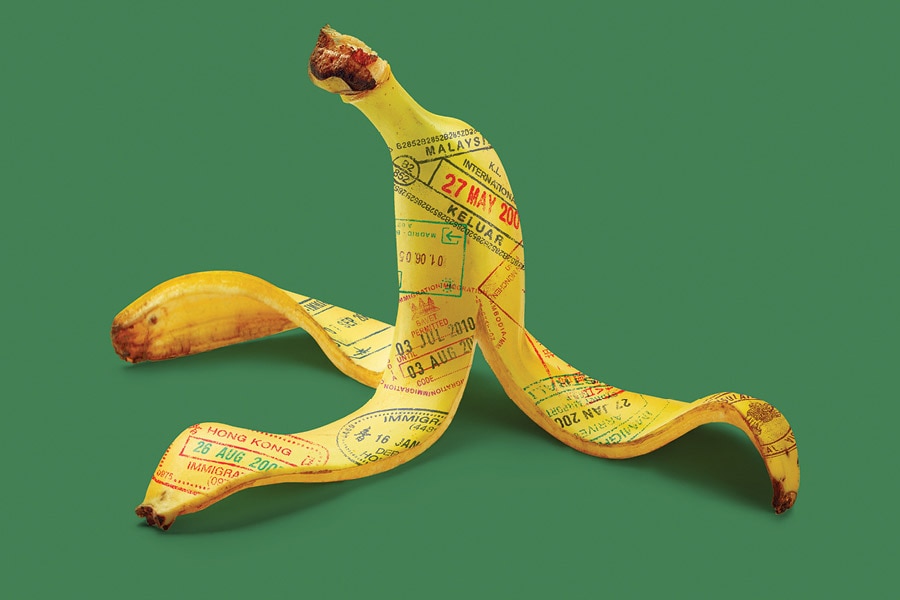

Traveling? Medicare Might Not Cover You

If you look forward to spending your retirement crossing state lines or adding a stamp to your passport, you should know in advance what your health insurance will cover while you're away from home. An accident or illness might not just be unpleasant; it could lead to big out-of-pocket costs—even if you're enrolled in a Medicare plan.

Here's how your health benefits will work—and what you can do if your Medicare coverage falls short—while you're traveling.

Original Medicare (plus Medigap)

When traveling domestically, rest assured that Original Medicare (Part A and Part B, which pay for hospitalization and medical services respectively) will cover you in all 50 states and U.S. territories, such as Puerto Rico and the U.S. Virgin Islands. However, it doesn't pay for health expenses incurred abroad—unless:

- You're traveling between Alaska and another U.S. state through Canada "without unreasonable delay," and a Canadian hospital is closer to you than the nearest U.S. hospital capable of treating your illness or injury. Medicare determines what qualifies as "without unreasonable delay" on a case-by-case basis.

- You have a medical emergency while you're traveling in the U.S., and a foreign hospital is closer to you than the nearest U.S. hospital capable of treating your illness or injury.

- You live in the U.S., and a foreign hospital is closer to your home than the nearest U.S. hospital capable of treating your medical condition, regardless of whether it's an emergency.

If you're on a cruise, be aware that you'll be covered only in U.S. waters. Once you're more than six hours away from a U.S. port, Medicare won't pay for medical costs. However, having a supplemental Medicare policy, or Medigap, can help fill the shortfalls in coverage—including internationally.

Medigap provides additional insurance coverage beyond Original Medicare and will cover some emergency care abroad—generally with a $250 annual deductible, a 20% copay, and a lifetime limit of $50,000—but it's typically limited to the first 60 days of your trip.1 Before you leave the U.S, contact your insurance company to confirm coverage.

Medicare Advantage

All Medicare Advantage plans, which are private insurance alternatives to Original Medicare, must cover—at a minimum—everything Parts A and B do, including emergency and urgent care anywhere in the U.S. However, a Medicare Advantage plan may not provide nonemergency coverage outside your service area—a significant drawback for those with a vacation home in another state or who otherwise frequent a different part of the country. Be sure to check with your plan to understand the limitations outside your standard coverage area and consider adjusting your insurance or provider as necessary.

Be that as it may, some Medicare Advantage plans do offer at least some protection for foreign travel, though there may be restrictions. For example, some plans may require you to pay out of pocket and then seek reimbursement, restrict reimbursements for emergencies and urgent care, or cap their overseas travel benefits. Always research the details of your policy before you travel so you understand exactly what is and isn't covered.

As for cruises, Medicare Advantage's domestic rules apply when you're in U.S. waters, and foreign-travel rules apply when in international waters.

Read the fine print

For both Medigap and Medicare Advantage plans that cover international travel, you can help avoid surprise out-of-pocket expenses by understanding your provider's distinction between emergency care—for a condition or an injury that places your mental or physical health in serious jeopardy—and urgent care—for nonemergency situations that require immediate medical attention, such as an unexpected illness or flare up of an existing condition. Additionally, prescriptions filled by a retail pharmacy outside of the United States may not be covered, so consider packing extra medication in case of travel delays.

Given all of these restrictions on care, all international travelers should consider looking into purchasing additional travel insurance, travel health insurance, or both. In addition to expenses like nonrefundable trip costs and cancellations, most travel insurance policies cover emergency medical care for sudden illness or injury that could become problematic if not treated immediately—within certain limits. For example, some plans won't cover accidents that result from adventure activities or expenses related to preexisting conditions. Travel health insurance, on the other hand, can provide for more routine medical care if you're going on an extended trip.

As pricy as travel insurance can be—averaging between 4% to 6% of your total travel costs—the peace of mind it offers will allow you to enjoy yourself without the shadow of unexpected medical expenses looming over your trip.

1"Medicare Coverage Outside the United States," medicare.gov, 12/2024.