What's Holding Back Small Caps?

With lower overhead and more room to grow on a percentage basis than their more-established peers, small-cap companies have long been prized for their potentially disproportionate upside. Yet that outperformance failed to materialize over the past decade, with small-cap stocks returning an average of 7.9% annually (as measured by the Russell 2000® Index)—compared with 13% for large caps (as measured by the S&P 500® Index).1

So, what's been holding back small caps, and what will it take to reverse course?

The hurdle: Higher borrowing costs

Taken as a whole, small-cap companies are less likely to be profitable and therefore more dependent on credit—something that became considerably more expensive over the past few years as the Federal Reserve raised interest rates to combat inflation. What's more, small caps are often considered riskier borrowers and so tend to pay higher interest rates than their large-cap counterparts—and their loans tend to be of shorter duration, exposing them to a greater degree of interest rate volatility.

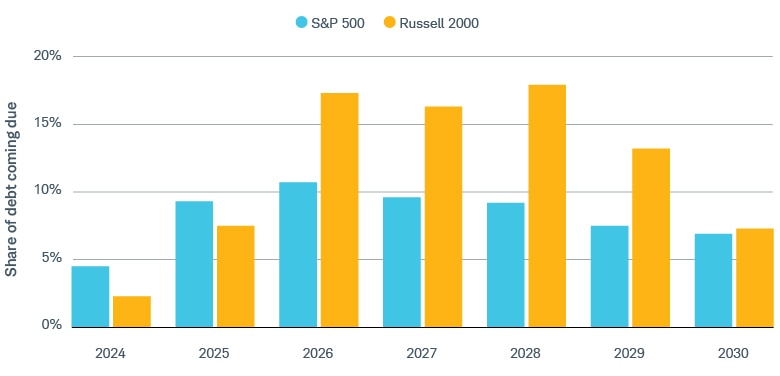

Time's up

Compared with large-cap companies, small caps have a larger share of debt coming due in the next four years, exposing them to potentially higher interest rates.

Source: Sagarika Jaisinghani and Alexandra Semenova, "A $600 Billion Wall of Debt Looms Over Market's Riskiest Stocks," bloomberg.com, 05/11/2024.

Forecasts contained herein are for illustrative purposes only, may be based on proprietary research, and are developed through the analysis of historical public data.

The help: Lower interest rates

An improved interest rate environment would be a huge boon for many small-cap companies; unfortunately, the interest rate outlook has dimmed on renewed inflation concerns. That said, higher interest rates alone are not a sign of trouble. Smaller companies can overcome the burden of rising costs if their earnings increase even faster—but that's a tall order for an entire asset class.

The hurdle: Elevated inflation

Earnings estimates for small caps cratered in 2023 and into the first half of 2024 due to a combination of high inflation and rising wages.2 And unlike many legacy brands, less-established companies often lack the pricing power to pass on their increased costs to consumers without undercutting demand.

The help: Moderating inflation

Inflation and interest rates both fell in 2024, which slowed the tendency of small caps to revise their earnings estimates downward. That said, investors will need to see consistent earnings growth—not just a short-term respite from inflation and rising rates—to shift their focus away from large caps, whose earnings have proved far more resistant to the same headwinds.

The hurdle: Investor sentiment

A company's ability to attract investor capital in recent years has largely depended on the sector in which it operates—and all eyes have been on technology stocks, which have benefited from the market's near-obsession with artificial intelligence (AI). However, tech companies represent a greater share of the large-cap market than the small-cap market. As of the end of March, technology firms composed roughly 30% of the S&P 500,3 versus just 10% of the Russell 2000 index.4

The help: Sentiment shift

If investor sentiment continues to sour on tech, we could see a shift toward small caps. Earlier this year, for instance, news about the success of a low-cost Chinese AI model prompted the start of an exodus from some of AI's biggest names. But that's only half the equation. We'd also like to see a marked improvement in sectors more common to small caps, such as financials, health care, and industrials. If those areas aren't performing well, it's mathematically difficult for a broad-based small-cap index—and therefore the funds that track it—to outperform.

Other factors

While some expect the Trump administration's policies to help prop up small caps, the net effect may be a wash.

On the one hand, deregulation could help, since lower compliance costs would be a bigger benefit to smaller businesses that lack the efficiencies of scale to absorb those kinds of expenses. On the other hand, uncertainty resulting from shifting tariff policies could disproportionately affect small, domestic companies, which could struggle to adapt to sudden cost increases and changes in supply chains.

What to consider

With so many variables—and the potential for extreme volatility—investors should exercise caution by:

- Checking the fundamentals: When hunting for small-cap companies, prioritize those with strong quality factors such as favorable cash flow per share, a low debt-to-equity ratio, and positive earnings momentum.

To research individual small-cap stocks, log in to Schwab's Stock Screener:

- Under Basic, select Market Capitalization, then Small Cap.

- Under Financial Strength, select Debt to Equity and Cash Flow Per Share, then select one or more ranges for each category.

- Under Company Performance, then under EPS Growth History, select a time frame, then one or more ranges.

- Choosing the right index: If you'd rather not pursue individual stocks, a small-cap index fund is a great way to diversify across hundreds of companies—just pay attention to what companies are in the index. According to Bloomberg, as of mid-April, 44% of companies in the Russell 2000 had negative earnings, versus 20% for the S&P SmallCap 600 Index. (This is primarily because the S&P 600 has profitability criteria for inclusion in the index whereas the Russell 2000 does not.)

To research small-cap index mutual funds, log in to Schwab's Fund Screener:

- Under Basic, select Market Cap/Style, then Small Value, Small Blend, or Small Growth.

- Under Basic, select Index Fund, then Yes.

- Under Basic, select Fund Strategy, then search for an index name.

To research small-cap index ETFs, log in to Schwab's ETF Screener:

- Under Fund Exposure, select Market Cap/Style, then Small Value, Small Blend, or Small Growth.

- Under Basic, select Underlying Index, then choose an index.

There's still a strong argument for maintaining at least some exposure to small caps for diversification purposes, but it may be some time before they reestablish their reputation as a growth engine for both the market and the greater economy.

1Morningstar, S&P 500 Total Return Index, and Russell 2000 Total Return Index, with data from 10/31/2014 through 10/31/2024.

2I/B/E/S Estimates, LSEG Data and Analytics, based on Russell 2000 Index.

3S&P Dow Jones Indices, as of 03/31/2025.

4FTSE Russell, as of 03/31/2025.

Discover more from Onward

Keep reading the latest issue online or view the print edition.