Trading Options in a Retirement Account

Retirement accounts like IRAs were designed for slow wealth building, so there are limits on certain speculative transactions. Although it might seem that this would forbid most options trading in a retirement account, it's possible for qualified investors to use several options strategies in their IRA.

Certain options strategies are allowed in traditional and Roth IRAs as long as the account is approved for options trading by the financial institution that holds the retirement account. These strategies may be used to enhance income or manage downside risk without violating IRS rules. Riskier options positions—such as naked calls or short puts—are generally not allowed because those strategies have the potential for unlimited losses to the retirement account.

Options trading in a retirement account isn't entirely restricted, but these strategies must be employed carefully, and there are guardrails in place to ensure investors do so.

IRA restrictions

Even though retirement accounts offer a reasonable amount of flexibility, there are some restrictions on what and how an investor can trade in an IRA. These include:

- An investor can't borrow money in an IRA to buy stock. Any options trade that requires margin can't be executed in an IRA.

- An investor can't short stock in an IRA. Because shorting stock is technically borrowing a stock the investor doesn't own and then selling it, the strategy runs afoul of the rule that prevents investors from using IRA assets as collateral for a loan.

- Naked short calls aren't allowed in IRAs due to their potentially unlimited risk. A naked short call is one that isn't "covered" by any position (like shares in the underlying or an offsetting position). An investor typically sells a naked short call to profit from collecting a premium, a technique that limits upside potential without limiting downside risk.

Fortunately, investors don't need to keep track of all the rules to stay compliant. When trading in a Schwab account, the risk management software is designed to reject any trade that would violate the rules.

Options trading strategies allowed in IRAs

Although IRAs have restrictions, qualified investors whose accounts are approved for an options trading level have access to corresponding strategies they can use in their IRAs.

When approved, an IRA receives "limited margin," allowing for certain options spreads. This limited margin does not allow investors to borrow funds to execute trades. In this context, limited margin is a term that denotes the ability to use expected cash proceeds from unsettled positions to trade certain options strategies.

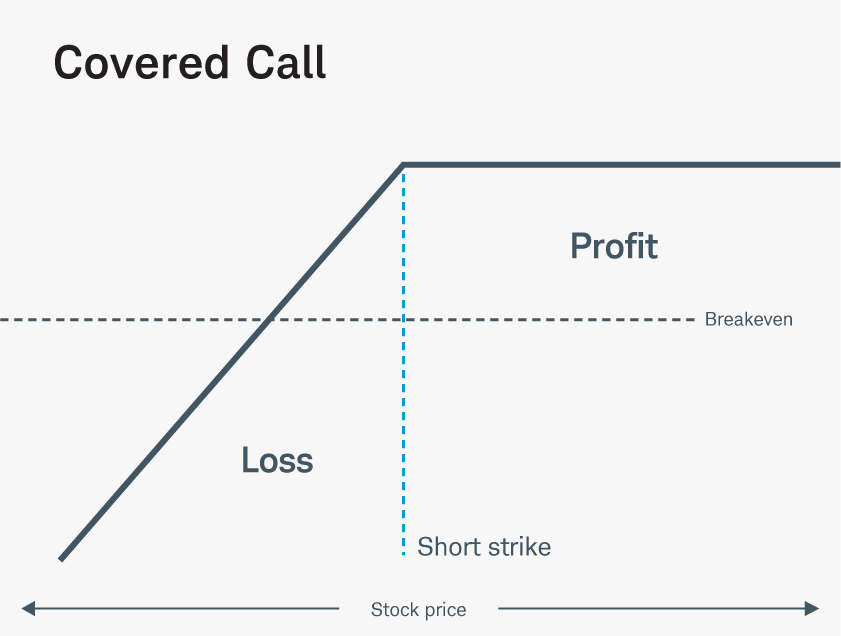

Selling covered calls

While naked call selling is forbidden, other strategies with a short call component are allowed. Specifically, the covered call, which is executed by selling call options—and collecting premium—against a stock the investor owns. The risk of the covered call strategy is the stock being called away because a call option is an obligation to sell the stock at the strike price on or by a specific expiration date. American-style options can be assigned at any time up to the expiration date, regardless of whether the stock price is at or above the strike price. In this event, the investor keeps the premium from selling the call but faces an opportunity loss if the stock, now relinquished to the call buyer, continues to rally. Any decline in the underlying stock, meanwhile, will be partially offset by the original options premium collected.

Source: Schwab

For illustrative purposes only.

Because a call typically appreciates in value if the underlying stock does, some investors prefer to buy calls instead of buying shares. The perceived advantage is that a call option can give its owner exposure to the stock's price changes at a lower cost.

Long-Term Equity Anticipation Securities (LEAPS) calls offer a longer-term option that is potentially a better mirror to the stock itself. While a long stock position can theoretically exist forever, a year or so may be enough time for the LEAPS strategy to achieve an investor's target profit. Choosing a LEAP that's near or in the money— with a strike price close to or below the stock's current price—is an even more conservative choice that's still less expensive than 100 shares of the underlying stock. Although because LEAPS have expirations up to three years in the future, their premiums tend to be high to account for the considerable time value.

When using this strategy, investors should understand that options usually require more active monitoring than stock, especially as expiration approaches. Another consideration is the fact that options trading doesn't come with voting rights or potential dividend payouts as stock ownership does.

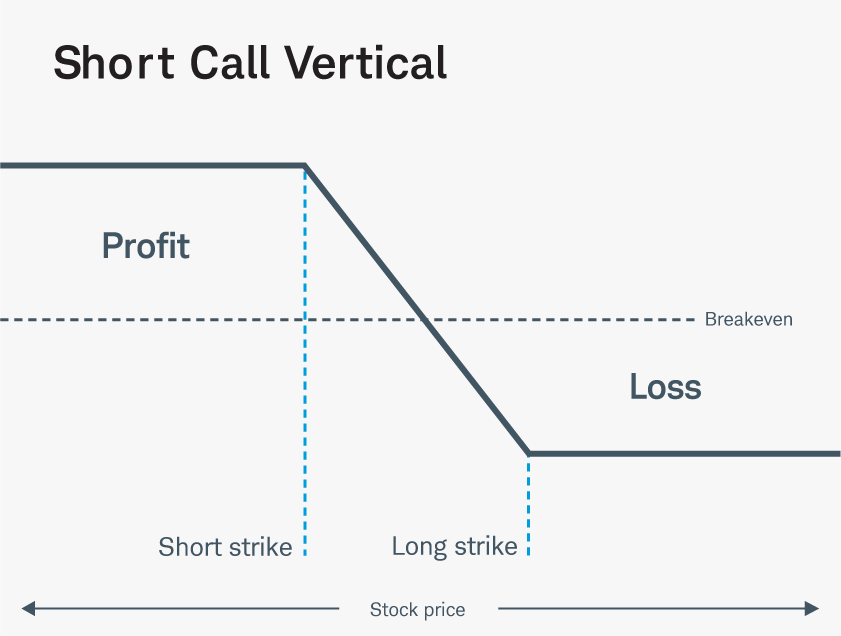

Bearish vertical call spreads

Shorting the stock—selling the stock without owning it first—is a traditional bearish strategy that can be profitable if the stock drops. But short selling is risky business that isn't allowed in an IRA, so bearish investors can take an alternative approach using options spreads.

A short call vertical, also known as a bear call spread or short call spread, is a bearish strategy that's permitted in an IRA. The trade is executed by selling one out-of-the-money (OTM) call—with a strike above the current stock price—and buying another call (in the same expiration) that is even further OTM.

Here's an example. An investor enters a short call vertical using strike prices that are $10 apart. Because the investor sells the position that's closer to the money, with a higher premium, they net a credit. The maximum potential profit—if the underlying is below the short call strike price at expiration—is the credit received (not including commissions and fees). The investor has a maximum loss of the difference in strike prices, minus this credit, if the underlying is trading above its long strike at expiration (not including commissions).

One downside to a short call vertical is the limited profit potential. Even if the price of the underlying drops to zero, the maximum possible profit is limited to the credit received for selling the pair of options. That's less than what an investor might make on a short sale, but the short call vertical has defined, maximum risk, no matter how high the underlying stock, index, or ETF rallies. That's why the short call vertical is allowed in an IRA, while short stock and short naked calls are not.

Source: Schwab

For illustrative purposes only.

Bearish vertical index put spreads

Similar to the risk/reward profile of a short call vertical, a long put vertical, or bear put spread, has both limited return and risk. It's another strategy to consider when trying to hedge a largely bullish IRA portfolio.

Because IRAs are intended to allow for long-term asset accumulation, they tend to be invested in long-term investments like index funds or portfolios of stocks. And although an investor may have a long-term bullish market outlook, there are times they might be concerned about a potential sell-off that could negatively impact their IRA's short-term outlook.

To hedge long positions they don't wish to liquidate, investors might consider a long put vertical using index options. Keep in mind that hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss.

A long put vertical consists of buying a put option and selling another put option at a lower strike price, both with the same expiration date. In this example, an investor chooses strike prices that are $50 apart using Nasdaq-100 Index® (NDX) options. This position has an upfront combined debit of $21 per contract, for a cost per vertical of $2,100. This is also the maximum amount at risk if the NDX is trading above both strikes at expiration, leaving both legs of the trade to expire worthless.

But if the index dropped sharply, the maximum potential profit on that long put vertical is the difference between the long and short strikes minus the debit originally paid. That profit helps offset the overall loss on the long portfolio.

1A trader might sell a stock they don't own. A trader who believes the price of the stock will decline can "borrow" the stock from a broker at a certain price and buy back ("cover") to close the position at a lower price later. The potential profit would be the difference between the higher price shorted at and the lower price covered.

2A limited-return strategy constructed of a long stock and a short call written on the same underlying. Ideally, the stock would finish at or below the call strike at expiration. If the stock price settles above the strike price, the stock would most likely be called away at the short call strike. The trader would keep the original credit from the sale of the call as well as any gain in the stock up to the strike. Break-even on the trade is the stock price paid minus the credit from the call and transaction costs.

3Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

4Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

5The simultaneous purchase of one put option and sale of another put option at a lower strike price, in the same underlying, in the same expiration month.