Market Commentary

Get our experts' perspective on recent market trends and what they could mean for your investment portfolio.

The latest commentary

Stocks Down on Iran War

What's the Difference: Jobs vs. GDP

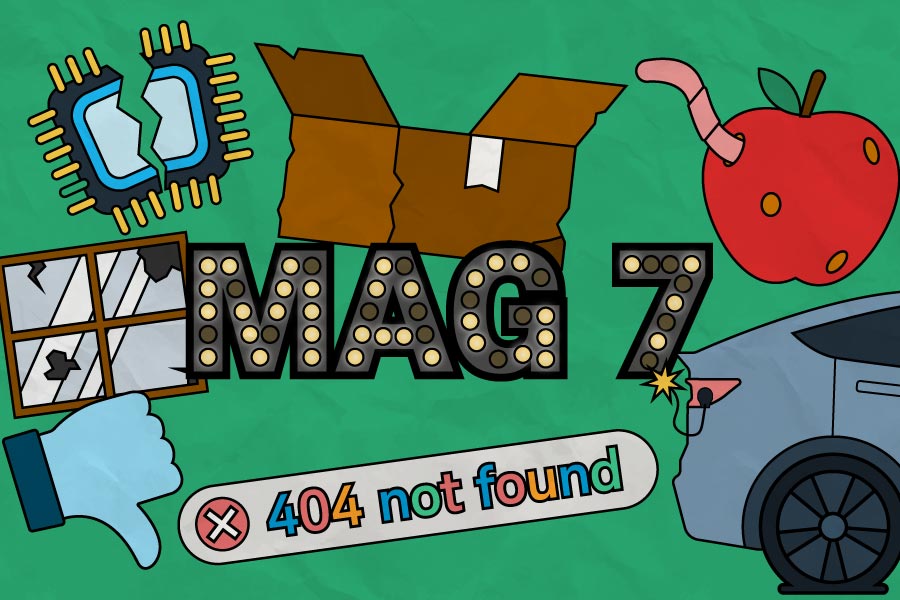

Magnificent Seven Stumble

SCOTUS Rejects Trump Tariffs

Washington: What to Watch Now

Muni Bonds: 3 Key Questions

US stocks and economy

Our perspective on what's driving U.S. equity markets

Market Snapshot

What's the Difference: Jobs vs. GDP

Cascade: AI's Latest Phase

Perspective: Riding the Waves

International stocks and economy

Our take on crosscurrents affecting international equities

Perspective: Riding the Waves

Geopolitical Risk is Evolving

EM: AI Opportunity and AI Risk

2026 International Outlook

Fixed income

Insights on the latest developments in fixed income and currency markets

Muni Bonds: 3 Key Questions

Perspective: Riding the Waves

Anchor in a Stormy Sea

Fed Holds Steady on Rates

Government affairs

Our take on policy decisions that may affect markets and investments

Explore more topics

This material is intended for general informational and educational purposes only. This should not be considered an individualized recommendation or personalized investment advice. The securities, investment products and investment strategies mentioned are not suitable for everyone. Each investor needs to review an investment strategy for their own particular situation before making any investment or trading decisions.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

For illustrative purposes only. Individual situations will vary. Not intended to be reflective of results you can expect to achieve.

Investing involves risk, including, for some products, more than your initial investment.

Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors.

The policy analysis provided by the Charles Schwab & Co., Inc., does not constitute and should not be interpreted as an endorsement of any political party.