Tax-Saving Moves You Can Make Before Year-End

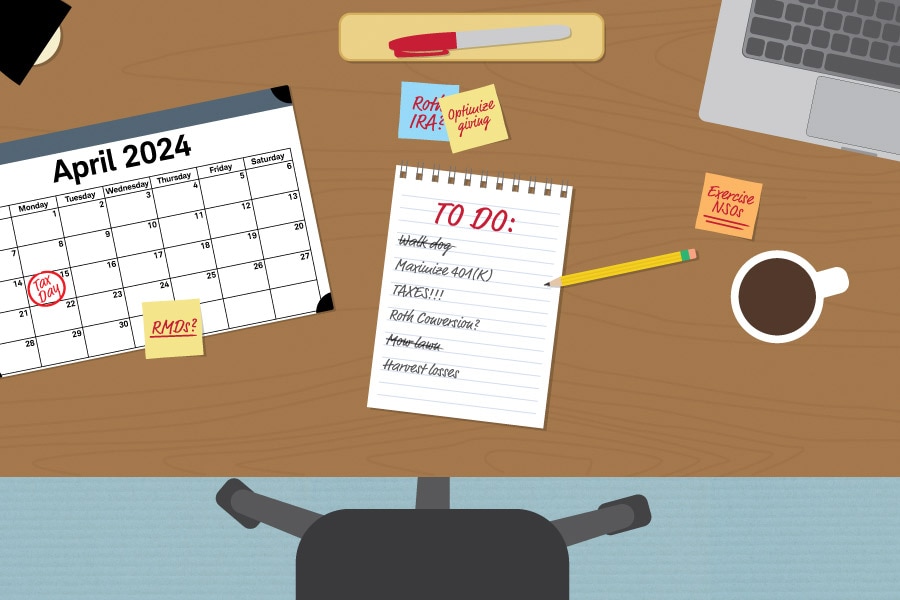

Tax Day may still be months away, but there are plenty of tax-planning strategies you can consider before then to help manage your tax bill. In fact, certain tasks should not—or in some cases cannot—wait until next year, lest you miss out on potentially important tax-saving opportunities.

Here are the top strategies to consider before December 31—and those you can ponder until Tax Day.

Tax-planning strategies to consider by year-end

Be sure to take all your required minimum distributions (RMDs)

Generally, taxpayers age 73 or older must take minimum distributions from your tax-deferred retirement accounts by the end of the year. (Individuals who reached RMD age in 2025 have until April 1 to take their first distribution.) If you miss the deadline, you could be subject to a 25% penalty on the portion of your RMD you failed to withdraw. That said, if you're concerned your RMD income could push you into a higher income tax bracket, you can start planning now to potentially reduce RMDs next year and beyond.

Calculating your RMDs

Use Schwab's RMD calculator to help determine how much you need to withdraw.

Maximize contributions to your workplace retirement plan

First and foremost, if your employer matches contributions, be sure to contribute enough to your tax-deferred workplace retirement plan to get the full amount. And consider contributing the maximum allowed if you have the means and your financial situation allows.

The 2025 limit is $23,500 for 401(k)s and similar plans, but older workers can make an additional catch-up contribution—up to $7,500 if age 50 or older ($31,000 total) with a supersize catch-up of up to $11,250 ($34,750 total) available to those ages 60–63. Not only can topping out contributions help reduce your taxable income for the current year and boost your overall savings, but doing so can also be a great tax-planning strategy if you think your tax rate will be lower in retirement than it is today.

On the other hand, if you believe your tax rate will be higher during retirement, funding a Roth account could be a better strategy. If your employer offers the option and you haven't already maxed out your traditional 401(k), you can make after-tax contributions to a Roth 401(k) up to the $23,500 limit ($31,000 if age 50 or older and $34,750 for ages 60–63), minus whatever you contributed to your traditional 401(k).

Be aware that starting in 2026, individuals earning more than $145,000 may only make catch-up contributions with after-tax dollars to a Roth 401(k)—if offered by their employer.

See if converting a traditional IRA to a Roth makes sense

If your income exceeds Roth IRA contribution limits (see "Contribute to a Roth IRA"), you can convert the pretax savings in a traditional IRA to a Roth in order to reap those tax-free withdrawals in retirement. As with any distribution of pretax funds from a tax-deferred account, the converted funds will be treated as income and will be taxed as such. Generally, you'll want to convert just enough to remain within a specific tax bracket to avoid a hefty tax bill (see "How are Roth conversions taxed?").

For example, if you are single and will earn $180,000 this year, you fall into the 24% tax bracket, which ranges from $103,351 to $197,300 for tax year 2025. That means you can convert up to $17,300 ($197,300 – $180,000) without being pushed into the next bracket and paying higher federal income taxes.

Consider a Roth conversion

If your income exceeds Roth individual retirement account (IRA) contribution limits (see "To consider by Tax Day" below for more on Roth IRAs), you can convert the pretax savings in a traditional IRA to a Roth IRA in order to reap those tax-free withdrawals in retirement. As with any withdrawal from a tax-deferred account, the converted funds will be treated as income, so generally, you'll want to convert just enough to remain within your current tax bracket to avoid a hefty tax bill. For example, if you're single and will earn $175,000 this year, you fall into the 24% tax bracket, which ranges from $95,376 to $182,100 in 2023. That means you can convert up to $7,100 ($182,100 – $175,000) without being pushed into the next bracket.

Should you convert to a Roth IRA?

Use Schwab's Roth IRA Conversion Calculator to help determine if this tax-planning strategy is right for your situation and how much you can rollover.

Consider after-tax contributions to an employer plan, along with a Roth rollover

This tax-planning strategy potentially allows high-income earners to save even more in a Roth account by sidestepping the income limits of a Roth IRA and the tax consequences of a regular Roth conversion (see "How are Roth conversions taxed?"). But remember, once the funds are in the 401(k), it can be difficult to access those assets before retirement without penalties, so be sure to have enough in your taxable account before considering these additional contributions.

If permitted by your workplace retirement plan, you would first max out your normal 401(k) contributions for the year, then contribute after-tax dollars up to the 2025 overall account limit—including employer matches—of $70,000 ($77,500 for ages 50–59 and 64 or older; $81,250 for ages 60–63). To avoid being taxed on any additional investment returns, you'll want to convert or rollover those funds as quickly as possible to a Roth 401(k) or to a Roth IRA—often called a mega-backdoor Roth conversion.

If your employer-sponsored retirement plan doesn't allow you to fund your account with after-tax dollars or take distributions while still employed, you could consider a backdoor Roth. With this tax-planning strategy, you would contribute after-tax dollars—up to $7,000 ($8,000 if age 50 or older) for tax year 2025—to your traditional IRA and then convert it to a Roth IRA.

Currently, the IRS allows taxpayers to use these two tax-planning strategies but hasn't issued formal guidance if using a backdoor Roth violates the "step-action rule," which treats a multistep transaction as a single one for tax purposes. Tax law is subject to change at any time, so consult your tax advisor to ensure you don't run afoul of the rules.

Optimize your charitable contributions

If charitable giving is part of your financial plan and you expect to itemize instead of taking the standard deduction, act by year's end to ensure your 2025 donations are as tax-efficient as possible:

- Charitable donations: In general, you can deduct cash donations worth up to 60% of your adjusted gross income (AGI), which is your total gross income minus certain deductions, to qualified charities or a donor-advised fund. Donating appreciated long-term investments can be especially tax-efficient because you don't have to recognize the capital gains and you can receive a tax deduction for the full fair-market value of the donation (up to 30% of your AGI).

- Qualified charitable distribution (QCD): If you're 70½ or older, you can donate up to $108,000 for tax year 2025 to a charity directly from your IRA using a QCD. (If both spouses qualify, you each can donate up to the limit.) You won't be taxed on the distribution or receive a tax deduction for the donation, but you can use your gift to satisfy all or part of your RMD without adding to your taxable income.

Can a QCD lower your tax burden?

Learn more about the tax-saving benefits of a QCD.

Exercise some nonqualified stock options (NQSOs)

If your employer issues NQSOs, which are taxed as ordinary income when exercised, waiting until the end of the year allows you to exercise just enough to stay within a specific tax bracket, thereby keeping your taxes lower than if you had exercised your options all at once.

Reduce or eliminate capital gains taxes with tax-loss harvesting

The end of the year is a great time to make sure your portfolio is still aligned with your goals. When rebalancing, you may be able to reduce your tax liability by offsetting any realized capital gains with your losses.

One way to employ this tax-saving strategy is to tally up your capital gains for the year, then cash out capital losses of equal value. If you have more capital losses than gains, not only can you potentially offset up to $3,000 of ordinary income on your tax return, but you can also carry over any excess amounts to future tax years.

To avoid the pitfalls of the wash-sale rule when tax-loss harvesting, be sure not to buy the same or a similar security within 30 days before or after the realization of the loss.

Tax-planning strategies to consider by Tax Day

Maximize all other tax-deferred savings accounts

You can potentially help reduce your taxable income by funding your tax-advantaged accounts, and with some accounts you have until Tax Day to make contributions for the 2025 tax year. Maximum contribution limits for 2025 are:

- Health savings accounts (HSAs), if available to you: $4,300 for individuals ($5,300 if age 55 or older) and $8,550 for families ($9,550 if age 55 or older). HSAs provide for many tax benefits, including tax-free contributions and potential growth, and you won't owe taxes on withdrawals so long as you use the funds to pay for qualified medical expenses.

- Traditional IRAs: $7,000, plus an additional catch-up contribution of $1,000 for individuals ages 50 or older. If you or your spouse are covered by an employer retirement plan, be aware your contributions to a traditional IRA may not be fully tax-deductible and deductions may be phased out.

Is a traditional IRA right for you?

Learn more about Traditional IRAs.

Contribute to a Roth IRA

Contributing after-tax dollars to a Roth IRA won't help reduce your taxable income when you make them. However, once you reach age 59½, all contributions and earnings can be withdrawn tax-free, so long as you've held the account for five years, and Roth IRAs aren't subject to RMDs—potentially lowering your taxable income during retirement. Unfortunately, you can't contribute to a Roth IRA if your annual income for 2025 is $165,000 or more ($246,000 for married couples), and the contribution limit is gradually phased out for those with income between $150,000 and $165,000 ($236,000 and $246,000 for couples).

A final word

No matter your level of wealth, we recommend working with a tax professional, a wealth advisor, or both to help determine which strategies may work for your situation and goals.