow time frame, day traders aim to capture smaller gains more frequently—unless they're trading a major news event or economic release, which can cause an asset to skyrocket or nosedive.

Typically, day traders pay little attention to market fundamentals, which are unlikely to shift within a single day. Much of the seemingly "random walk" of prices from minute to minute may appear as noise to long-term traders, while day traders might consider these tradable fluctuations. And because fundamentals are likely not influencing these minute price shifts, day traders often rely on technical analysis to gauge these micro-movements of supply and demand.

In contrast, swing traders attempt to target larger market swings within a more extended time frame and price range. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Hence, swing traders rely on technical setups to execute a more fundamental-driven outlook.

Common price patterns

Swing trading vs. longer-term investing

While not as narrowly focused as the day-trading strategy, swing trading also differs from long-term position trading. Position traders, not unlike investors, may hold a security for weeks, months, or even years. This longer-term outlook may also change the nature of how they conduct their initial analysis.

Because position traders look at the market's long-term trajectory, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and capture potential returns that may result from correctly forecasting the large-scale context.

The longer the time horizon, the more prices swing within the trajectory. A position trader might hold through many smaller rallies or pullbacks, while a swing trader would likely consider trading them.

Advantage and risks of swing trading strategies

Some traders might use swing trading strategies to try to supplement or enhance a longer-term investment strategy. It's one of the few ways traders can attempt to capture frequent short-term price movements in a market landscape that tends to evolve at a much slower pace.

Those beginning to experiment with swing trading should be mindful of two key risks and may wish to be conservative with the capital dedicated to this trading style.

Trading frequency: By definition, short-term trading opportunities can occur more frequently than their longer-term counterparts, but more frequent trading brings more frequent risk exposure and more transaction costs. Unless a trader understands and can confidently manage the risks and costs that come with higher trading frequency or volume, they might want to start slowly.

Trading complexity: Because every trading opportunity can present a unique market scenario, a swing trader's approach can vary considerably, which adds complexity. The greater the complexity, the greater the risk of misreading the market or making mistakes executing on their strategy.

Risks of swing trading

Trading frequency and risk: Short-term trading opportunities can sometimes occur more frequently than their longer-term counterpart. Bear in mind that more frequent trading brings more frequent risk exposure. Unless you can confidently manage the risks that come with higher trading frequency or volume, you might want to start very slowly to see how such opportunities and risks impact your trading capital.

And remember, the shorter your time horizon and the more trades you make, the more you'll rack up in transaction costs. This can water down your overall return, even if your swing trading strategy is otherwise profitable.

Trading complexity and risk: Because every trading opportunity can present a unique market scenario, your approach can vary considerably—and that introduces complexity. Remember, too, the greater the complexity, the greater your risk of misreading the market or making mistakes in your execution.

Swing trading strategy: Adopt or avoid?

Swing trading is a specialized skill. It isn't for every trader, and not every trader can succeed at it. It takes time, practice, and experience to trade price swings.

As the saying goes: It's one thing to know what a chart is. It's another to know how to read it effectively.

Those with a low risk tolerance or lacking sufficient risk capital might want to avoid the strategy altogether. Others may find it a valuable skill that could potentially supplement longer-term investments. The right combination is different for every trader, so it's important to start with the basics of technical analysis and transition to using indicators and patterns that make the most sense.