Web3: Welcome to the Multiverse

Key takeaways:

- Digital asset integration is the next wave of the internet era, or Web3. This new combination of finance and the internet offers the opportunity to build microeconomies on top of the existing global economy.

- Investors who are interested in this cryptocurrency perspective might favor exposure to smart-contract platforms such as Ethereum as opposed to store-of-value cryptocurrencies such as bitcoin.

- Amid the recent crypto bear market, a debate has emerged around Web3 and whether it has failed to materialize or if this flush-out offers an opportunity to cleanse the broader crypto ecosystem. Schwab's perspective is that this offers a strategic reset, similar to the dot-com bubble, which ultimately saw new internet products and services launched that changed our global economy forever.

The multiverse is a theoretical concept that proposes our universe is just one of many, potentially infinite, parallel universes existing alongside our own. Smart-contract ecosystems (blockchain networks that are programmable and allow developers to build applications on them) such as Ethereum (the largest and most well-known smart contract blockchain) offer an opportunity to build additional layers on top of the global economy. Some of these crypto economies may be integrated into the global economy, while others may operate in isolation, ultimately creating a multiverse of economies. While some investors have begun to understand the case for bitcoin as a potential store of value, the broader cryptocurrency market and its potential to create a multiverse of economies remains misunderstood by many investors.

With the growth of these digital economies, traditional businesses are actively integrating digital assets into their operating models, like the early days of the internet. In the following report we explore the growth of crypto economies, the future of the internet—often referred to as Web3, the next-generation shift from centralized platforms (Web2) to a decentralized blockchain-based web—and how investors could position themselves for exposure to this new multiverse of economies.

Nothing in this report is a recommendation to buy or sell cryptocurrencies or any financial products. This is for informational use only. Bitcoin and other cryptocurrencies are relatively new and due to their novel and unproven nature, reliable methods for estimating performance may not be available. The regulatory landscape for crypto is still evolving. Cryptocurrencies may be subject to potential encryption breaking, illiquidity and increased risk of loss. Theft, scams and fraud have been a factor to deal with, and if you decide to invest in crypto directly remember that there may not be an effective way to recover assets if they're stolen or lost.

Smart contract platforms have specific risks associated with them, which include risks related to the core development team, key man risks, and competitive risks. If the core development team were to resign, it could have a negative impact on the cryptocurrency's price. Some have key man risks. If the founders were to move on from the projects, it could trigger a loss of confidence in the network. Smart contract platforms also have competitive risks and any perceived market share losses incurred by a platform could have an adverse impact to their cryptocurrencies. Ultimately each cryptocurrency has their own specific risks, and investors must make sure to understand them before investing. Smart contract platforms have been hacked in the past. As an example, in 2016, there was a hack against "The DAO," an application built on the Ethereum network. The DAO had raised $150 million worth of ether through a public crowdfunding campaign, and in less than three months from its launch, $60 million of raised ether was stolen in a hack. Additionally there have been failures of networks and applications, security breaches, and massive losses on smart contract platforms.

Why are cryptocurrencies innovative?

Throughout history, currency standards have been enforced through societal structures within a domestic economy, such as taxes, and through geographic borders and military power on a global basis. One of the hallmarks of a reserve currency has been the acceptance of it as a currency outside of its country's borders. Historically, it has not been possible to start a completely new "microeconomy," based on decisions made by individuals and businesses, with its own widespread currency. Cryptocurrencies have changed this.

Bitcoin, the first cryptocurrency, was launched in 2009. Since then, it has become a global asset with a market capitalization of $1.7 trillion as of December 31st, 2025, according to CoinMarketCap.com. On February 13th, 2026, bitcoin's price was 45% below its October 2025 all-time peak, according to data from Bloomberg. Ethereum, the first smart-contract platform, launched in 2015. Smart-contract platforms are blockchains that enable users to program logic into their transactions (programmable money). These layer 1 blockchains enable the building of applications on their networks as opposed to only being a payments network.

Many crypto critics argue that cryptocurrencies lack any backing and are simply a function of the "greater-fool theory"—the idea that you can make money as long as there is a "greater fool" who will buy overvalued assets. This may be a feature of meme coins, cryptocurrency that is inspired by internet jokes or viral trends. What believers of the greater-fool theory fail to recognize is that smart-contract platforms, for the first time in history, offer a means to build microeconomies on top of the existing global economy. These microeconomies operate with cryptocurrencies as their native currencies. These ecosystems can be completely closed off, offer connectivity to other crypto microeconomies, or be fully integrated into the existing off-chain global economy.

The multiverse of economies

Source: Schwab,

For illustrative purposes only.

Digital asset integration is the next wave of the internet era

The internet era is often discussed within the technology community in phases, which include Web1 and Web2. The initial adoption of the internet occurred during the Web1 phase, when business and consumers were connected globally. Email created instant communication, regardless of distance. Companies began to integrate the internet into how their businesses operated to make them more efficient and more distributed. Eventually, digital-first businesses appeared for the first time, such as Amazon.

In the Web2 phase, the global telecommunication network became internet-enabled. This period saw cellphones transformed into on-the-go computers, enabling a new wave of businesses, such as Instagram and Uber. Mobile phones went from a method of communication to a personal assistant in your pocket that manages daily activities including banking, travel, grocery shopping and much more. Over the past 30 years, the internet has enabled a connected, digital-first, on-demand global economy.

The global economy is currently built upon three core rails of infrastructure: financial, internet and energy. The global financial rails include central banks, commercial banks, investment banks, regional banks, exchanges, brokerages, asset managers, private lenders, and many more. The global internet rails include fiberoptic lines laid across the ocean floor, internet service providers, internet companies, telecommunication firms, and different internet- or mobile-based applications. Finally, the third rail is energy infrastructure. Energy markets are global, but less connected than financial and internet markets. Most nations have centralized power grids that are fueled by various types of energy, including coal, natural gas, nuclear, wind, and solar.

While these three rails have degrees of connectivity to one another, ultimately, they are separate networks. Smart-contract platforms present an opportunity to fuse two of these legacy infrastructures, financial and internet, into a single economic rail. The digital asset community refers to this new era of connectivity as Web3.

Key pillars of Web3 include decentralization and individual ownership of data (privacy). This integrated rail of financial and internet infrastructure opens the possibility for new economies to be built, regardless of local structures or geopolitical borders.

Smart contract blockchains offer something that has never been achievable throughout history: a multiverse of economies. These different microeconomies, each with their own native currencies, can operate in closed structures, but many may operate with open structures, allowing connectivity to different microeconomies in addition to the traditional global economy. At the center of it all is bitcoin—which exists as a global currency whose ability to mint new currency is based on energy. That ties the third rail of the global economy into this new combined rail of internet infrastructure and financial infrastructure.

Quantifying the potential opportunity

The global economy was $114 trillion in 2024 according to the World Bank. The World Bank estimates that the digital economy contributes more than 15% to global gross domestic product (GDP) and has been growing nearly 2.5x faster than the physical world economy. Digital assets such as cryptocurrencies are not included in these figures.

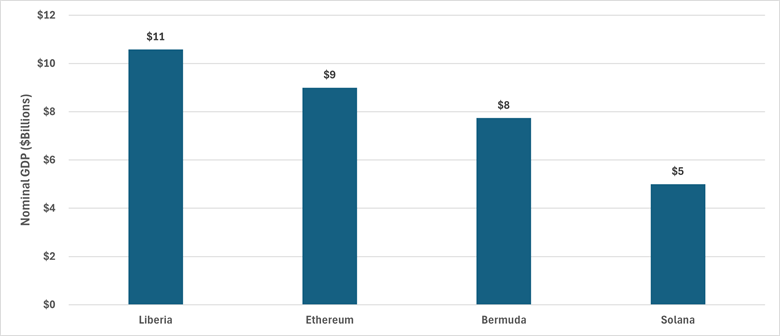

In 2025, the crypto multiverse generated $33 billion in fees, according to Token Terminal (as of December 31st, 2025). That's the equivalent of Iceland's 2024 nominal GDP (the total market value of all final goods and services produced in a country within a specific time period, without adjusting for inflation or changes in price levels), according to estimates from the World Bank. The largest and most well-known smart contract blockchain, Ethereum, had a "GDP" in 2025, measured by the sum of all fees generated across its ecosystem, of almost $9 billion. If Ethereum were a country it would have the world's 158th largest economy—larger than Bermuda's and not much smaller than Liberia—based on 2024 nominal GDP data from the World Bank. Solana, another well-known smart contract blockchain, had a "GDP" of almost $5 billion.

If Ethereum were a country it would have the 158th-largest economy

Source: World Bank, Token Terminal and Charles Schwab.

Global Economy, Liberia and Bermuda data as of 12/31/2024, which is the latest data available, and measures the full 2024 calendar year. Ethereum and Solana data as of 12/31/2025 and includes the full calendar year. For illustrative purposes only and are not intended to be, nor should they be construed as, a recommendation to buy, sell, or continue to hold any investment.

What might the future look like?

Currently, most crypto businesses and products are focused on creating a personalized financial economy, where users directly engage with these offerings. In a future state, service-style businesses could emerge that use different crypto protocols on behalf of their customers. We are already seeing the off-chain economy begin to integrate with the on-chain economy, with banks and payment firms integrating stablecoins and tokenized securities. Prediction markets are actively becoming mainstream, real-time feedback mechanisms. This is very similar to the 1990s, when companies started integrating internet offerings into their business models. In 1995, no one could have imagined social media or the on-demand economy of today, but just as the arrival of the internet caused a wave of innovative new companies and business models to emerge, we suspect the same will play out in crypto.

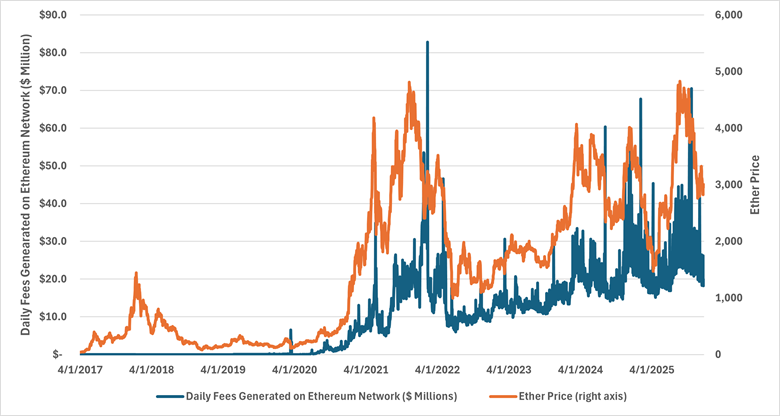

What we do know is that historically, increased activity on a smart-contract platform has typically resulted in increased demand for its native currency, as evidenced by the daily fees generated on the Ethereum network and its resulting price movements from April 1st, 2017 through December 31st, 2025. An investor that wants to position their portfolio for Web3 exposure may be more interested in owning the cryptocurrency associated with a smart-contract blockchain as opposed to store-of-value blockchain.

Smart-contract blockchains offer exposure to some of the fastest-growing economies in the world. As a country's economy grows, often demand for its currency will grow, resulting in a strengthening versus other currencies. We believe this relationship will also be a feature in digital-asset economies. As an example, we can see evidence of this by looking at how the price of ether has responded to activity on the Ethereum network. It's important to point out that just because this relationship held historically, there is no guarantee that activity on the Ethereum network will continue in the future. Competition from other blockchains could result in lower usage, user growth could slow, and changes to the governance of the network could have adverse impacts to the use of the network and the price of its native cryptocurrency, ether.

Demand for ether has historically increased as the Ethereum blockchain has seen more activity

Source: Token Terminal, Charles Schwab from 4/1/2017 through 12/31/2025.

Past performance is no guarantee of future results. For illustrative purposes only. Not intended to be reflective of results you can expect to achieve and are not intended to be, nor should they be construed as, a recommendation to buy, sell, or continue to hold any investment. On February 13, 2026 ether's price was 58% below its August 2025 all-time peak, according to data from Bloomberg.

How should investors position for Web3?

We previously identified an industry framework and method to evaluate different cryptocurrencies. We feel 2026 could be a key year for smart-contract platform integration into the global economy. While demand for the native cryptocurrencies of these smart-contract protocols is likely to still trade based on momentum, we feel it is important for investors to begin to educate themselves on the merits of different smart-contract platforms and their core use cases. For the foreseeable future, altcoins—a term for any cryptocurrency other than bitcoin—will remain a way to get even higher volatility exposure to bitcoin's price movements, but as the crypto multiverse becomes more mature, we feel over time this may shift to a more fundamental drivers of cryptocurrency prices. That said, we should also consider the risks of investing in cryptocurrencies. Investing in cryptocurrencies involves risk, including the risk of total loss of principal invested. Cryptocurrencies [such as bitcoin and ethereum] are highly volatile, are not backed or guaranteed by any central bank or government; are not deposits; are not FDIC insured; are not SIPC protected; and lack many of the regulations and consumer protections that legal-tender currencies and regulated securities have. Due to the high level of risk, investors should view digital currencies as a purely speculative instrument. Cryptocurrency-related products carry a substantial level of risk and are not suitable for all investors. Investments in cryptocurrencies are relatively new, highly speculative, and may be subject to extreme price volatility, illiquidity, and increased risk of loss, including your entire investment in the fund. Spot markets on which cryptocurrencies trade are relatively new and largely unregulated, and therefore, may be more exposed to fraud and security breaches than established, regulated exchanges for other financial assets or instruments. Some cryptocurrency-related products use futures contracts to attempt to duplicate the performance of an investment in cryptocurrency, which may result in unpredictable pricing, higher transaction costs, and performance that fails to track the price of the reference cryptocurrency as intended. Additional risks apply.

Web3 debate following the recent crypto bear market

We are still in the early stages of the Web3 era. Importantly, not all Web3 investment returns will come from cryptocurrencies, and there likely will be lots of ways to participate in traditional financial markets. There are already companies integrating digital assets into their businesses every day.

Amid this recent crypto bear market, some in the crypto community feel Web3 has failed to materialize. Believers of this narrative point to the fact that non-financial focused crypto use cases have not seen broad growth or adoption. Examples of these include social media and gaming applications. The other perspective is that bear markets offer a cleansing of the ecosystem. Similar to recessions in traditional economies that are often accompanied by a bear market, a crypto recession may result in a reallocation of resources across the crypto ecosystem.

The crypto market has no barriers to entry, and Schwab's perspective is this may present an opportunity to flush the millions of tokens out of the system that were created without any purpose or utility. Often in times like this, creative destruction sees ideas and businesses built on shaky foundations fail, and new, better ideas emerge. Like the dotcom bubble, where many newly formed internet businesses and products failed, ultimately, new use cases grew from the ashes and transformed our global economy. Bitcoin was born out of this very same process—being launched in January 2009 following the global financial crisis. This recent bear market may serve as a strategic reset for Web3.