What's the 10-Year Outlook for Major Asset Classes?

Looking in the rearview mirror is great for seeing where you've been, but it can't tell you where you're headed.

"The phrase 'past performance is no guarantee of future results' exists for a reason," says Rob Williams, managing director of financial planning and wealth management at the Schwab Center for Financial Research. "Expecting assets to deliver the same returns they have in recent years or decades can cause you to fall well short of your goals."

Instead, your expectations should be grounded in the macro and micro trends that could shape the markets today and tomorrow. That's especially true in an age as unpredictable as this one, where emerging technologies, geopolitical tensions, and uncertainty related to global trade agreements have the potential to upend industries and even national economies that have long been market leaders.

"That's not to say you should react to every piece of market news," says Eric Tarkin, director of asset allocation and model portfolios at Schwab Asset Management. "But the global economy is constantly evolving, and investors should be mindful of these changing dynamics when thinking through their long-term investment plans."

With that in mind, Schwab Asset Management periodically updates its capital market expectations for the next 10 years—a process informed by experience, proprietary data, and forward-looking qualitative and quantitative research by Schwab's senior investment professionals.

"Our capital market expectations are grounded in economic theory and are demonstrably better than relying on recent performance or a simple long-term average to inform your decisions," Eric says.

Here's a look at how Schwab expects every major asset class to perform during the next decade, compared with the previous 10-year period, and how investors can respond to projections.

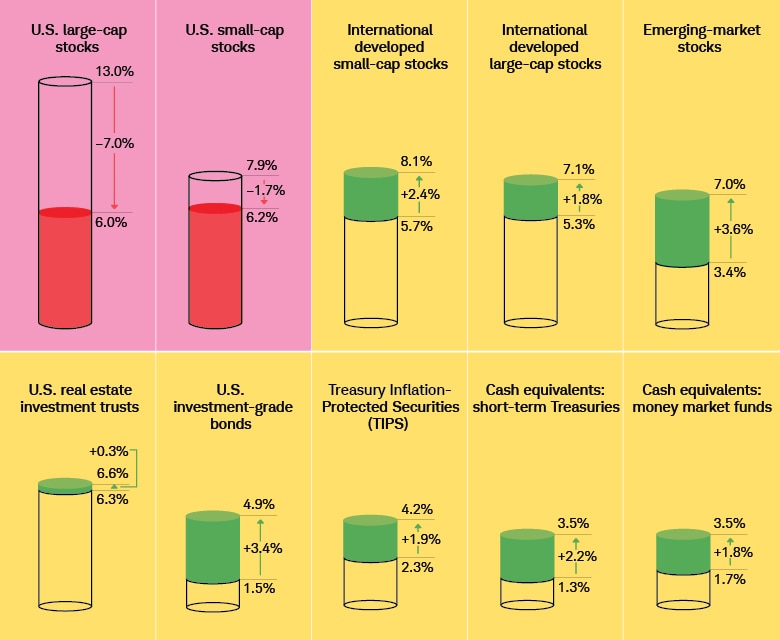

Asset-class outlook

How the major asset classes are expected to perform during the next decade, compared with the previous 10-year period.

Source: Schwab Asset Management. Data as of 10/31/2024.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research, and are developed through analysis of historical public data.

Lower expectations

↓ U.S. large-cap stocks (+6.0% vs. +13.0%)

Among the major asset classes, no others came close to the performance of the biggest public U.S. companies over the past decade. The U.S. has enjoyed significant advantages, including a resilient economy, an upswing in productivity, and generous profit margins fueled by its tech-heavy cohort of market-leading companies.

But after back-to-back years of 20%-plus gains for the S&P 500® Index, similar appreciation will be difficult to replicate—due in no small part to sky-high stock valuations. As of January, the S&P 500 had been so highly valued only twice before: during the dot-com bubble in the late 1990s and again in 2021, when investors underestimated COVID-19's impact on the economy.1

Recent performance also has blunted dividend yield as a driver of total returns; dividend yields naturally decline when share prices rise faster than dividend payouts. Combined with companies' growing preference for buybacks and internal reinvestment over dividend hikes, that's likely going to reduce the contributions of dividends to U.S. large-cap returns relative to their historical record.

Finally, while the U.S. economy has proved resilient and corporate earnings have been strong, structural challenges, such as an aging population and slower labor force gains, are expected to moderate the growth of gross domestic product (GDP) over the next decade. As a result, Schwab Asset Management's forecast for average annual real GDP growth over the next decade is 2%, which is down about 0.4 percentage points2 from actual annual GDP growth for the 10-year period through 2023—and well below the historical average of 2.7% since 1970.

"Without robust economic growth, market returns suffer, which undermines the outlook for equities," Eric says.

Companies within the S&P 500 are estimated to grow real per-share profit at a 2.4% annual rate over the long term, compared with roughly 4% over the past 10 years—a reflection of moderating economic growth but also higher borrowing costs and conservative expectations for AI-driven gains.

↓ U.S. small-cap stocks (+6.2% vs. +7.9%)

Theory has it that smaller companies generally are not only more agile than their large-cap counterparts but also able to expand more quickly because they're working from a smaller base. However, the reality of the past decade didn't match that potential, as both macroeconomic and structural forces kept smaller companies from keeping pace with the performance of larger ones.

Economic volatility has been particularly challenging for this group. Small-cap companies tend to be less profitable and carry more debt, which increases their sensitivity to both interest rates and economic slowdowns. The recent period of interest rate hikes and high inflation has driven up their cost of capital and delayed investment decisions that could fuel future growth.

"Small caps need a more supportive economic landscape," says Seth McMoore, senior researcher of multiasset quantitative solutions at Schwab Asset Management. "Barring that, it's hard for companies to remain profitable."

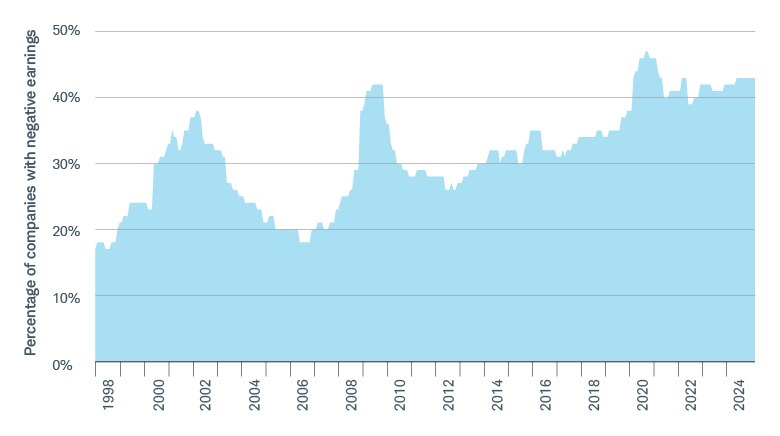

In fact, the small-cap universe includes a growing number of unprofitable companies.

An uphill battle

The percentage of companies within the Russell 2000® Index with negative earnings has been on a steady climb since 2012 and remains near its historical peak.

Source: LSEG Workspace, using data from S&P Compustat. Data from 01/31/1998 through 03/31/2025.

Earnings are represented by 12-month trailing earnings per share. Past performance is no guarantee of future results.

"Small-cap stocks are inherently riskier than their mid- and large-cap rivals, but with that risk comes the potential for greater returns," Seth notes. "Having the appropriate level of exposure for your goals and risk tolerance is key."

Higher expectations

↑ International developed small-cap stocks (+8.1% vs. +5.7%) and large-cap stocks (+7.1% vs. +5.3%)

In the eyes of investors, international companies have been operating in the shadows of their U.S. counterparts due to their slower earnings growth and economic sluggishness in their home markets. Over the past decade, returns for both large- and small-cap developed equities have not only underperformed the S&P 500 but also their long-term averages, and by a significant degree.

Over the next 10 years, developed international stocks could outperform their U.S. peers, driven in large part by differences in the starting point for valuations—the MSCI EAFE Index opened 2024 at about 15 times earnings, compared with about 25 times for the S&P 500.

Lower share prices offer greater potential for appreciation while also boosting dividend yields. Schwab Asset Management anticipates that nearly half of the returns from international developed stocks will likely come from dividend yields over the coming 10 years.

"That extra income should help compensate investors who expect higher returns from international stocks to reflect the higher risks involved with investing abroad, including those related to trade disputes, domestic policies, and currency fluctuations," Eric says.

↑ Emerging-market stocks (+7.0% vs. +3.4%)

Developing countries offer the potential for faster economic growth than their developed counterparts thanks to urbanization, lower-cost manufacturing, and an expanding middle class. But they have struggled to live up to those expectations, undone by some of the risks that often plague countries in early stages of development, including policy uncertainties, elevated borrowing costs, and currency weaknesses. While those risks will always be part of the equation with emerging-market stocks, the macroeconomic situation for many countries has improved in recent years.

For one, several governments have agreed to float their exchange rates, which allows their currencies to adjust naturally to economic shifts and can help absorb external shocks. (Previously, many countries' exchange rates were pegged to the U.S. dollar and therefore more exposed to U.S. fiscal policy.) Likewise, many governments have begun issuing debt in their local currencies (versus the U.S. dollar), giving them more certainty over repayment costs.

"These factors, as well as rebounding economic activity and low stock valuations, support our more positive long-term outlook for emerging markets," Eric says.

Despite these improvements, China—the largest of the emerging markets—remains a potential liability. The country's housing market has been in freefall since 2018, its consumer spending is weak, and an aging population is rapidly exiting a shrinking workforce and driving up health care costs.

"We've seen some glimmers of improvement for China's economy—particularly housing in the past few months—but lingering domestic demand weakness and growth challenges could drag down emerging markets as a whole," says Jeffrey Kleintop, Schwab's chief global investment strategist. "Even so, emerging-market stocks seem to have largely priced these challenges in."

Though Schwab Asset Management is cautiously optimistic about emerging markets, it's important to remember that the asset class is not right for all investors. "Even if you can tolerate some risk, we believe these stocks should play a supporting role in your total international allocation rather than the lead," Seth says.

↑ U.S. real estate investment trusts (+6.6% vs. +6.3%)

The fallout from the pandemic continues to affect real estate investments, particularly among office properties still experiencing lower demand as return-to-office mandates get mixed reviews. But this asset class presents a diverse set of opportunities, with real estate developers and operators benefiting from longer-forming trends such as data center usage and industrial reshoring. Real estate investment trusts (REITs) also tend to benefit from economic growth, which supports rent collections and property prices. However, they are susceptible to higher interest rates because they tend to borrow heavily, so the current rate environment could mute REIT returns.

"Even though the past decade included unusual circumstances—especially the pandemic—we believe the broader trends supporting REITs will lead to average returns similar to what investors have experienced historically," Seth says.

↑ U.S. investment-grade bonds (+4.9% vs. +1.5%)

The low and volatile interest rates that characterized much of the past decade led to wide swings in the total returns offered by bond investments. The net result was lackluster performance that didn't keep up with the rate of inflation.

However, the days of near-zero interest rates are behind us—at least for the foreseeable future. With rates settling higher, the majority of bond fund returns are coming once again from coupon payments, which sets a higher floor for returns.

The positive bond market outlook is in part based on expectations for yield to maturity, or the total return an investor expects to earn from a bond if they hold it until maturity (barring default and assuming all interest payments are reinvested at the same rate). That measure has been a reliable predictor of total returns in the past, and the recent increase in yield to maturity of U.S. Treasuries suggests that higher total returns for the asset class will follow.

The 10-year Treasury yield is expected to remain above its 10-year average of 2.4% but below its long-term average of 6.0%, and rising U.S. debt is one factor keeping longer-term yield expectations elevated.

↑ Treasury Inflation-Protected Securities (+4.2% vs. +2.3%)

Inflation surged above 9% in mid-2022, pushing its average to 2.9% for the past decade, which seems like it should have benefited TIPS since their principal value and coupon payments are indexed to inflation. Still, TIPS returns (as measured by TIPS indexes) underwhelmed investors, in large part due to a sharp rise in yields.

TIPS are still bonds, so their prices move in opposition to their yields. Generally, for every 1% move up in interest rates, the price of a TIPS falls by an amount roughly equal to its duration (e.g., 7% decrease in price for a 7-year TIPS). Since the price declines dwarfed the increases in principal value, TIPS returns suffered.

If yields continue to climb, higher income payments should help TIPS investors offset any additional price drops, while a resurgence in inflation could boost the value of the underlying holdings through positive principal adjustments.

"Particularly with some of the uncertainty around policies coming out of Washington, the stickiness of inflation may remain a concern, which makes TIPS appear attractive," says Collin Martin, director and fixed income strategist at the Schwab Center for Financial Research.

↑ Cash equivalents: short-term Treasuries (+3.5% vs. +1.3%) and money market funds (+3.5% vs. +1.7%)

Yields on short-term Treasuries and money market funds are heavily influenced by the Federal Reserve's rate decisions. Even though the federal funds rate rose from close to zero early in the decade to about 4.5% by the end of 2024, the increase came too late for money market funds and other cash equivalents to top a total return of 2% for the past 10 years.

With rates above the recent near-zero environment, cash equivalents should generate better returns going forward—especially if inflation remains above the Fed's 2% target. "We believe ongoing market dynamics will keep rates significantly higher than the extreme lows of the past decade, though potentially not as high as today's levels," Seth says.

Long-term takeaways

With return expectations for most major asset classes diverging from the recent historical record and a fair amount of uncertainty in the future, it can seem overwhelming to chart a path forward. But one of the ways to ignore the noise and focus on your long-term goals is to review your portfolio's allocations and ensure it's constructed to respond to different market conditions. As you undertake this objective, ask yourself four questions:

- Are my return assumptions realistic? Counting on asset classes such as U.S. stocks to continue delivering such heady returns will likely cause you to fall short of your savings goals. Work with your financial planner to make sure your return expectations across asset classes aren't too optimistic.

- Am I taking on too much risk? Recent market performance may have pushed your portfolio holdings out of step with your target allocations, exposing you to more risk than you realize. If your current portfolio composition is out of whack with your target risk exposure, bring your allocations back in line through rebalancing—that is, selling some of your winning investments and reinvesting them in areas that haven't kept up.

- Am I diversified enough? Ensure your portfolio contains a mix of asset classes that perform differently under various market conditions. Predicting the best-performing asset class each year is challenging; diversification helps mitigate the impact of market volatility and reduces the risks of chasing past performance.

- Am I saving enough? Don't take your foot off the pedal just because your portfolio performed better than you expected the last few years. Returns can fluctuate from year to year, and maintaining a savings discipline is critical to staying on track. The more you save, the greater cushion you'll have if actual returns come in on the light side.

"Market conditions are always in flux, so it's wise to regularly revisit your portfolio with these questions in mind—not just when things feel like they're at an inflection point," Rob says.

1Trevor Jennewine, "The Stock Market Is Doing Something Seen Just 2 Times Since 1957, and History Is Clear About What Happens Next," fool.com, 01/10/2025.

2"Projected Gross Domestic Product growth linked to slower labor force growth," bls.gov, 09/24/2024.

Discover more from Onward

Keep reading the latest issue online or view the print edition.