How Fed Rate Cuts Can Impact Mortgage Interest Rates

At the September Federal Open Market Committee (FOMC) meeting, Fed Chair Jerome Powell announced a 25-basis-point interest rate cut. It marked the first time rates were cut in 2025, and more interest rate cuts are expected before the end of the year — leaving many prospective homebuyers wondering how these changes will impact mortgage interest rates.

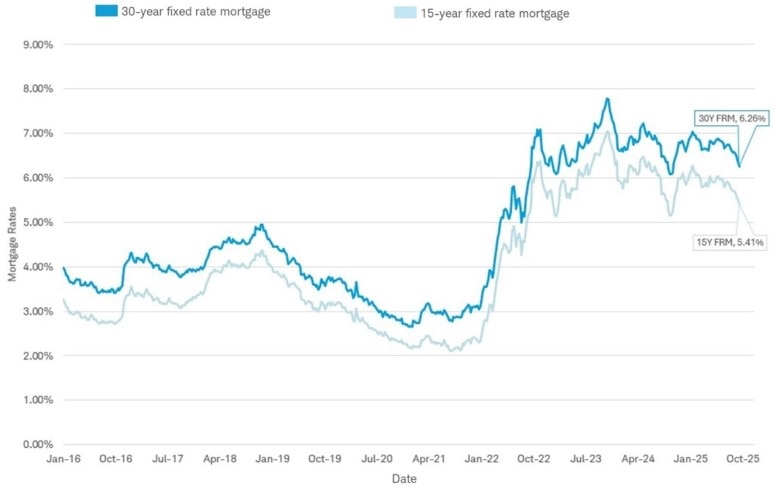

Mortgage rates have fallen modestly over the last few months, with the average 30-year fixed rate dipping to 6.26% in mid-September, according to Fed data. That's the lowest rate in nearly a year, but it's still well above average rates that fell below 3.0% in late 2021.

Although the Federal Reserve (the Fed) is expected to make at least one more cut to short-term interest rates before the end of the year, mortgage interest rates may, or may not, follow the same path. That's because multiple factors affect mortgage and other long-term interest rates, including inflation, the labor market, economic growth, GDP, and the bond market.

Mortgage rates are impacted by several factors

As a result of general economic uncertainty, rising Treasury bonds, and nagging high inflation,

both 30-year and 15-year fixed mortgage rates have remained above 6.0% over the last few years, despite several Fed rate cuts.

Since bottoming out below 3.0% in early 2021, rates on 30-year fixed rate mortgages rose steadily since mid-2022 to the 6.0% to 7.0% range.

Mortgage rates are beginning to fall

Source: Schwab Center for Financial Research with data provided by Freddie Mac. Weekly mortgage rates from January 7, 2016 to September 18, 2025.

When the central bank chooses to "cut rates," like it did on Sept. 17, it's cutting the Federal Funds Rate, which is the shortest-term national U.S. interest rate. The Federal Funds Rate is the interest rate that banks charge to borrow money from each other (even though banks maintain reserves, when they need more, they borrow from other banks).

The Fed does not directly cut mortgage rates, 10-year Treasury rates, or the rates on corporate debt. To better understand mortgage rates, let's look at the 10-year U.S. Treasury yield.

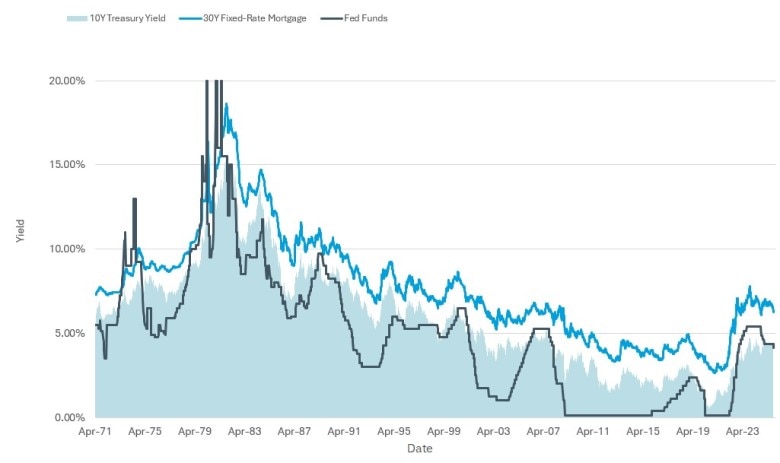

Thirty-year mortgage rates have tended to follow the 10-year Treasury yield more closely than short-term rates like the Federal Funds Rate.

Moving together: 30-year mortgage rates and 10-year Treasury yields

Source: Schwab Center for Financial Research. Data provided by Freddie Mac and Bloomberg from April 2, 1971 to September 18, 2025.

Past performance is no guarantee of future results.

In the chart above, the light blue area is the yield on 10-year U.S. Treasuries from April 1971 through September 18, 2025. The darker blue line is the average U.S. 30-year fixed mortgage rate during that same time. They tend to move together. And the dark gray line is the Federal Funds Rate.

While the short-term Fed Funds and long-term mortgage rates tend to move together over time, they may move in opposite directions for short periods of time. There are other factors involved, including housing activity, market demand for mortgages, and other factors.

Adjustable-rate mortgage (ARM) rates, on the other hand, generally track to a specified benchmark interest rate that determines how the interest rate adjusts over time. The most common is the Secured Overnight Financing Rate (SORF), with a pre-specified spread.

Will mortgage rates continue to drop?

As of September 2025, Fannie Mae forecasts that the average national 30-year fixed rate mortgage may fall to 6.4% by the end of 2025 and to 5.9% at the end of 2026. The average national 30-year fixed rate from 1971 to 2025 in the U.S. has been 7.71%, measured by Freddie Mac.

It's not likely that 30-year fixed mortgage rates will fall soon to anywhere near their record lows in 2020 of below 3.0%. A drop below 6.0% would be a welcome dip for Americans looking to purchase a home or refinance an existing fixed-rate mortgage or adjustable-rate mortgage with lower rates.

We'll wait and see if rates drop meaningfully from here, but keep in mind that the driving factors for mortgage rates are different, and more complex, than the direction of Fed cuts. That's why we'll be watching rates on the 10-year Treasury, along with the broader economic outlook, rather than focusing on the Fed cuts alone.

Mortgage rates affect home affordability

For many investors, their home is a major asset. And if there's a mortgage on that home, it's also likely their largest liability. For future homeowners, saving for a home purchase is a common financial goal. When it comes time to buy, mortgage interest rates can meaningfully affect buying decisions by raising or lowering borrowing costs.

When mortgage rates were low (between 2.0% and 3.0%) for much of 2020 through early 2022, we saw high levels of home purchases and mortgage refinances. When mortgage rates are higher, affordability is lower.

The cost of housing impacts the housing market and home sales prices, along with other factors.

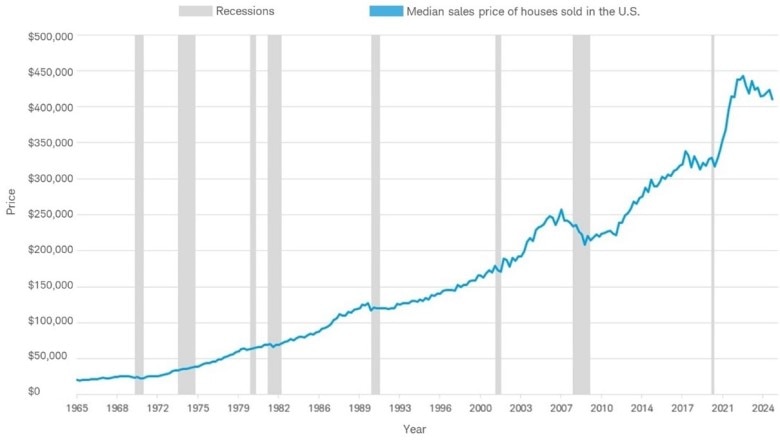

As shown in the chart below, U.S. home sales prices dropped after the sharp rise driven, in no small part, by the low mortgage rates of 2020 to 2022. Since then, prices have dropped but are "holding on."

Median U.S. home sale prices are holding on

Source: Schwab Center for Financial Research.

Median sales price data provided by the U.S. Census Bureau and U.S. Department of Housing and Urban Development, retrieved from FRED. Data from January 1, 1965 to June 30, 2025.

Several factors have driven up home prices, including low (or zero) short-term interest rates, and low rates on longer-term debt and lending, including 10-year U.S. Treasuries and 30-year fixed rate mortgages. These were driven by the Fed's near-zero interest rate policy following the 2008 recession until modest hikes started in December 2015.

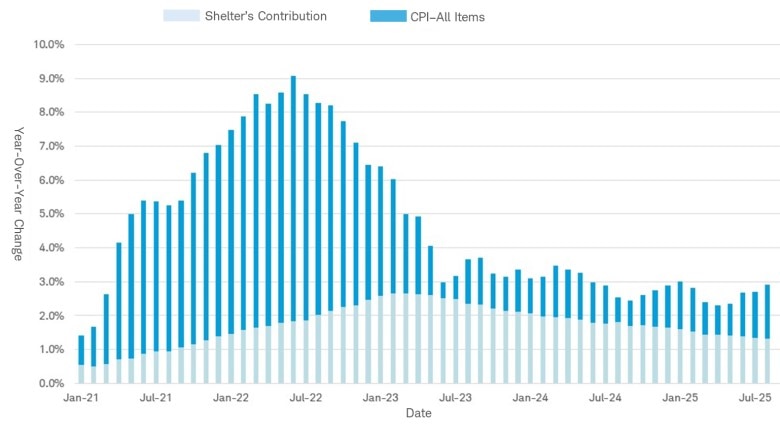

Home and shelter costs, as measured by the U.S. Bureau of Labor Statistics, remain high. Shelter costs are one of the largest inputs to the Bureau of Labor Statistics Consumer Price Index (CPI), a key inflation indicator. The shelter input in the CPI Index measures rent of a primary residence or the owner's simulated equivalent rent. It is not a direct measure of homeowner mortgage costs.

Home and shelter costs remain high

Source: Schwab Center for Financial Research.

Consumer Price Index for All Urban Consumers data provided by U.S. Bureau of Labor Statistics and reflects the data released in September 2025. Shelter's Contribution measures the portion of the year-over-year change of the All-Items index contributed by Shelter. Chart displays monthly data from January 1, 2021 to August 31, 2025.

What about tapping home equity or locking in fixed-rate home loans?

Existing homeowners may have significant equity in their homes. Would it make sense to tap the increased equity to help with other rising expenses or cash flow? Home equity lines of credit generally have floating rates, and the average rate in the U.S. is currently 8.0% or higher. These rates are more attractive than borrowing to fund spending using credit cards.

But we suggest that homeowners tap home equity wisely for home improvements or other projects, if needed, not to fund daily expenses or consumer spending, if possible. If 30-year fixed- rate mortgage rates fall further, refinancing home equity borrowing into a long-term mortgage may make sense. We suggest that all borrowers have a plan to build and manage wealth over time, taking into account both assets and liabilities.

For borrowers with ARMs coming due, refinancing into a 30-year fixed rate mortgage, after the recent dip below 7.0%, may make sense. As noted above, the average 30-year fixed-rate mortgage rate since 1971 has been above 7.0%, and few analysts forecast that 30-year mortgage rates will fall much below 6.0% in the next few years. It seems the record-low fixed rates between 3.0% and 4.5% were an anomaly of the modern era, not the norm.

Bottom line: Understanding how mortgage interest rates work can help you plan

Mortgage rates are top of mind for many Americans, given the rising cost of home ownership, drop in turnover of existing homes, and lack of opportunities for refinancing for those who have purchased homes over the past few years. Understanding how mortgage interest rates are influenced and impacted by other interest rates and economic factors can help current and future homeowners make informed buying or refinancing decisions.