Markets & Economy

Get timely stock market analysis, perspectives and ideas from Charles Schwab & Co., Inc.

Markets & Economy

Today's Options Market Update

Washington: What to Watch Now

Stocks Plunge on Oil Fears

Looking to the Futures

Monday's Schwab Market Update Podcast

Markets & Economy

Weekly Trader's Outlook

Emerging Markets' AI Glow-Up

What's the Difference: Jobs vs. GDP

Markets & Economy

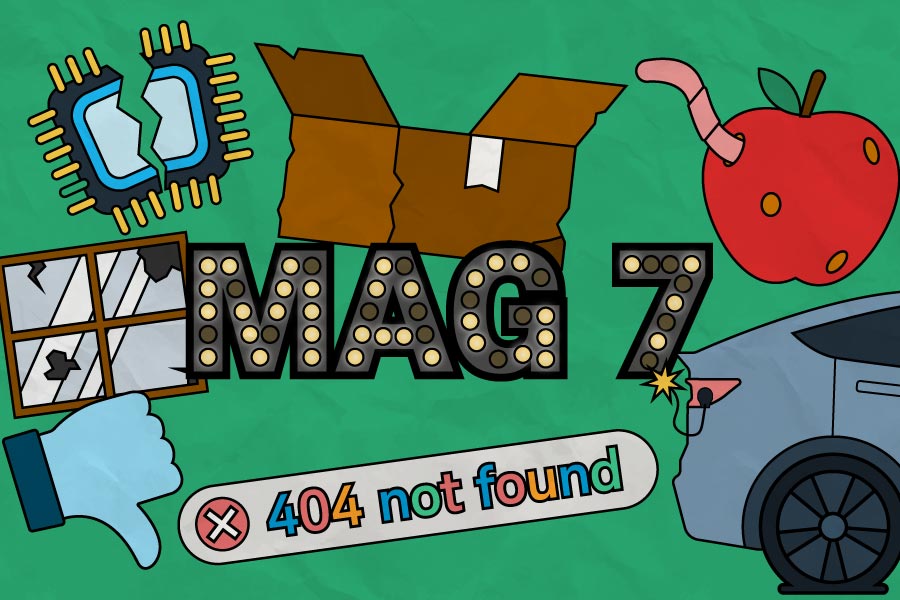

Magnificent Seven Stumble

SCOTUS Rejects Trump Tariffs

Muni Bonds: 3 Key Questions

Markets & Economy

Cascade: AI's Latest Phase

Perspective: Riding the Waves

Taylor Rule Provides Rate Guide

Markets & Economy

Anchor in a Stormy Sea

Covered-Call ETF: What to Know

Geopolitical Risk is Evolving

Insights & Education are provided by Charles Schwab & Co., Inc.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.