Test Your Tax Smarts

Staying abreast of the ever-evolving U.S. tax code may feel like a fool's errand, but keeping tabs on major changes can help avoid costly mistakes, minimize your taxes, and maximize your wealth. So, how familiar are you with the current tax landscape? Answer the following questions to find out.

Question 1

IRS-mandated withdrawals from tax-deferred retirement accounts currently kick in for retirees at age 73—but will rise to 75 in what year?

A) 2027

B) 2029

C) 2031

D) 2033

Answer: D | Those born in 1960 or later can now wait until they reach age 75 to take required minimum distributions (RMDs) from their tax-deferred retirement accounts. "Taking RMDs later allows your money to stay invested longer, potentially providing you with more tax-deferred growth," says Hayden Adams, CPA, CFP®, director of tax and wealth management for the Schwab Center for Financial Research. "However, bigger account balances mean bigger RMDs—which are taxed as ordinary income and could bump you into a higher tax bracket." In other words, just because you can wait to make withdrawals doesn't mean you should. Depending on your situation, drawing down larger account balances as early as age 59½ could reduce your RMDs in the future and provide you with greater control over your taxable income.

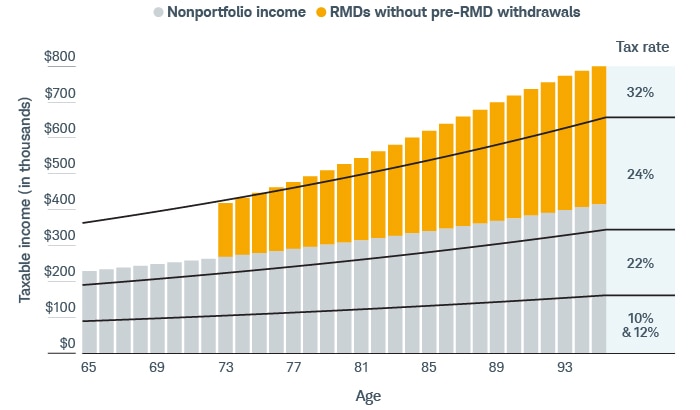

Minimizing RMDs

Scenario 1 | Without pre-RMD withdrawals

Without pre-RMD withdrawals, RMDs push this investor into the 32% tax bracket in retirement.

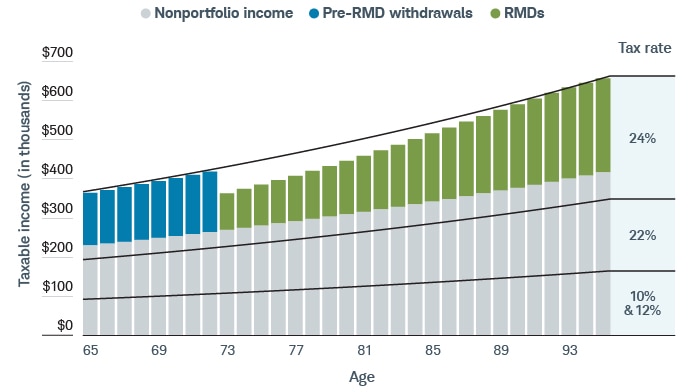

Scenario 2 | With pre-RMD withdrawals

Making annual withdrawals prior to RMD age, up to the limit of the 24% tax bracket, helps keep the investor out of the 32% tax bracket in retirement.

Source: Schwab Center for Financial Research.

Calculations assume a married couple with $230,000 in combined taxable income and $2.5 million in combined tax-deferred accounts at age 65. Annual growth of 6% is added to the account balance at the end of each year, and nonportfolio income and tax brackets increase by 2% annually to account for inflation. Nonportfolio income may include business income, pension payments, rental income, Social Security benefits, etc. This hypothetical example is only for illustrative purposes. Tax changes and income fluctuations may negatively affect the outcome of this strategy.

Read more RMD insights and strategies.

Question 2

How much money can you give tax-free to each individual in 2024 without eating into your lifetime gift and estate tax exemption?

A) $16,000

B) $17,000

C) $18,000

D) $19,000

E) $20,000

Answer: C | Individuals can give up to $18,000 (for married couples, it's $36,000) to as many people as they like in 2024 with zero gift- and estate-tax consequences. "Implementing an annual gifting strategy is a way to transfer wealth to the next generation entirely tax-free," Hayden says, "particularly if you're concerned about exceeding the federal estate tax exemption." (It's currently $13.61 million per individual but could fall to roughly half that effective January 1, 2026.)

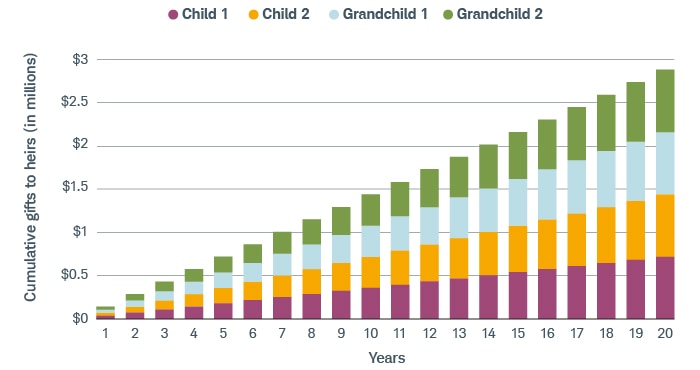

Bit by bit

A couple who gives $36,000 annually to each of their four heirs could transfer $2.88 million after 20 years entirely gift and estate tax-free.

Source: Charles Schwab.

This hypothetical example is only for illustrative purposes.

Read more about tax-efficient strategies.

Question 3

Could working in retirement reduce your Social Security benefits?

A) Yes

B) No

Answer: A | But only temporarily:

- If you're younger than your full retirement age (FRA) for the entire year, your benefit will reduce by $1 for every $2 you earn in excess of the annual limit ($22,320 in 2024).

- In the year you reach your FRA, your benefit will reduce by $1 for every $3 you earn in excess of the annual limit ($59,520), but only for the months prior to reaching your FRA.

- Once you reach your FRA, you'll start receiving your full benefit no matter how much income you earn. What's more, the Social Security Administration will recalculate your benefit to make up for any previous reductions that resulted from working.

Learn more about income planning in retirement.

Question 4

Which of the following gifts do not count against your annual gift tax exclusion or your gift and estate tax exemption?

A) Tuition payments made directly to an educational institution

B) Student loan payments made directly to the lender

C) Contributions to a minor's custodial brokerage account

D) Contributions to a 529 college savings account

Answer: A | For example, you could cover your granddaughter's annual tuition payment in its entirety—provided you pay the school directly—and give her up to $18,000 in 2024 with zero tax consequences (see question No. 2).

Read more insights about saving and paying for college.

Question 5

Is income generated from a foreign investment subject to U.S. taxes?

A) Yes

B) No

Answer: A | The U.S. government taxes all earned and unearned income, regardless of where it originates. But if you pay tax to the country where you generated the income, you may be eligible for either a credit or a deduction on your U.S. taxes. "The IRS limits the foreign tax credit you can claim to the lesser of either the amount of foreign taxes already paid or the U.S. tax liability on the foreign income," Hayden says.

Learn more about claiming foreign taxes.

Question 6

For 2024, what is the maximum penalty for failing to take the full required minimum distribution (RMD) from your tax-deferred retirement accounts by the end of the calendar year?

A) 5% of the shortfall

B) 10% of the shortfall

C) 25% of the shortfall

D) 50% of the shortfall

Answer: C | The SECURE 2.0 Act recently lowered the penalty from 50% to 25%; however, that penalty may be further reduced to 10% if you withdraw the full amount within two years. "That said, there's no good reason to pay even a 10% penalty when it can be so easily avoided," Hayden says.

Calculate your RMDs for the year.

Question 7

Is receiving a tax refund better or worse than having to pay additional taxes on Tax Day?

A) Better

B) Worse

Answer: B | A tax refund is essentially an interest-free loan to the government, which means you may have lost out on interest or other income that money could have earned. On the other hand, you may face an underpayment penalty if you had too little tax withheld throughout the year. (You can generally avoid this penalty if you owe less than $1,000 after subtracting your withholding and refundable credits, or if you paid withholding and estimated tax of at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is smaller.) "In an ideal world you would break even on Tax Day, meaning you'd neither owe additional taxes nor be due a refund," Hayden says. "That's a high bar, but staying on top of your tax withholding and estimated tax payments throughout the year can get you pretty close."

Update your tax withholding from your Schwab IRA distributions.

Question 8

If you loan a family member money, are you required to charge interest?

A) Yes

B) No

Answer: A | Intrafamily loans must charge minimum interest rates—known as the applicable federal rates. "Typically, an intrafamily loan allows family members to borrow from each other at a lower rate than they could get at a bank," says Austin Jarvis, director of estate, trust, and high-net-worth tax at the Schwab Center for Financial Research. However, if you fail to charge an adequate interest rate, the IRS could tax you on the interest you could've collected but didn't. What's more, if the loan exceeds $10,000 or the borrower uses the money to produce income (by, say, investing in stocks or bonds), you'll need to report the interest income on your taxes.

Learn more about intrafamily loans.

Question 9

In 2024, individuals ages 50 and older can make catch-up contributions of up to $7,500 to their 401(k)s and similar workplace plans. However, starting in 2025, individuals who fall into what age range can make even larger catch-up contributions?

A) 52 through 55

B) 56 through 59

C) 60 through 63

D) 64 through 67

Answer: C | For qualified plans, such as a 401(k) or 403(b), individuals ages 60 through 63 can make contributions of 150% of the regular catch-up amount or $10,000—whichever is greater.1 For SIMPLE plans, the amount is 150% of the regular catch-up amount or $5,000—whichever is greater.2

Estimate how much savings you'll need to retire.

Question 10

Starting in 2026, do all individuals who make catch-up contributions to a 401(k) need to do so with after-tax dollars to a Roth account?

A) Yes

B) No

Answer: B | Only employees whose wages are higher than $145,000 will be required to make catch-up contributions with after-tax dollars to a Roth account.3 "While you'll no longer defer the taxes on these funds," Hayden says, "neither will you pay tax when you withdraw them in retirement, assuming you're at least age 59½ and have held the account for at least five years."

Find out how to incorporate a Roth account into your retirement withdrawal strategy.

1,2The maximum catch-up contribution limit will be adjusted for inflation in subsequent years.

3The income limit was set in 2024 and will be adjusted for inflation in subsequent years.

Discover more from Onward

Keep reading the latest issue online or view the print edition.