TTM Squeeze Indicator: Technical Signals for Traders

The following content is intended for sophisticated options traders with substantial knowledge of options and technical analysis. If you're not familiar with the terminology in this article, please review our options content for beginners available to Schwab clients.

Deciding whether to sell options premiums depends on whether the market is consolidating or trending. If it's consolidating, an options investor could consider selling some premium. If it's trending, on the other hand, and the market has just pulled back to support, an investor might go either way. For example, an investor could buy a 0.70 delta1 call for an in-the-money2 (ITM) directional trade or sell an at-the-money3 (ATM) put vertical spread4. Both trades make sense.

But what if the market is about to switch from a consolidation to a full-on trend? Such a switch may be obvious in hindsight, but by the time an investor realizes it, it could be too late. However, there are tools on the thinkorswim® trading platform that can help detect when such a switch might be near.

Connect the dots

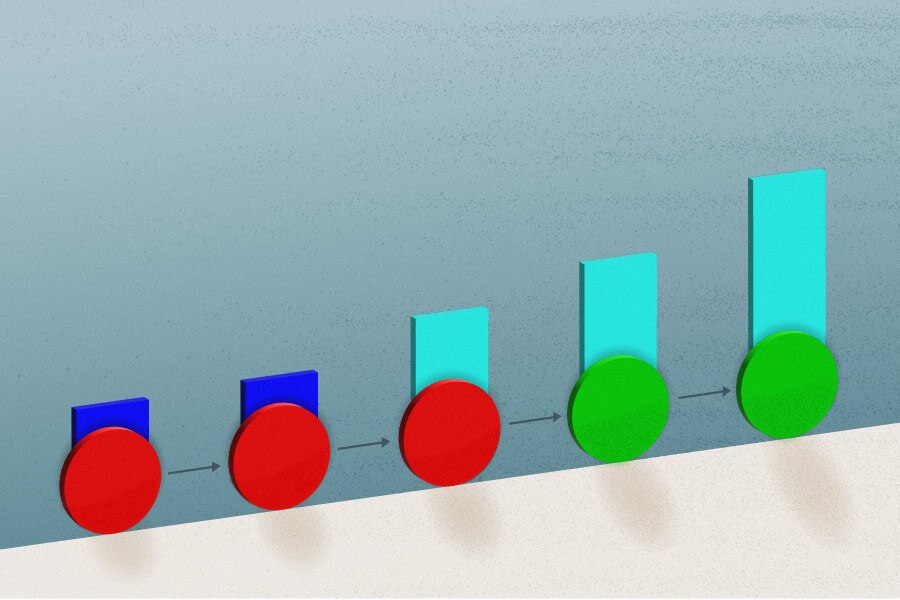

The image below shows a stock price chart with the TTM Squeeze indicator (TTM: Trade the Market) displayed on the bottom pane. The TTM Squeeze indicator looks at the relationship between Bollinger Bands®5 and Keltner Channels6 to help potentially identify consolidations and signal when prices are more likely to break out (whether up or down). This colorful indicator is displayed as histogram bars above and below a horizontal axis. The red dots along the horizontal axis indicate that the stock is "squeezing" out the last bit of consolidation from a period of sideways price action. It then starts to build up energy to shift to a trending market. The market trends until the momentum starts slowing down—a sign the trending action could potentially be coming to an end.

Source: thinkorswim platform

For illustrative purposes only. Past performance is not a guarantee of future results or success.

The first green dot after the series of red dots suggests the squeeze is on, and this market could be ready to move.

In this scenario, with the histogram above zero, a bullish options strategy might make sense.

For example, an investor could consider legging in to a bullish call vertical spread. Initially, an investor could buy ITM calls. To get price movement that closely mimics the underlying asset, an investor could look at options with a delta of at least 0.70.

Next, the investor could wait for the momentum on this trade to end. That happens when the momentum on the histogram changes color (in this case, from light blue to dark blue), indicating the trending price action is likely reaching a conclusion.

This is when an investor might sell some ATM calls close to expiration to complete the vertical spread.

A best-case scenario at this point is a market that goes back into a choppy consolidating phase. Under these circumstances, long ITM calls hold mostly intrinsic value and suffer minimal premium decay. The short call, on the other hand, starts losing premium at a quick clip. However, if the market moves down, the trader could loss everything invested for the trade.

The TTM Squeeze indicator represents a unique moment in the life of the underlying asset—right before it moves out of a consolidation range. The key is to identify that critical moment and use delta in the options to maximize the potential opportunity.

How to plot the TTM Squeeze Indicator

Log in to the thinkorswim® trading platform and select the Charts tab. At the upper right of any chart, follow the path: Studies > Quick Study > John Carter's Studies > TTM_Squeeze.

1 A measure of an options contract's sensitivity to a $1 change in the underlying asset. All else being equal, an option with a 0.50 delta (for example) would gain $0.50 per $1 move up in the underlying. Long calls and short puts have positive (+) deltas, meaning they gain as the underlying gains in value. Long puts and short calls have negative (–) deltas, meaning they gain as the underlying drops in value.

2Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's current price is above the strike price. A put option is ITM if the underlying asset's current price is below the strike price. For calls, it's any strike lower than the current price of the underlying asset. For puts, it's any strike that's higher.

3 An option whose strike is "at" the price of the underlying equity. Like out-of-the-money options, the premium of an at-the-money (ATM) option is all time value.

4 An options position composed of either all calls or all puts, with long options and short options at two different strikes. The options are all on the same underlying security and of the same expiration, with the quantity of long options and the quantity of short options netting to zero.

5A chart indicator in which lines, or bands, are typically plotted two standard deviations above and below a simple moving average. Because standard deviation is a measure of volatility, Bollinger Bands adjust to the market conditions. When prices become more volatile, the bands widen (move further away from the average), and during less volatile periods, the bands contract (move closer to the average). Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply.

6 A volatility-based technical indicator that uses average true range to create envelopes above and below an exponential moving average.