Wealth Is More Than Money

Findings from Schwab’s 2023 Modern Wealth Survey

Americans surveyed recently by Schwab say it takes more money to feel financially comfortable today than it did a year ago. They also define wealth as being about more than just money, and they are establishing financial goals and creating a plan to achieve them at younger ages.

These are some of the key findings from the 2025 Schwab Modern Wealth Survey, offering an opportunity for me to share insights and possible actions to help you build wealth and achieve your financial goals.

Wealth is more than money

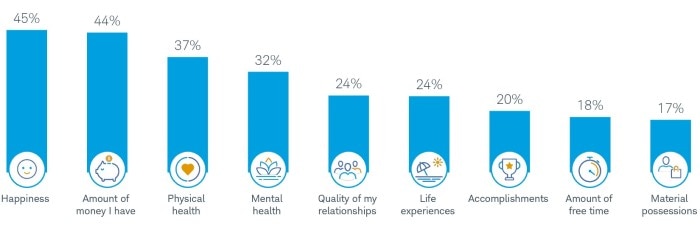

When asked what it means to be wealthy, the 2,000 Americans ages 21 to 75 polled in April and May for this year's survey place nearly equal value on happiness as they do on the amount of money they have, and this is a theme we've seen in previous Modern Wealth Surveys.

Survey respondents are more likely to define the meaning of wealth as their physical health, mental health, quality of relationships, life experiences, accomplishments, and their amount of free time, than they are by their net worth or material possessions. Wellbeing is more integral to the definition of personal wealth than the amount of money someone has. This suggests that affluence today is more holistic and less tied to material wealth alone.

How do you define wealth?

Source: 2025 Schwab Modern Wealth Survey. The survey question represented here asked, “Which of the following factors contribute most to your personal definition of wealth?”

"Wealth" isn't just about having a lot of money. Rather, it's more about what money does for us and how we use it to achieve our financial and life goals, and less about our bank balances, net worth, and material possessions. Financial planning is never just about the numbers, and this is consistently confirmed by what we hear in client conversations—the meaning of wealth is about what the financial numbers enable us to experience and achieve.

Beyond the dollars and cents and portfolio balances, people feel healthy and wealthy in those areas that make our lives rich.

Feeling financially comfortable is more challenging today than last year

While the amount of money survey respondents say is required to be "wealthy" ($2.5 million) has not meaningfully changed over the last five years, the amount of money it takes to feel "financially comfortable" has, increasing to $839,000 in 2025, compared to $778,000 in 2024.

This may seem like a discrepancy in the survey findings, but I suggest what's at play here is that the concept of "wealth" is aspirational—it's something we want to achieve in the future and over time.

"Financial comfort," on the hand, is more tangible. We relate it to things in our everyday lives, such as experiencing inflation when we pay more for groceries and eating out than we did last year, dealing with higher interest rates when shopping for a car or a home loan, or struggling to afford the rising cost of health care. These are the kinds of real-world experiences that can lead to a sense that we need more money to feel financially comfortable and maintain our current standard of living—especially when factoring in future needs like Social Security and saving for retirement.

Take steps to control what you can

Although it wasn't a meaningful change from previous studies, this year's survey respondents did indicate that it takes more money to be "wealthy" compared to last year. Some of the most common reasons why respondents indicated this include: inflation/cost of living is higher (73%), the economy is worse (62%), and interest rates on loans are higher (43%).

Although we can't control inflation, the economy, or interest rates, we can take control of our financial lives by identifying financial goals and making a financial and wealth management plan to achieve them. Portfolio adjustments and strategic planning that align with your risk tolerance and goals might help, too.

Help combat inflation. In our annual and midyear outlooks, we shared that staying invested in equities, according to your time horizon and financial and/or wealth plan, is one of the best chances to outpace inflation over time. This remains true today. You might also consider ways to buffer your portfolio from inflation, including investing in Treasury Inflation Protected Securities (TIPS) and maintaining some cash reserves to increase your ability and confidence to stay invested. (Keep in mind that TIPS are a long-term investment position best suited to keep pace with inflation, rather than "beat" inflation, and they can be impacted in the short term by changing interest rates.)

Whether or not the U.S. economy is better or worse today than it was a year ago is debatable based on how it's measured. While the S&P 500 is up over last year (as of this writing), other factors like inflation pressures, high interest rates on loans, and mixed unemployment numbers can make many Americans feel like the economy is worse.

Help combat high interest rates. There are two sides to the interest rate equation: investing and borrowing. On the borrowing side, the cost of credit in areas critical to achieving financial goals, including mortgage rates, remains stubbornly higher than it has been for most of the last decade. With 30-year mortgage rates hovering near 7%, those looking to buy or refinance may be tempted to wait for interest rates to come down.

We don't expect that mortgage rates will drop more significantly soon. So waiting to buy a first home, for example, until interest rates come down may be a long wait. Consider what you can control. Have a down payment equal to 20% or more of the purchase price (don't stretch affordability by making a smaller down payment) and understand that a home purchase is a long-term commitment and investment. If needed, mortgages can be refinanced if mortgage interest rates fall.

On the investing side, take advantage of higher interest rates by committing to learn more about, and then review the allocations to investment-grade bonds and cash investments in your portfolio. Is the allocation sufficient to help manage risk and increase liquidity, stability, and income, based on your goals, investment time horizon, and needs?

Bonds and cash investments can be a helpful cushion, providing relative stability and predictability in a portfolio. They can help generate income and be available when you need to fund future purchases, whether that's a home, college education, or the first few years of spending in retirement.

Younger people are more likely to have a financial plan

Another interesting finding from Schwab's 2025 Modern Wealth Survey is that 39% of Gen Z Americans surveyed have determined their financial goals and documented them in a formal plan, compared to 26% of boomers. Along those same lines, just 18% of Gen Z survey respondents indicate they don't have a financial or wealth management plan of any kind, compared to 45% of boomer respondents who don't.

1Blanchett, David M. "Financially Sound Households Use Financial Planners, Not Transactional Advisers." Journal of Financial Planning 32 (4): 30–40, 2019.