What to Know About Trump Accounts

The One Big Beautiful Bill Act (OBBBA) created a new tax-advantaged savings and investment account for children—called the Trump Account—that could give families a new way to save for their children's futures.

You could almost think of a Trump Account as a cross between a traditional individual retirement account (IRA) and a 529 savings account. In brief, these accounts will initially be eligible for after-tax contributions of up to $5,000 a year until the year the beneficiary reaches age 18. Like with an IRA, potential earnings can then grow tax-free and eligible withdrawals will generally be taxed at the beneficiary's income tax rate. However, withdrawals are generally prohibited until the beneficiary reaches age 18, at which point the account will need to be converted to an IRA.

Like with a 529, the beneficiary doesn't need to have earned income to accept contributions and nearly anyone can contribute to their account, but there's no requirement that the proceeds be used for education expenses—or any other purpose.

One of the more eye-catching features of Trump Accounts is that the OBBBA promises newborns born between Jan. 1, 2025, and Dec. 31, 2028, a federal grant of $1,000. We expect more details on how this will work in the coming months.

With that in mind, here's what we know about these accounts today.

When do Trump Accounts launch?

Trump Accounts will become available in 2026. However, the first contribution to the account can't be made until after July 4, 2026. At this time, it isn't clear who will open the account or where it will be held.

Who is eligible for Trump Accounts?

Any child who hasn't reached the age of 18 during the calendar year and has a Social Security number can have a Trump Account. In other words, the beneficiary must be 17 or younger for the entire year to accept contributions to their account. As noted above, contributions cease in the year the eligible the beneficiary reaches 18. However, to receive the free $1,000 federal grant, the child will need to be a U.S. citizen.

What are the contribution rules?

Almost anyone can contribute to a child's Trump Account—including parents, grandparents, family members, friends, employers, and nonprofits—and unlike other tax-advantaged retirement accounts, these accounts have no earned-income requirement.

- Individuals can contribute to the account until the year the beneficiary turns 18. The maximum annual contribution will generally be $5,000 and this amount will be indexed to inflation beginning in 2028.

- Employers can contribute up to $2,500 to the child of an employee's account, tax free, each year. Note: At this time, it appears that employer contributions are included in the overall $5,000 limit; however, additional IRS guidance may be needed to clarify this issue.

- Local, state and federal governments, as well as charities, can also contribute tax-free to a child's account. Such contributions won't count toward the $5,000 annual limit.

Contributions to a Trump Account won't affect the contribution limits on other tax-advantaged retirement accounts, such as IRAs or a 401(k). So, a child with a Trump Account and earned income from a job could theoretically max out their annual IRA contribution and still accept contributions to their Trump Account.

How can funds in the account be invested?

Funds held in these accounts can be invested in eligible mutual funds or exchange-traded funds (ETFs) that track a major index.

What are the tax rules?

Contributions will generally be made with after-tax dollars, which means there is no tax deduction for contributions. However, some contributions—such as those made by an employer, a charity, or the government—can be made with pre-tax dollars.

Any potential appreciation or earnings within the account can grow tax-free.

What are the withdrawal rules?

Generally, no withdrawals are allowed from a Trump Account. Once the beneficiary turns 18, the Trump Account will need to be converted to an IRA—at which point IRA withdrawal rules will apply. (Note that eligible disabled children may also be permitted to roll their Trump Accounts into an ABLE account.)

Since the original Trump Account could potentially hold two types of savings—after-tax contributions and untaxed earnings from the investments—taxes on withdrawals will depend on what portion of the account is being withdrawn:

- After-tax amounts (i.e., contributions) that are withdrawn will be tax free, since the taxes have already been paid on these assets.

- Pre-tax amounts (i.e., any tax-free contributions, appreciation, or earnings) will generally be taxed at the beneficiary's ordinary income tax rate.

In addition, it's important to understand that early withdrawals before age 59½ may be subject to a 10% penalty.

Trump Accounts in action

Trump Accounts represent a potentially valuable tool for building up savings and tapping the power of compound growth for the young.

Some families may also be able to use them as part of their estate-planning strategy, as these accounts could give parents or grandparents a place to transfer wealth from their taxable estate, while giving the child a huge boost in retirement savings.

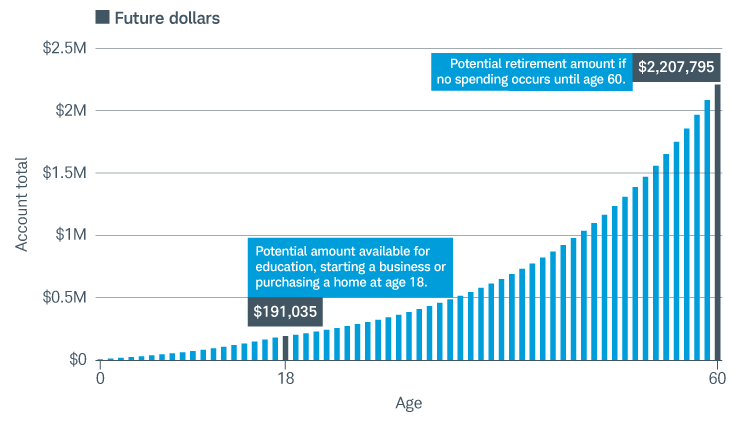

For example, imagine a family that could contribute to and invest the full $5,000 in a Trump Account (adjusted for a 2.3% inflation rate per year) for the entire 18 years.

Assuming a reasonable growth rate of 6%, by age 18, the child's account would hold around $191,000 in assets, comprising about $108,000 in after-tax contributions (which would no longer be included in the family's estate), and about $83,000 in investment gains.

At that point, the beneficiary could convert the account to a traditional IRA, meaning it could continue to accumulate potential gains on a tax-free basis. Even if the beneficiary made no additional contributions to the account, by the time they reached age 60, the account could be worth more than $2.2 million.

Potential growth of a Trump Account with maximum contributions

Source: Schwab Center for Financial Research.

Assumes 2026 government contribution of $1,000 and parental contribution of $5,000 for child born in 2026, followed by annual parental contributions of $5,000, which are adjusted for inflation at a rate of 2.3% beginning in 2028. Parental contributions continue through the year the child turns 17. Assumes investment growth of 6.0%. Dividends and interest are assumed to have been reinvested, and the example does not reflect the effects of fees which would cause performance to be lower. For illustrative purpose(s) only. Individual situations will vary. Not intended to be reflective of results you can expect to achieve.

What about a Roth conversion after age 18? In this case, any pre-tax sums in the account will generally be taxed at the beneficiary's ordinary income tax rate. After the conversion, potential gains could accumulate in the account tax-free and withdrawals after age 59 ½ would also be free of taxes. (Parents or grandparents could add to the tax advantages by paying the taxes due on the conversion via a gift.)

Bottom line: Consider Trump Accounts as you plan ahead

Many rules and regulations need to be settled before we have a full picture of how Trump Accounts work. That said, Trump Accounts could join IRAs and 529 savings plans as tax-advantaged savings vehicles that could help families build wealth for the next generation.

Families interested in planning ahead should meet with a tax or financial advisor to learn more about the tax law changes and potential tax benefits within the OBBBA, and to see how these proposed accounts might fit into their broader strategy for long-term savings—whether that means saving for college tuition or supporting a child's eventual first-time home purchase.