Waiting to Save for Retirement Could Cost You

When it comes to saving for retirement, the clock is ticking. To illustrate the value of time, let's consider three Roth IRA investors.

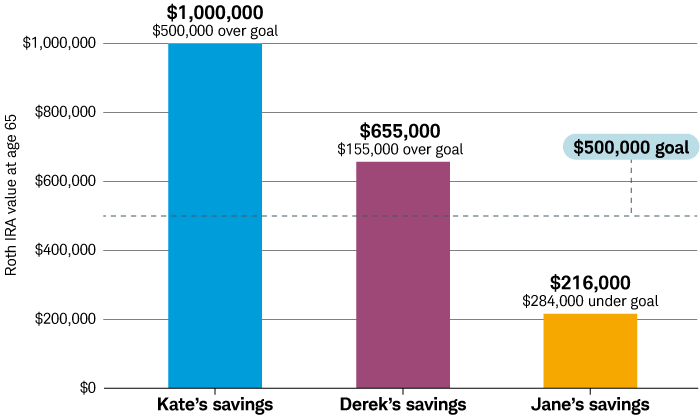

Kate, Derek, and Jane all decide to open Roth IRAs to supplement their other retirement accounts. Each investor hopes to build their Roth IRA to $500,000 at the time of retirement, though they're starting to save for retirement at different ages. All plan to retire at age 65, and the investors make the maximum allowed contribution each year.

*People age 50 and older are allowed to include a $1,000 "catch-up" contribution.

By age 65, here's how their savings could add up

The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product. Dividends and interest are assumed to have been reinvested, and the example does not reflect the effects of taxes or fees. Assumes annual contribution of $7,000 until age 50, and $8,000 from age 50 to age 65; also assumes 6% average annual portfolio growth. Values are rounded.

How you can best prepare for the future

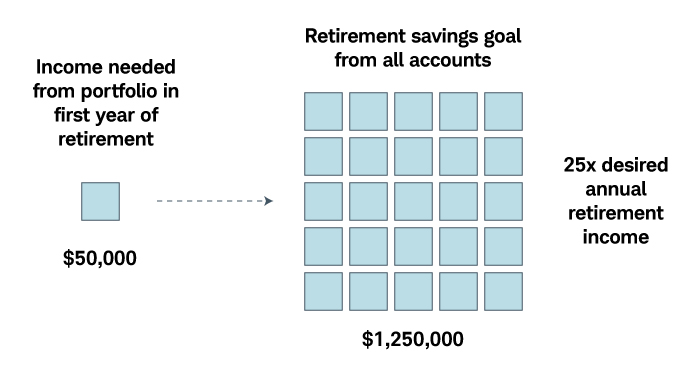

Here's a retirement savings rule to get you started.

If you start saving in your 20s, contributing 10% to 15% of your paycheck (including any savings match from your employer), you'll be more likely to meet your retirement savings goal. With every decade you delay, however, you'll need to save a larger percentage of your paycheck.

Source: Schwab Center for Financial Research

For illustrative purposes only.

Find additional ways to save

Here are some options for getting on the right track:

- Maximize your workplace retirement plan. For 2025, the maximum 401(k) contribution for employees under age 50 is $23,500, up from $23,000 in 2024. Employees aged 50 or older can make additional catch-up contribution— $7,500 if you’re age 50 to 59 or over 64. For those between age 60 to 63, employees can contribute an additional $11,250. Be sure to take advantage of any match your company offers.

- Consider devoting funds from a windfall, such as a bonus or inheritance, to an investment account geared toward your retirement.

- Set up a taxable brokerage account to supplement your retirement savings.

- Think about increasing your savings when you get a raise. As your income increases, you may be able to up your savings rate by 1% to 3% each year. Before you know it, you'll be savings a lot more than you thought you could.

- Start a Health Savings Account (HSA)—if you're able—to help cover medical expenses, both now and later in life. If you don't use the money, you won't lose it. An HSA stays with you. (Note: You may only open and contribute to an HSA if you're covered by a high-deductible health plan. Contribution limits for 2025 are up to $4,300 for single coverage and $8,550 for family. At age 55, individuals can contribute an additional $1,000. See HealthCare.gov for details).

Better late than never

Invest in your future sooner rather than later. If you're starting later in life, don't get discouraged—there are other options that could help you reach your financial goals. All it takes is discipline and perseverance.