Using Sentiment Analysis Tools in Your Trading

Sentiment analysis tools are helpful resources for traders when analyzing time horizons or tracking the potential velocity or magnitude of a move. Tactically, sentiment measures—including the thinkorswim® platform tools discussed below—offer estimated ranges for a security during a certain time period.

By analyzing the behavior of the options-trading crowd through these sentiment gauges, traders have another tool to help determine when it might potentially be time to build a new position, add a hedge, or plan for a potential reversal.

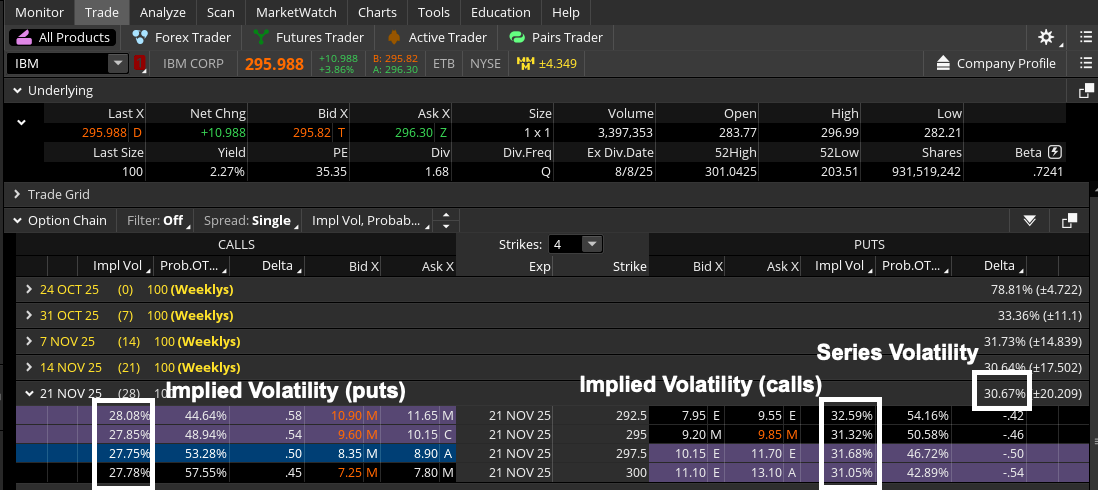

Tracking volatility on thinkorswim

Source: thinkorswim platform

Past performance is no guarantee of future results. For illustrative purposes only.

This figure provides the absolute dollar value of an options series' expected move by a particular expiration date (as priced in by option traders). This is the non-percentage value shown on the far right of each options series header. Although the expiration date doesn't affect traders directly, this kind of benchmark is theoretically a forward-looking indicator that can complement traditional charting methods.

The above option chain for IBM reflects a series volatility of 30.67% for the year. This annual volatility reading corresponds to a move of roughly 20.2 points (higher or lower) within the 28 days before November 21 series options expire. By using this indicator, traders can compare one series to another to see how relatively high/low they are. In the above scenario, the series volatility reading for the October 24 weekly options was notably higher, near 79%, likely because IBM reported earnings on October 22.

1The market's perception of the future volatility of the underlying security directly reflected in the options premium. Implied volatility is an annualized number expressed as a percentage (such as 25%), is forward-looking, and can change.

2Volatility (vol) is the amount of uncertainty or risk of changes in a security's value. This concept is based on supply and demand for options. Higher demand for options (buying calls or puts) will lead to higher vol as the premium increases. Low demand or selling of options will result in lower vol. Vol in its basic form is how much the market anticipates the price may move or fluctuate.