Which Bond Strategy Is Right for You?

Investors turn to bonds to accomplish a variety of financial objectives, which usually include generating income and preserving capital. But not all bond strategies are created equal, and some may be more tailored to your goals than others.

The way you layer together bonds with varying interest rates and maturities should differ depending on your needs. There's no one-size-fits-all strategy.

Goal: Generate predictable income

Solution: Bond ladder

A bond ladder is a portfolio of individual bonds with staggered maturity dates—say, from one to 10 years. Barring default, if you hold each bond to maturity you'll receive regular interest payments over the life of the bond (typically every six months), plus the repayment of your principal at maturity.

Buying longer-term bonds can mean missing out on higher income payments if interest rates rise, but because bonds in a ladder generally mature every year or two—and you typically reinvest the proceeds to keep the ladder going—you continuously capture prevailing rates.

It's important to consider a bond's credit quality when building your ladder. Lower-rated bonds, like high-yield bonds, have a greater likelihood of default, which could undermine your ability to generate steady income and preserve your investment capital.

A bond ladder generally is a good all-weather strategy. If rates are rising, you lock in higher yields as bonds mature; if rates are falling, you benefit from the longer-term bonds purchased when rates were higher.

That said, there are two significant drawbacks to building a bond ladder:

- Startup costs: For Treasury bonds and certificates of deposit (CDs), investors can consider ladders with smaller amounts of investible assets, since these investments typically must be purchased in $1,000 minimums. However, when building a ladder with individual corporate or municipal bonds, the minimum suggested investment is larger to help with liquidity. Schwab recommends holding bonds from at least 10 issuers to achieve adequate diversification.

- Time: Vetting bonds, particularly corporate and municipal issues, can be a significant time commitment—especially when establishing your bond ladder. What's more, ladders require regular research as you seek to replace maturing bonds.

How to build a bond ladder

Purchase bonds of varying lengths that mature at regular intervals—say, every year. As each bond matures, you can keep the ladder going by reinvesting the proceeds in a new bond with the longest maturity in your ladder.

For illustrative purpose(s) only. Not intended to be reflective of results you can expect to achieve.

With Schwab's CD & Treasury Ladder Builder tool (schwab.com/ladder-tool), you can build your own ladder composed of certificates of deposit, Treasury bonds, or both.

Goal: Capture rising rates

Solution: Barbell

Like a ladder, a barbell strategy involves purchasing bonds with different maturity dates. However, a barbell focuses exclusively on short- and longer-term bonds—and avoids intermediate-term bonds entirely. While bonds with longer maturities tend to offer higher yields, shortening your bond maturities generally reduces income and interest-rate risk.

A barbell can be more of a tactical strategy that gives investors a bit more flexibility. Holding some longer-term bonds allows investors to lock in yields in case interest rates fall, while the brief duration of short-term bonds—which tend to be less volatile—can let investors consider different investments should an opportunity arise.

This strategy may make less sense as the Federal Reserve lowers interest rates. Once rates start falling, investors utilizing a barbell approach may wish to shift more of their maturing principal back toward longer-term bonds, similar to a traditional bond ladder.

How to build a barbell

Purchase bonds that mature in the next three months to three years, along with those that mature in the next seven to 10 years. As the short-term bonds mature, you can either reinvest the proceeds in new short-term bonds (if you believe rates will rise) or shift to longer-term bonds (if you believe rates will soon fall).

For illustrative purpose(s) only. Not intended to be reflective of results you can expect to achieve.

For help choosing a strategy for your needs, contact your Schwab financial consultant or call a Schwab fixed income specialist at 877-903-8069.

Goal: Save for a near-term expense

Solution: Bullet

Unlike ladders or barbells, a bullet doesn't rely on multiple maturity dates. In fact, the goal is to purchase multiple bonds that all mature around the same time to generate a large influx of cash.

For example, say you plan to buy a house in five years. Instead of putting the money for your down payment in a savings account—whose interest rate might be relatively high now but isn't fixed—you can generate predictable income from bonds set to mature around the time you'll need the money.

With a relatively shorter timeline, investors may be tempted to take on riskier bonds in the chase for better yields. However, bonds from issuers with strong credit ratings are most appropriate for this goal. If you're using a bullet strategy as a short-term planning tool, you won't want to run the risk of default.

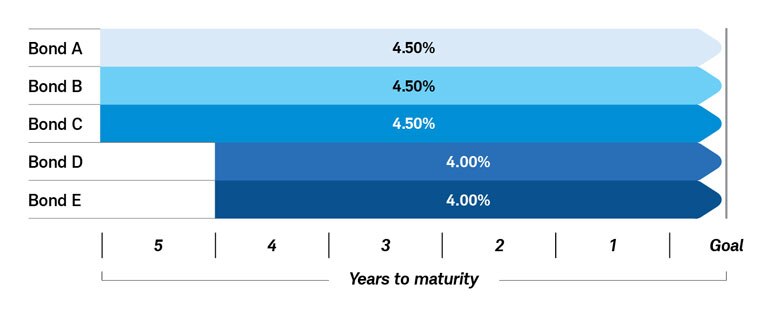

How to build a bullet

Purchase a handful of bonds that mature when you need the money, say in five years. Depending on the interest-rate environment and the amount of cash you have to invest, you may choose to purchase the bonds all at once or at staggered intervals between now and your maturity date.

For illustrative purpose(s) only. Not intended to be reflective of results you can expect to achieve.

For help assembling a bullet for your needs, contact your Schwab financial consultant or call a Schwab fixed income specialist at 877-903-8069.

Mix and match

Choosing individual bonds takes work, but it gives investors the greatest control over their cash flow and exposure to credit risk. Of course, some investors simply don't have the time or interest in managing a portfolio of bonds, in which case a bond fund—which holds dozens or hundreds of bonds with varying maturities, coupon payments, and credit ratings—can be a good alternative.

Bond funds don't offer as much control over your cash flow or interest-rate exposure, nor is your principal investment guaranteed as it is with individual bonds, assuming you hold such bonds to maturity and barring default. However, they can be a great fit for investors looking for diversification and regular, albeit sometimes unpredictable, income.

The Schwab Mutual Fund OneSource Select List® can help you screen quality funds that match your risk tolerance and investment time horizon. Learn more at schwab.com/selectlist.

In some cases, a combination of strategies can offer the best of both worlds. For example, you might invest in a bond fund for diversification but also create a bullet for a near-term expense. Another option for investors is a separately managed account that, under active management by a fixed income professionals, can be designed to meet your objectives. For example, Schwab's Wasmer Schroeder™ Strategies offers bond ladders or a blend of strategies to meet your goals.

Whichever strategy you choose, working with a bond professional can help you navigate the vast bond market and vet individual issuers.