Unbalanced Butterfly and Strong Directional Bias

When traders want to express a directional view, but still limit risk and potentially generate income, they sometimes turn to advanced options strategies. One such strategy is the unbalanced or "broken wing" butterfly—a version of the classic butterfly spread that incorporates more directional bias. By shifting one of the strike prices or changing the contract ratio in a standard butterfly, traders can tilt their trade payoff to favor one side of the market. Before exploring how this works, let's review how a standard butterfly spread is structured and what makes it useful.

What is a butterfly spread?

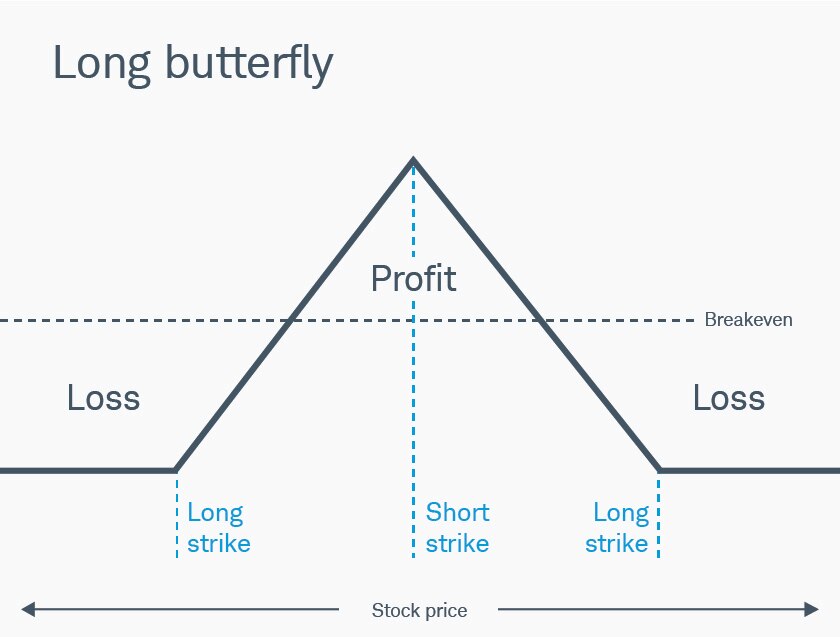

A butterfly spread vertical spread combines a long vertical spread1 and a short vertical spread, assuming the following conditions:

- The options are the same type (all calls or all puts).

- Each vertical spread has the same distance between strikes.

- The short option in the long spread and the short option in the short spread have the same strike.

- All options must have the same expiration date.

A combination of these conditions could result in a risk profile similar to the one below.

For illustrative purposes only.

Because the two spreads in the butterfly share the same short strike, the buy spread is usually more expensive than the sell spread. Therefore, the trade is opened for a net debit.

However, for some traders, there might be two potential problems with the butterfly. First, because it's a three-legged trade, commissions might be higher than with other strategies, making it a potentially expensive trade. Second, it might be difficult to pinpoint a max profit because it can only be reached at one price, which might be highly improbable. This is where an unbalanced butterfly may help.

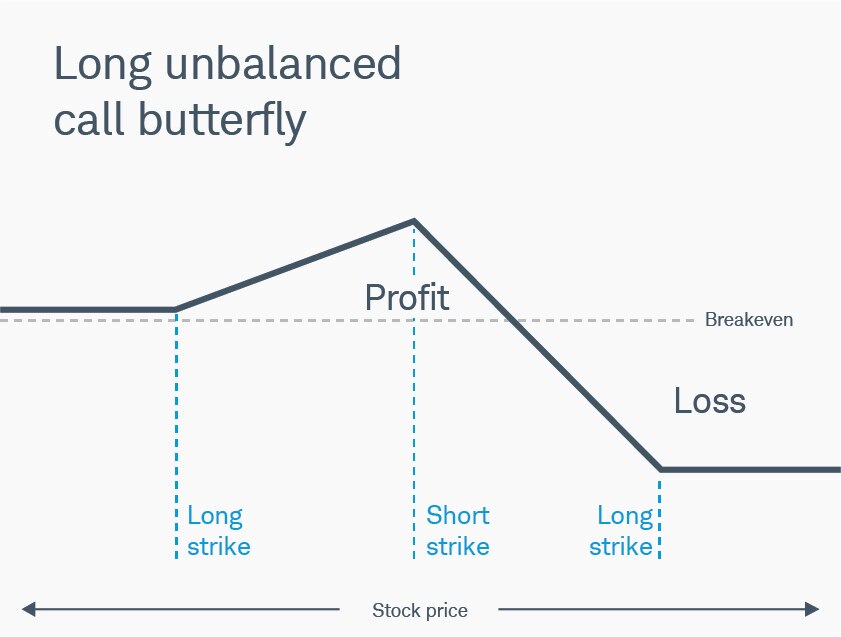

For traders looking to place a trade for a net credit, incorporate more directional bias, or widen their profit zone, an unbalanced butterfly can be appealing. Minor changes to a traditional butterfly's structure can alter the risk profile of the trade to help meet a trader's goals.

Using an unbalanced butterfly for credits

Rather than place a trade for a net debit, the unbalanced butterfly allows traders to potentially receive a net credit. Even if the trade doesn't work out, there's potential the trader will still get to keep that credit.

Unbalanced butterflies include an extra short call or put vertical, even though it might not be readily visible in the chart below. They're sold at the strike furthest out of the money2 (OTM), and the goal is to sell enough premium in the second vertical to place the trade for a credit. This approach has the potential to increase profit, but it also comes with increased risk. The added vertical layer would need monitoring and managing. In this scenario, the risk profile could look similar to the one below.

For illustrative purposes only.

Uncovering the unbalanced butterfly

Unlike the standard butterfly where maximum loss is limited to the debit paid, an unbalanced butterfly can potentially be a riskier trade, even if the risk is still defined.

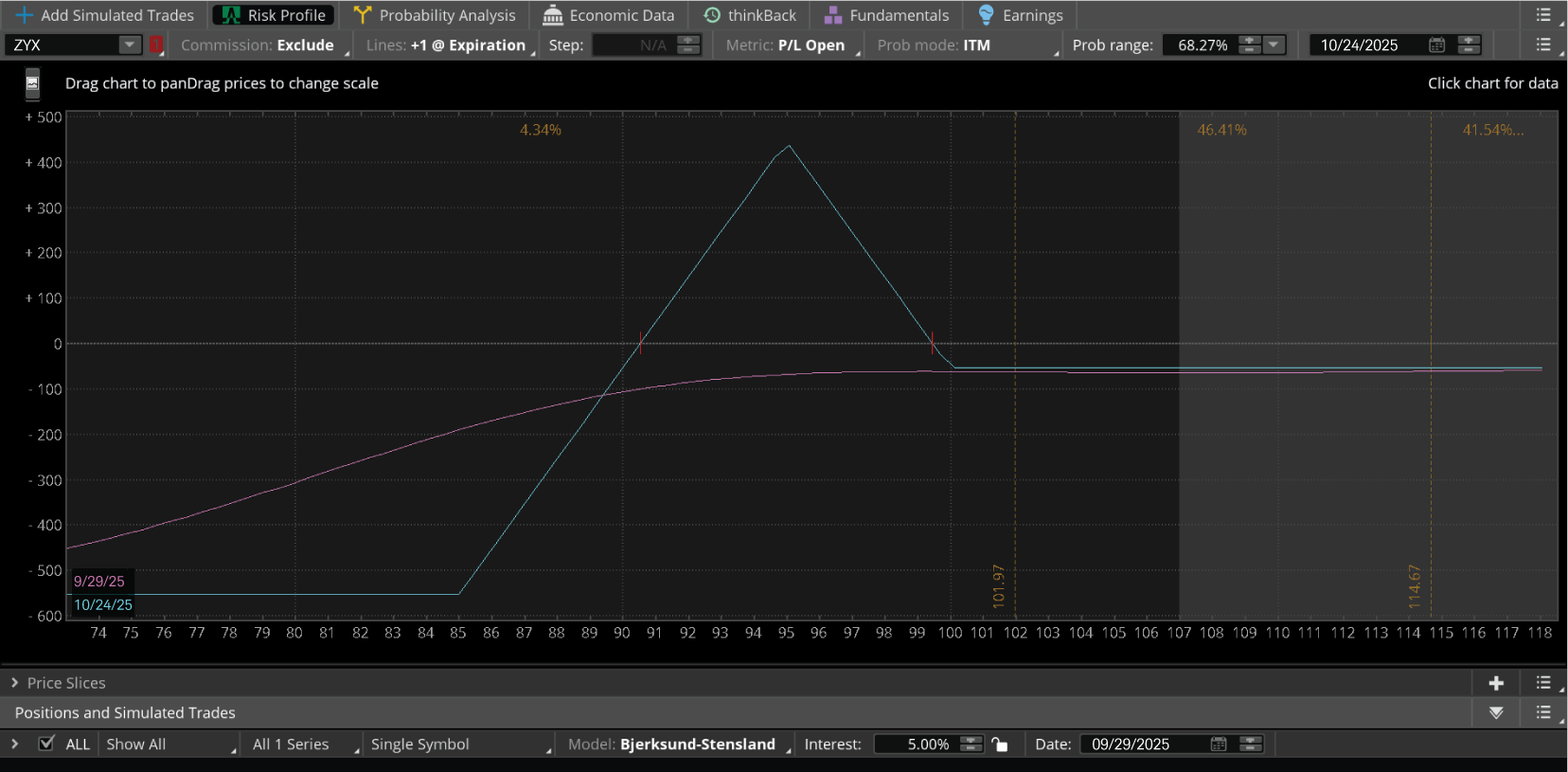

For example, a trader might review OTM butterfly trades on stock ZYX, currently trading at $115 per share. The trader might be bearish and think there's a chance the stock could settle around $95 per share at expiration. In this position, a trader might decide to buy the 100-95-90 put butterfly expiring in about two months.

For this example, we assume the trader can place this trade for a $0.07 debit, excluding commissions. While it might not seem like much, the maximum gain is still $20 from the current stock price. In this case, there's a chance the stock could reach $95 at expiration, but the more likely outcome is the position will expire OTM and the trader will lose the debit.

Rather than accepting this outcome, a trader could potentially turn the net debit into a net credit. Instead of trading the 100-95-90 put butterfly, the trader would "skip" a strike and trade the 100-95-85. In this case, the trade might be placed for a net credit of $0.02, excluding commissions. The credit may not seem like a big amount, but for a trade with a high probability of not realizing its maximum profit potential, getting $0.02 might be a reasonable compromise.

Even if a trader put on the unbalanced butterfly as one trade, it might be useful to look at the trade as a butterfly plus an imagined short vertical. When considering the trade in this manner, a trader can monitor the price of that imagined short vertical, potentially buy it back for a profit, and leave the rest of the butterfly active.

Learn more about how to execute and manage a short vertical options strategy.

However, the original trade was the 100-95-90 put butterfly. That trade can be broken down into one long 100-95 put vertical and one short 95-90 put vertical. In other words, the trader has one long 100 put, two short 95 puts, and one long 90 put.

To create the 100-95-85 unbalanced butterfly, a trader would sell to close the 90 long put leg of the trade and buy to open a long 85 put.

The adjustment can be made by selling the 85-90 put spread, which would close the 90-strike put and open the 85-strike put. The trader now has an unbalanced butterfly, in which the two long strikes are no longer the same distance from the center strike. The furthest OTM option, the 85 put, is less expensive than the 90 put. Because the trader didn't pay as much for the furthest OTM long option, those savings were passed on to the cost of the trade, leaving the trader with a net credit.

Watch for gaps

In the above example, moving the furthest OTM strike $5 lower results in a gap in protection. The trade can now lose more than the entry price. In this case, the trade still has a defined risk, but while the risk in the original butterfly was limited to the $0.07 debit, the risk in the new unbalanced butterfly is limited to the extra $5 of difference in strikes added, minus the $0.02 credit, for a total potential risk of $4.98.

That may seem like a large change. However, the image below illustrates how the stock would have to drop from $115 (its present price) to $85 per share or lower to realize maximum loss.

Source: thinkorswim® platform

For illustrative purposes only.

Manage the embedded vertical spread

A trader could decide it's no longer worth having the additional downside risk created by an unbalanced butterfly. As time passes, if the stock in the example doesn't drop below $90 per share, time decay (theta) potentially works in the trader's favor. If the 90 puts and the 85 puts are still OTM, the trader may find that both options are close to worthless.

At this point, a trader might decide to buy back the 90-85 put spread for a potential profit. That would revert the trade back to a 100-95-90 butterfly and potentially reduce the position's overall risk. Alternatively, if the 90 and 85 puts are near worthless, a trader might simply buy back the 90 put. This would have the same potential effect of limiting risk, except the trade would still be long the 85 put.

How to place a butterfly on the thinkorswim platform

It's possible to review the risk profile of an unbalanced butterfly on the thinkorswim trading platform. Under the Analyze tab, create a simulated unbalanced butterfly trade, then select Risk Profile.

A 3-2-1 unbalanced butterfly is different from an unbalanced butterfly where a trader "skips" a strike. Here's how to place the skipped strike fly on thinkorswim:

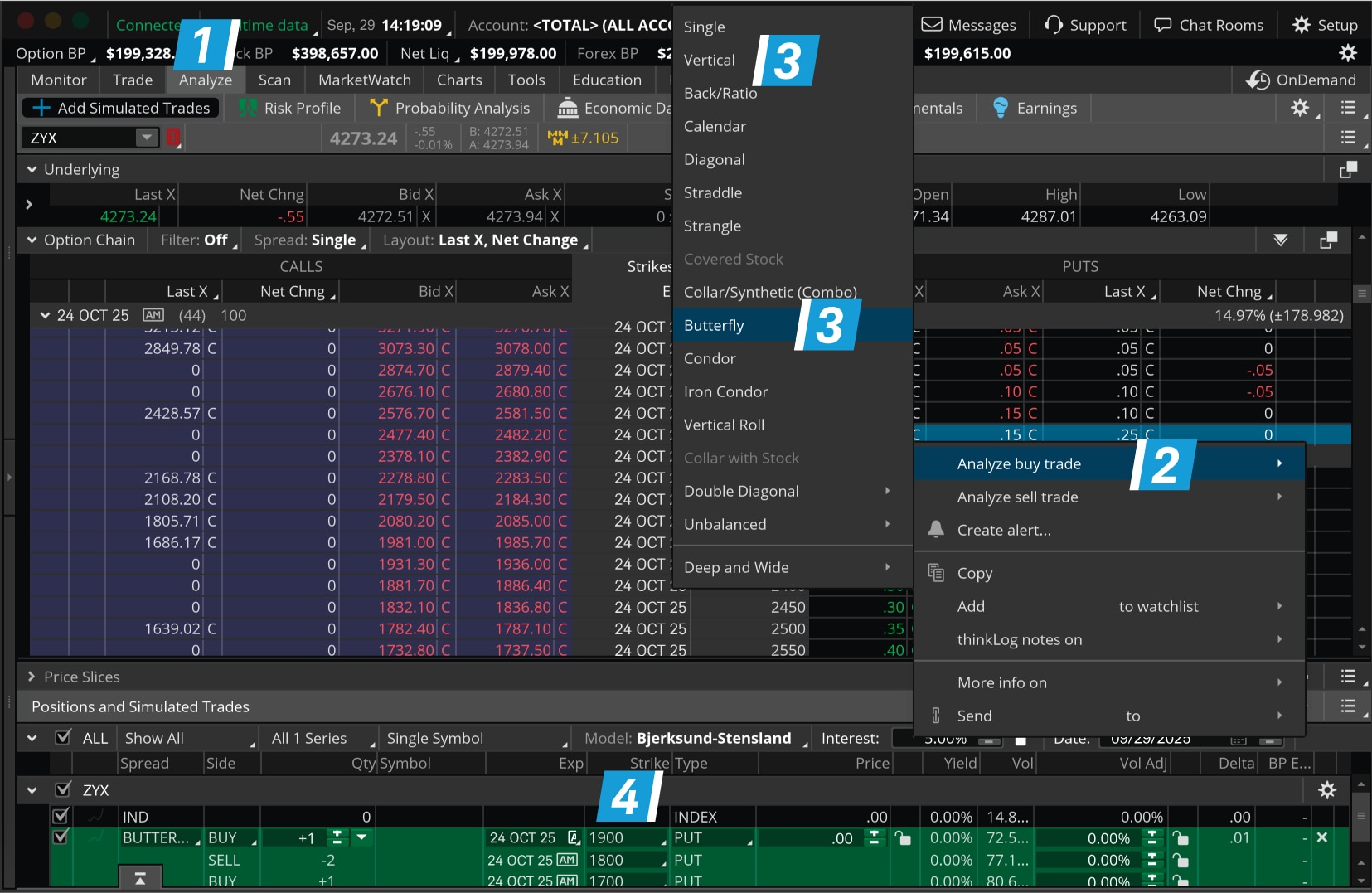

1. From the Analyze tab, add a simulated trade.

2. Right-click on the Option Chain and select Analyze buy or sell trade.

3. Select Butterfly to place a regular butterfly trade. Then add a vertical.

4. Change the strike prices for the butterfly and vertical before placing the order.

Source: thinkorswim platform

For illustrative purposes only.

Bottom line

Unbalanced butterflies can change the landscape for traders looking to potentially shift risk further away from a prevailing stock price. This might be done by adjusting time to expiration or looking for a larger net credit.

As traders become more experienced, they might explore unbalanced trades where they can change the ratio rather than the difference between the strikes. For example, instead of a butterfly with a 1-2-1 ratio, a trader might decide to sell a vertical spread using the options strikes already within the trade. This may change the trade ratio from a 1-2-1 to a 1-3-2, or some other ratio.

1An options position composed of either all calls or all puts, with long options and short options at two different strikes. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero.

2Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.