Advanced Tax Strategies for Donating Equity Awards

Many people who have equity compensation are both concentrated in their company stock and charitably minded. What if you could manage both by donating stock?

Equity compensation can make an excellent gift to charity because of the potential charitable impact and tax benefits available to the donor. If you donate these stock awards directly to charity (rather than selling them first and then donating cash proceeds) you may be able to eliminate capital gains tax you would have paid, resulting in up to 20% more to charity. In addition, you may claim a fair market value deduction for your gift.

Donor-advised funds, which are 501(c)(3) public charities, are an excellent gifting option for donations of company stock awards, as the funds typically alleviate the tax burden on what is often highly appreciated stock.

Please be aware that gifts of appreciated non-cash assets can involve complicated tax analysis and advanced planning. This article is only intended to be a general overview of some donation considerations and is not intended to provide tax or legal guidance. In addition, all gifts to donor-advised funds are irrevocable. Please consult with your tax or legal advisor.

Equity compensation awards generally aren't transferable until vested or exercised

The most common forms of equity compensation awards are typically restricted stock units (RSUs), restricted stock awards (RSAs), non-qualified stock options (NSOs), and incentive stock options (ISOs). The awards themselves are generally not transferable and therefore cannot be given to charity. However, once these awards are vested and/or exercised—and the underlying stock is held for more than one year—they can make excellent tax-smart charitable gift options.

What types of equity compensation can be donated to charity?

Not all equity compensation awards are treated the same when it comes to the charitable income tax deduction. As illustrated below, ideal gift options should meet IRS holding period requirements of at least more than one year and have high appreciation above your cost basis. Such gifts enable you to potentially eliminate capital gain tax on the difference between fair market value on the date donated and fair market value when vested or exercised, while also claiming a charitable income tax deduction.

- Equity compensation awards

- Tax treatment upon vesting or exercise

- Your charitable gift option

- Potential tax benefits

- Gift rating

-

Equity compensation awardsVested Restricted Stock Units (RSUs) and Restricted Stock Awards (RSAs) held greater than 1 year from vesting§§Tax treatment upon vesting or exerciseOrdinary income tax on difference between fair market value (FMV) at vesting and amount paid for your stockYour charitable gift optionEliminate capital gain recognition on difference between cost basis and FMV at gift datePotential tax benefitsDeduction at FMV, up to 30% of your adjusted gross income (AGI), with 5-year carryoverGift ratingIdeal

-

Equity compensation awardsStock received upon Nonqualified Stock Option (NSO) exercise held greater than 1 year from exerciseTax treatment upon vesting or exerciseOrdinary income tax on the difference between the exercise price and the stock's FMV at exerciseYour charitable gift optionEliminate capital gain recognition on difference between cost basis and FMV at gift datePotential tax benefitsDeduction at FMV, up to 30% of your AGI, with 5-year carryoverGift ratingGood

-

Equity compensation awardsStock received upon Incentive Stock Option (ISO) exercise held greater than 1 year from exercise and 2+ years from grant§Tax treatment upon vesting or exerciseNo ordinary income tax, although Alternative Minimum Tax (AMT) may applyYour charitable gift optionEliminate capital gain recognition on difference between cost basis and FMV at gift date**Potential tax benefitsDeduction at FMV, up to 30% of your AGI, with 5-year carryoverGift ratingGood

-

Equity compensation awardsVested RSUs and RSAs held 1 year or lessTax treatment upon vesting or exerciseOrdinary income tax on difference between FMV at vesting and amount paid for your stockYour charitable gift optionNo advantage to selling your stock and donating cash proceeds††Potential tax benefitsDeduction at lesser of cost basis and FMV, up to 50% of your AGI, with 5-year carryoverGift ratingGood

-

Equity compensation awardsStock received upon NSO exercise held 1 year or lessTax treatment upon vesting or exerciseOrdinary income tax on difference between exercise price and your stock's FMV at exerciseYour charitable gift optionNo advantage to selling your stock and donating cash proceeds††Potential tax benefitsDeduction at lesser of cost basis and FMV, up to 50% of your AGI, with 5-year carryoverGift ratingGood

-

Equity compensation awardsUnvested RSUs and unexercised ISOsTax treatment upon vesting or exerciseNot transferrable to charityYour charitable gift optionNot transferrable to charityPotential tax benefitsNot transferrable to charityGift ratingUnacceptable

-

Equity compensation awardsUnexercised NSOsTax treatment upon vesting or exerciseNot applicableYour charitable gift optionGenerally, not transferrable; exercise by charity may result in ordinary income tax to youPotential tax benefitsDeduction at lesser of cost basis and FMV, up to 50% of your AGI, with 5-year carryoverGift ratingUnacceptable

-

Equity compensation awardsVested Performance Stock Units (PSUs) and Performance Stock Awards (PSAs) held greater than 1 year from vestingTax treatment upon vesting or exerciseOrdinary income tax on difference between FMV at vesting and amount paid for your stockYour charitable gift optionEliminate capital gain recognition on difference between cost basis and FMV at gift datePotential tax benefitsDeduction at FMV, up to 30% of your AGI, with 5-year carryoverGift ratingIdeal

-

Equity compensation awardsVested PSUs and PSAs held 1 year or less from vestingTax treatment upon vesting or exerciseOrdinary income tax on difference between FMV at vesting and amount paid for your stockYour charitable gift optionNo advantage to selling your stock and donating cash proceeds††Potential tax benefitsDeduction at lesser of cost basis and FMV, up to 50% of your AGI, with 5-year carryoverGift ratingGood

-

Equity compensation awardsEmployee Stock Purchase Plans (ESPPs) Tax-qualified ESPPs held greater than 1 year from purchase and greater than 2 years from the grantTax treatment upon vesting or exerciseNo ordinary income tax, although you must meet holding period requirements prior to gifting or there may be income recaptureYour charitable gift optionEliminate capital gain recognition on difference between cost basis and FMV at gift date. Recognize ordinary income on the discount amount.Potential tax benefitsDeduction at FMV, up to 30% of your AGI, with 5-year carryoverGift ratingModerate

-

Equity compensation awardsStock Appreciation Rights (SARs)Tax treatment upon vesting or exerciseYour charitable gift optionGenerally, not transferrable; any transfer may result in adverse tax impact to youPotential tax benefitsGift ratingUnacceptable

Case study: Charitable tax planning opportunity

Cheryl is a senior executive of TechCo, a technology company that recently went public. She has accumulated a significant amount of restricted stock from the vesting of RSUs that she has held for more than one year.

Cheryl is eager to plan for her family's future and charitable giving is a big part of her goals. In addition, she has always been charitably minded and will have an unusually high income this year, so a charitable gift could help her to minimize tax exposure.

After speaking with her financial advisor, Cheryl learns about how she can easily fund a donor-advised fund account to receive a current-year tax benefit while making more money available to charity over time.

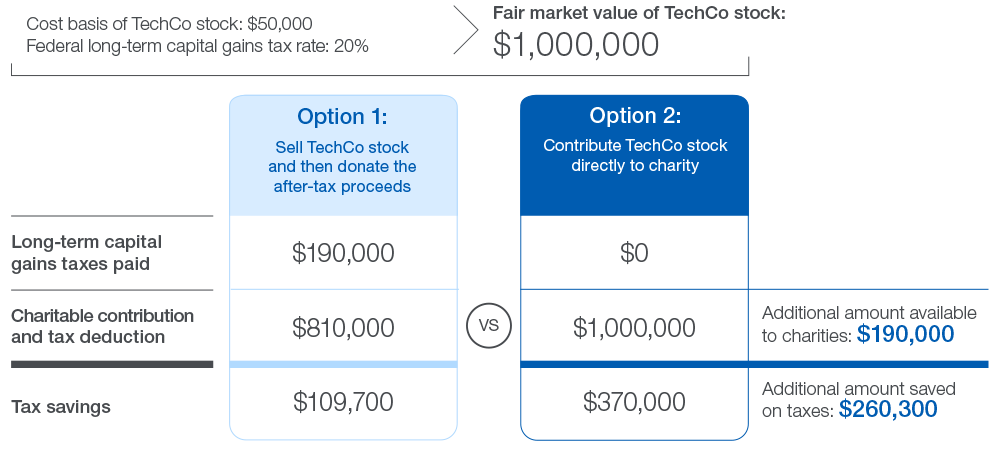

Cheryl decides to fund a donor-advised fund account with $1 million of company stock, with a cost basis of $50,000. By donating $1 million of TechCo stock directly to charity, as shown in Option 2 below, Cheryl eliminates $190,000 in projected federal capital gains taxes and this money is instead available to grant to charities through her donor-advised fund. She also has an additional $260,300 in tax savings from her claimed income tax deduction.

For illustrative purposes only.