6 Things to Know About How Mutual Funds Work

A mutual fund is a convenient and simple way for investors to help diversify their investments at generally low cost, but it takes a fair degree of complexity to deliver such a simple solution. Here are six things to know about how mutual funds work, including how they make money, how they're priced, and what they cost.

1. How mutual funds invest

A mutual fund pools money from many investors and invests it in securities, such as stocks, bonds, or other assets. The combined holdings are referred to as a "portfolio," which is managed by a fund manager or team of fund managers. How the portfolio is managed depends on the type of mutual fund: passively managed mutual fund or actively managed mutual fund.

To understand how a specific mutual fund invests the money it collects from investors, you can refer to its prospectus, which is a pamphlet or brochure that describes the fund's objectives and the types of assets it invests in.

2. How mutual funds are priced

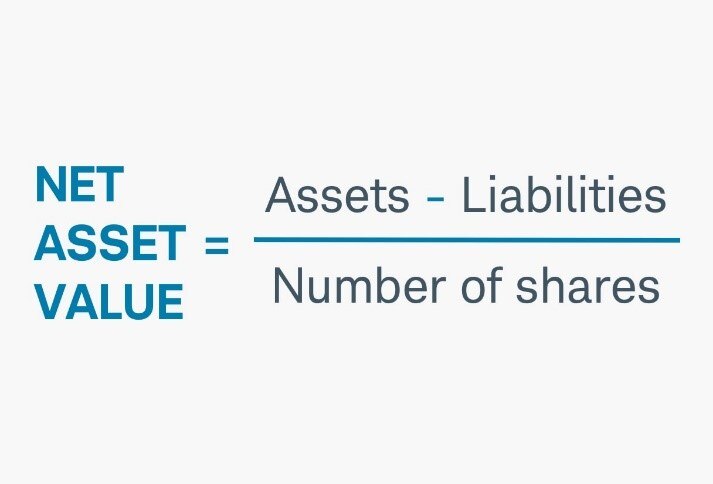

Individual stocks trade using a share price—that is, the cost of one share in a company. The price per mutual fund share is known as its net asset value (NAV). The NAV is the net value of a fund's assets minus its liabilities (regular expenses), divided by the number of shares outstanding at market close.

For example, if at market close, a mutual fund has $100 million in total assets with liabilities of $20 million and 2 million outstanding shares, its NAV per share would be $40.

The NAV fluctuates daily as the value of the individual fund holdings and the number of outstanding fund shares change. The NAV is calculated and published each day around 6 p.m. Eastern Time.

3. How investors can make money with mutual funds

Mutual fund returns can come from several sources:

- Appreciation in the fund's NAV, which happens if the fund's investments increase in price while you own the fund

- Income earned from dividends on stocks or interest on bonds

- Capital gains or profits incurred when the fund sells investments that have increased in price

4. How often mutual funds trade

Unlike stocks, which can be sold at any time during regular market hours, mutual funds trade only once per day after the markets close at 4 p.m. Eastern Time. You can enter an order to buy or sell mutual fund shares at any time, but your trade won't be executed until the closing of the current trading session or the next trading session if you place your order after hours. The price you realize will be the NAV that is calculated after the market closes.

5. How much mutual funds cost

Mutual fund costs fall into three broad categories:

- Operating expense ratio (OER): This is what the fund charges to cover its operating expenses and are factored annually into the total return you receive.

- Load: Some fund companies charge a one-time commission to buy or sell shares in certain mutual funds that rely on a sales intermediary, such as a broker.

- Transaction fee: Brokerage firms may charge a trading fee whenever you buy or sell mutual fund shares.

Another cost to keep in mind is that Index mutual funds generally cost less than actively managed mutual funds, which require more work on the part of the fund manager to select investments, and time purchases and sales.

6. How mutual funds handle taxes

When a mutual fund sells investments that have increased in price, it will ultimately need to distribute the profit—known as capital gains—by the end of the year. When this occurs, taxes on your capital gains may be due. If you hold the mutual fund in a taxable account, such as a brokerage account, you will receive a Form 1099-DIV at the end of the year that details the capital gains and losses your mutual fund may have incurred.

Mutual fund managers have some flexibility over capital gains and can often offset them by selling investments that have lost value and realizing a capital loss. But generally speaking, the more turnover the fund has in its holdings, the more likely you are to incur capital gains on which you may owe taxes.

Any income the mutual fund receives from stock dividends or bond interest payments will also be distributed to investors and taxed just as any other dividends or interest are.

Finally, if you ultimately sell shares of the mutual fund at a profit, this is also a capital gain, which is taxed just as any other investment you sell at a profit.

Costs and taxes, along with performance, are important factors to keep in mind when you're considering investing in a mutual fund.