Tools for Trading Options Around Earnings

Even veteran traders sometimes feel shy jumping into a stock on one special day each quarter: earnings reporting day. Stocks often see sharp moves around earnings announcements as investors react to the results and how they compare to estimates or guidance. A positive surprise can drive a stock higher, while disappointing results can send it suddenly lower. This volatility can potentially create opportunity, but it also comes with risk that some traders would rather avoid.

Although there's no guarantee a trader will be on the right side of a trade when a company reports earnings, some approaches are designed to help address, and perhaps even take advantage of, the related volatility.

Assuming a trader feels ready to take on the ups and downs of trading an earnings report, it's important to consider a slow and methodical approach. Traders might have to adjust their normal trading strategies to deal with the added level of complexity during earnings season.

There are a few tools that can potentially help earnings traders, however. Monitoring the basics like implied volatility (IV) as well as proprietary Schwab indicators—such as the Market Maker Move™ and Current IV Percentile—can provide information that may help traders make more informed decisions around earnings announcements.

One way to trade earnings: Not at all

The first thing a trader should consider before trading around earnings reports is whether they're prepared to take on the associated risk. For some traders, it may be wise to stay away from the ebbs and flows of earnings season and wait until the dust settles. At the end of an earnings period, traders can sort through the numbers, guidance, and conference call transcripts and then decide if they still want to trade or own the stock.

Also, research shows that long-term investors may have a better chance of building wealth over the years if they avoid trying to time the market or make trades based on short-term metrics like one or two quarterly earnings reports.

On the other hand, being patient and waiting out earnings season isn't necessarily always the right approach. Here are some considerations to keep in mind for qualified option traders who decide to trade around earnings reports.

Options prices and earnings announcements

Before trading the options of a stock on its earnings day (or on any day for that matter), bear in mind that not all accounts qualify for options trading. Also, an option trader entering a position ahead of an earnings report should be comfortable with the uncertainty about any subsequent move in the underlying stock. For example, when speculating on the post-earnings direction of the underlying stock by buying a put or call, the risk of being wrong is typically limited to the premium paid for that option (plus any transaction costs).

Selling naked options, on the other hand, may be especially risky during earnings season. Such strategies have unlimited risk, and underlying stocks can swing sharply around earnings announcements, potentially increasing the risk of assignment. Instead, many traders prefer defined-risk strategies that may help limit losses.

Before developing a strategy for trading earnings, it's also important to understand and consider the basics like implied volatility. IV greatly impacts options pricing and tends to be elevated before earnings.

For example, a 20% IV for a $30 stock indicates traders think the stock might either rise or fall $6 (20%) from its current level, meaning a potential price range of between $24 and $36 throughout the course of the next year (because IV is an annualized number). Knowing this range can help a trader develop a forecast for the stock and determine if it's a candidate to trade during earnings season.

IV can also be used to calculate the expected daily move of a stock using the following formula: Expected Daily Move = Stock Price * Annualized IV * 1/√Number of Trading Days in a Year. For the example discussed above (a $30 stock with a 20% annualized IV) the expected daily move would be roughly $0.38, or 1.26%. This assumes a normal return distribution and is not guaranteed. However, finding the expected daily move may still be helpful for traders looking to gauge the potential risk involved in a trade, particularly around specific events like earnings.

As previously mentioned, IV plays a fundamental role in the value of an options contract. A higher IV typically means a higher options premium. This is important to understand, particularly when trading earnings. In the immediate aftermath of an earnings report, IV can sometimes collapse, removing value from associated options contracts. Traders sometimes call this sudden drop in IV an implied volatility "crush," and it can cause the value of an option to fall even when the stock makes a move in the anticipated direction.

Some traders, for instance, trade long puts on a stock and then can't understand why their trade lost money even though the stock declined following its earnings report. It's often because the IV collapsed, removing IV premium from the options.

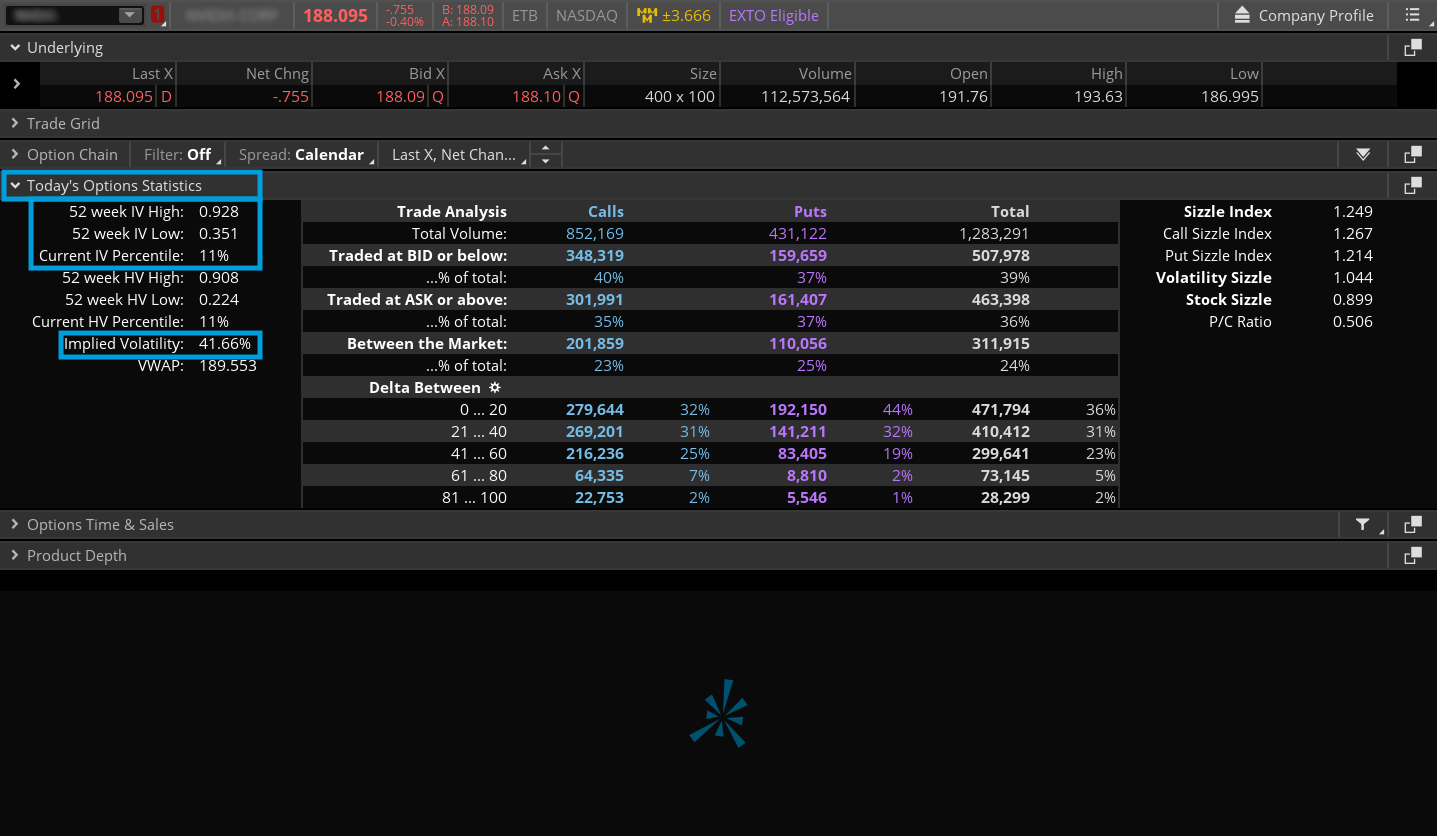

Implied volatility can easily be found on the thinkorswim® platform for any underlying stock. Simply navigate to the Trade tab and enter a stock symbol. Then, select Today's Options Statistics, and the second to last item on the list is Implied Volatility (see image below).

Source: thinkorswim platform

For illustrative purposes only.

The first column of Today's Options Statistics (in the figure above) illustrates several key statistics that might help a trader around an earnings announcement. On the seventh line, you can see the current Implied Volatility of the options currently trading. The top two lines contain the 52-week IV High and the 52-week IV Low, providing further context. And the third line from the top holds the Current IV Percentile, which is critical to monitor starting a few weeks before earnings and right up until reporting day. This shows (in percentage form) how the current IV compares with its highs and lows over the past 252 trading days (one year). Knowing whether an IV is high or low relative to its recent history for a given stock can sometimes help traders weigh strategies for current volatility levels.

For example, if the current IV percentile is high, it means options premiums are typically going to be relatively expensive. This typically favors strategies that involve selling options—such as short straddles or strangles or credit spreads—because traders can collect higher premiums. Conversely, a low current IV percentile, particularly relative to prior earnings seasons, tends to favor strategies that involve buying options, such as long straddles or strangles or debit spreads.

Measuring implied earnings moves

Another metric to consider before trading around earnings is the Market Maker Move (MMM), which is also found on thinkorswim. The MMM tells traders the one-day expected move in the underlying stock due to an upcoming event like earnings. It is based on a proprietary calculation that reverse engineers the options-pricing model based on assumptions about IV.

For example, going into an earnings report, a stock might have an MMM of ±5, which implies a potential post-earnings one-day move of plus or minus $5. The calculations are theoretical, and a stock might see a move that is greater or less than the implied move. The MMM is merely an indicator of what is currently "priced in" to the options.

The MMM can also give traders a sense of where they might consider placing stops if they trade the underlying stock. For instance, if the MMM forecasts a ±4 move, some traders might decide to place a stop that's $4 under the current stock value to help cut potential losses if the stock moves lower than the market projects.

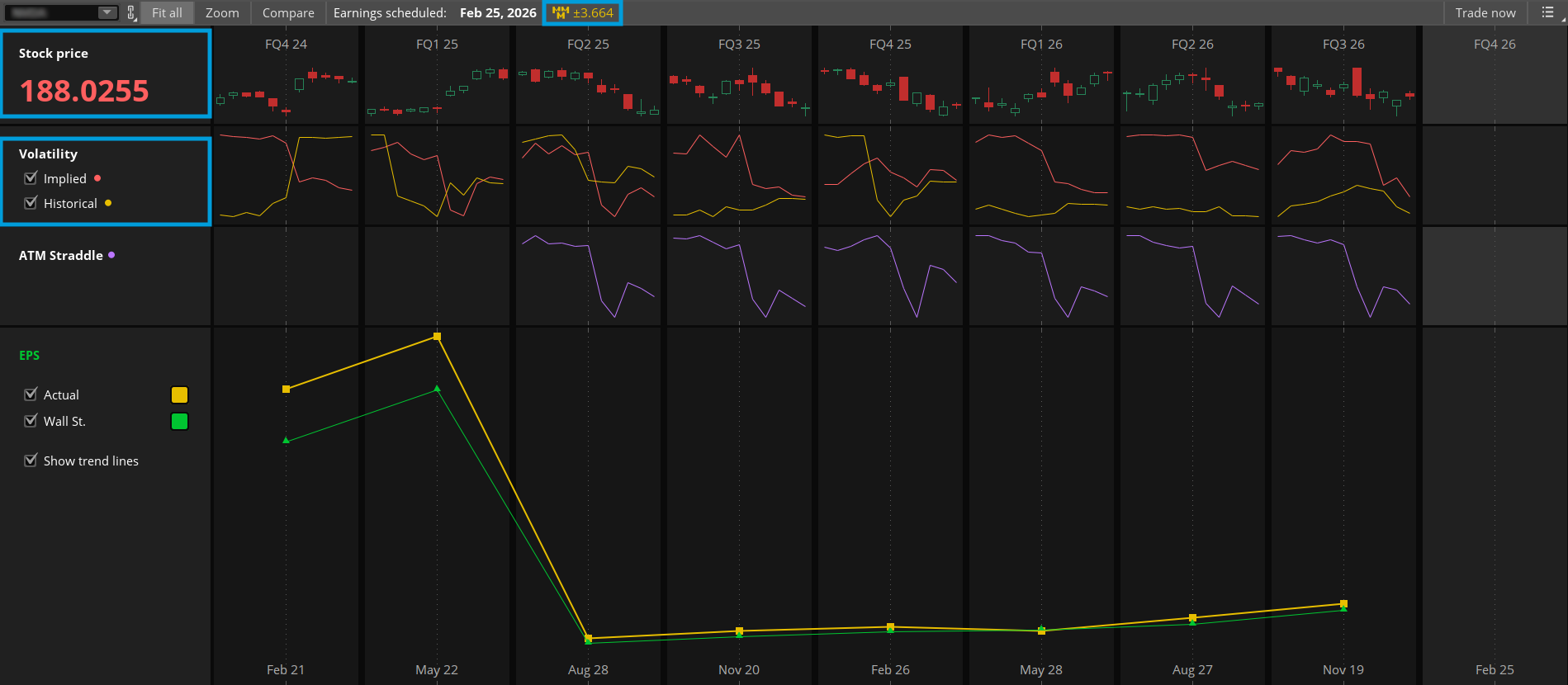

It can also be helpful to have a sense of how a stock moved around earnings historically. Traders can measure this historical movement on thinkorswim by selecting the Analyze tab and then Earnings. This will allow traders to see how the stock performed versus implied volatility over the past eight earnings periods and monitor the MMM (see image below). Note: Traders can also find the MMM on the Trade tab above the Option Chain. Knowing all this can be helpful, but remember, it's no guarantee of how a stock might perform on its next earnings date. A surprisingly bullish or bearish outcome can sometimes cause historical precedent to go out the window.

Source: thinkorswim platform

For illustrative purposes only.

Fundamentally speaking

Although understanding the MMM and IV may help traders place options trades around an earnings event, it's also important to have deep knowledge of the stock in question before trading its options on earnings day. That means digging into the fundamentals of a company and understanding what analysts expect to see and hear when the firm reports.

Within an earnings report, the earnings per share (EPS), revenue, and forward guidance can all have implications for the company and its share price. For example, a company could report strong revenues and EPS, but the stock might react negatively if forward guidance is weak.

A stock can decline immediately when a company reports earnings. That's why many traders try to stay on top of earnings news. Getting a sense of the analysts' average earnings and revenue estimates (the average EPS estimate can be found on thinkorswim) ahead of time may help traders understand the market's reaction to the results. Any guidance in a company's previous earnings report for the current quarter can also have implications because failing to meet that guidance—or projecting guidance for the upcoming quarter that falls short of Wall Street analyst estimates—can often cause a stock price to dive.

Even if traders stay on top of all the news, events, and numbers, there's still the company's conference call to consider. The conference call can sometimes include important information not available in the earnings report, which can also have a quick short-term impact on the stock price.

Bottom line

Ultimately, options statistics and tools like implied volatility, the current IV percentile, and the MMM can be invaluable for traders, but they can't help anyone predict the future. Only qualified traders who fully understand the risks involved should consider trading options around earnings. It's a tactic that presents opportunities but also comes with significant risks.